Editor Notes: No matter how you slice it, Microsoft’s $26.2 billion purchase of LinkedIn is expensive. That sets a pretty high bar for the tech giant to prove it’s worth it.

By Brooke Sutherland

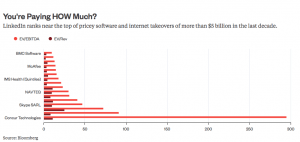

Microsoft is paying about 91 times LinkedIn’s Ebitda in the past year, making it the priciest major deal of 2016 on that basis.  Compared with the M&A bonanza of 2015, only two takeovers rated as more expensive and those involved makers of cancer drugs and rare-disease medicines. Prior to this week, Microsoft had paid a median of 34 times Ebitda for its biggest deals — many of which had questionable logic.

Compared with the M&A bonanza of 2015, only two takeovers rated as more expensive and those involved makers of cancer drugs and rare-disease medicines. Prior to this week, Microsoft had paid a median of 34 times Ebitda for its biggest deals — many of which had questionable logic.

LinkedIn multiples are based on value in press release, which is inclusive of net cash; the mulitple is closer to 84 excluding net cash.

Analysts are projecting LinkedIn’s Ebitda will grow to about $1 billion in 2016 — almost four times what it earned in 2015. Based on that number, Microsoft is paying a multiple closer to 26 times for the networking site. That’s still higher than what’s typical for $5 billion-plus software and internet deals announced over the last decade.

Analysts are projecting LinkedIn’s Ebitda will grow to about $1 billion in 2016 — almost four times what it earned in 2015. Based on that number, Microsoft is paying a multiple closer to 26 times for the networking site. That’s still higher than what’s typical for $5 billion-plus software and internet deals announced over the last decade.

Things don’t look much better when you compare the price to LinkedIn’s 105.5 million unique monthly visitors as of the latest quarter. Microsoft is paying almost $250 a pop for each of those subscribers, or about $60 per LinkedIn’s 433 million registered members, versus the $42 that Facebook paid per WhatsApp user. Oh, and by the way, revenue at LinkedIn this year is set to grow at the slowest rate in the company’s public history.

Good luck selling this one to investors, Microsoft.

- This is based on the deal’s total value as indicated in the companies’ press release, which is said to be inclusive of net cash. Excluding net cash, the multiple is closer to 84, according to data compiled by Bloomberg — still the priciest major deal of the year.