- MEXC gained market share in Q1 2025 despite a global crypto downturn.

- Derivatives market share jumped from 8.2% to 12.5%—the biggest among top exchanges.

- MEXC led spot market growth as overall volumes shrank.

While the global crypto market experienced a sharp downturn in Q1 2025, MEXC, a leading global cryptocurrency exchange, bucked the trend with significant gains in both spot and derivatives market share, according to the latest reports from TokenInsight and CoinGecko.

Market share growth despite industry decline

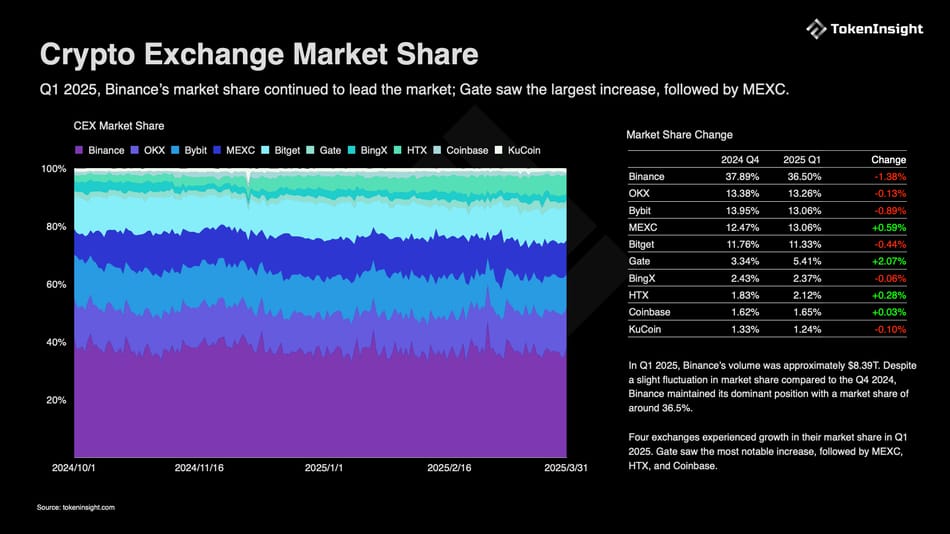

According to TokenInsight’s Q1 2025 Exchange Report, MEXC was one of the few major centralized exchanges (CEXs) to grow its presence while the total market saw a 12.53% decline in trading volume, dropping to $23 trillion.

MEXC increased its market share from 12.47% to 13.06% quarter-over-quarter. On the spot market, the exchange saw the largest increase in market share among all major CEXs, growing by 1.7% — a standout performance in a quarter marked by declining investor activity.

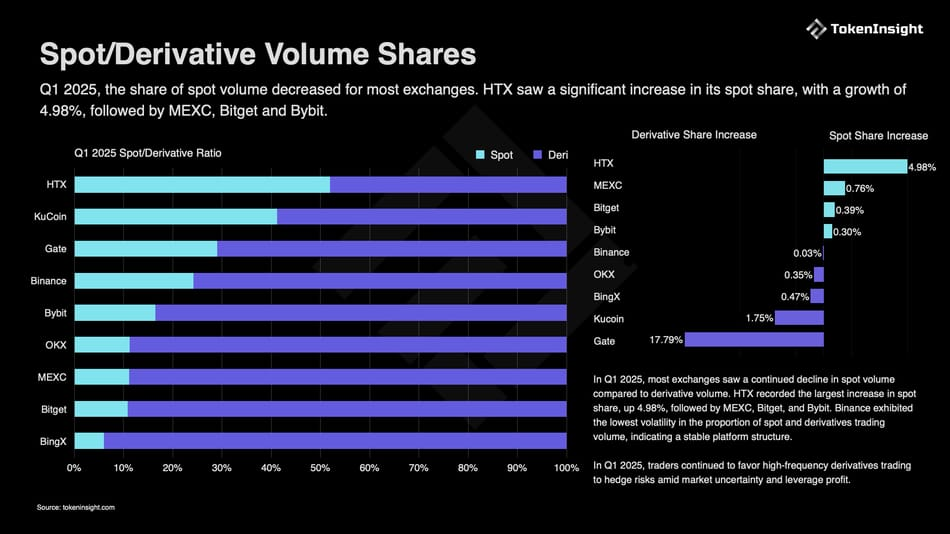

Leading the charge in derivatives

MEXC’s most notable performance was in the derivatives segment, where it posted a 4.3% increase, jumping from 8.2% to 12.5% market share, according to TokenInsight.

This marks the largest gain among all top 10 derivatives exchanges, as other major players struggled with declining volumes and heightened market uncertainty.

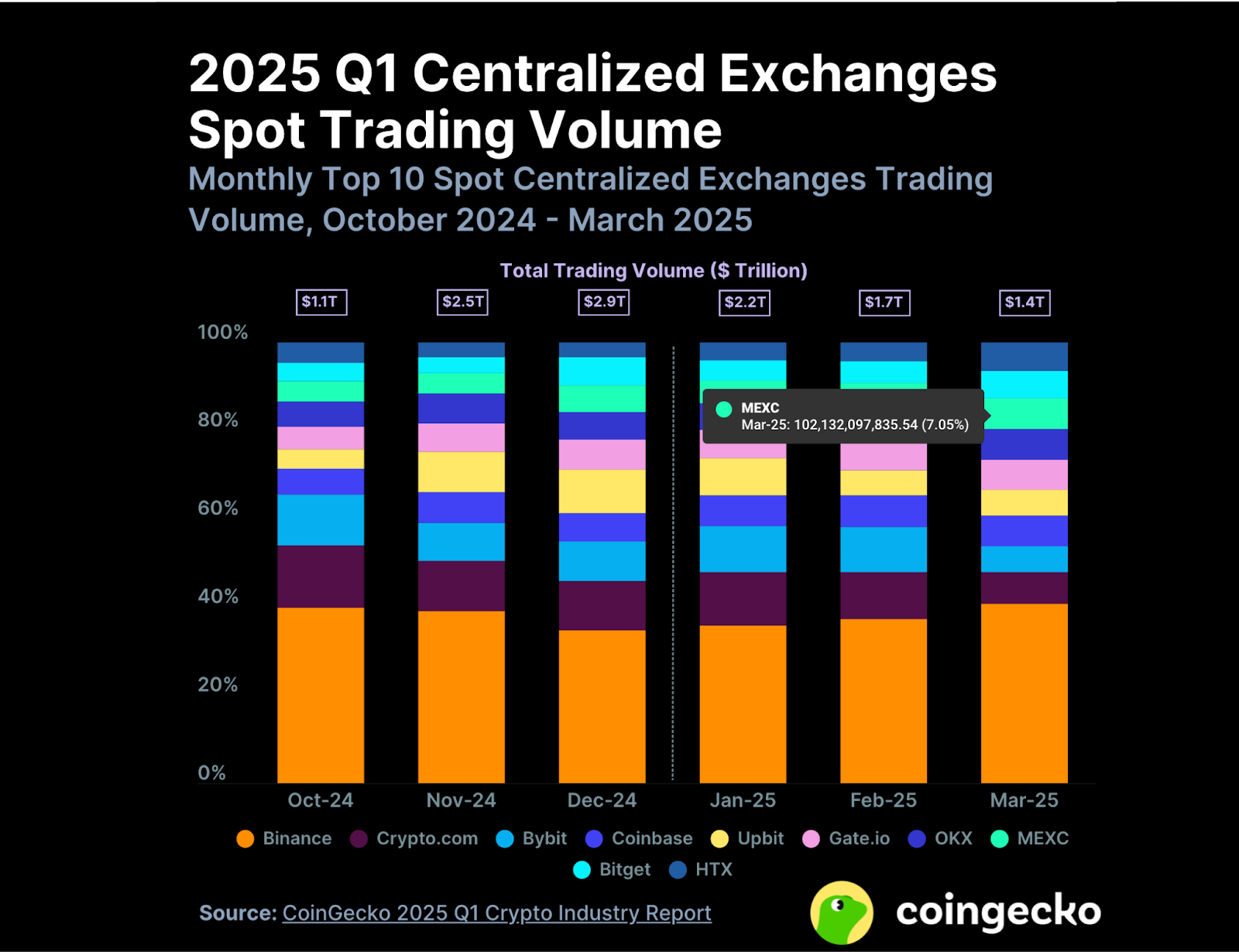

Outperforming in a shrinking spot market

While CoinGecko’s report showed spot trading volumes across centralized exchanges fell by 16.3% to $5.4 trillion in Q1 2025, MEXC gained ground, outperforming most peers and reinforcing its position as one of the fastest-growing CEXs globally.

This performance came at a time when high-risk assets lost investor favor and speculative trading declined sharply.

MEXC’s consistent growth highlights its reputation for reliability, market responsiveness, and user-focused innovation.

Exchange stability amid market turmoil

Following major security incidents in Q1 — traders increasingly migrated toward secure, stable platforms. MEXC capitalized on this trend, with both trading volume and user adoption increasing as confidence in competitor platforms waned.

Looking ahead: innovation & resilience

With geopolitical tensions and regulatory changes continuing to influence global markets, MEXC remains committed to expanding its DeFi product suite, embracing regulatory clarity, and delivering early access to emerging trends and tokens.

Its unique approach to agile listings and risk-managed derivatives makes it a standout performer in a maturing exchange landscape.

About MEXC

Founded in 2018, MEXC is dedicated to being “Your Easiest Way to Crypto.”

Known for its extensive selection of trending tokens, airdrop opportunities, and low fees, MEXC serves over 36 million users across 170+ countries.

With a focus on accessibility and efficiency, our advanced trading platform appeals to both new traders and seasoned investors alike.

MEXC provides a seamless, secure, and rewarding gateway to the world of digital assets.

For more information, visit: MEXC Website | X | Telegram | How to Sign Up on MEXC

This article is authored by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertisements, products, or materials. Readers should independently research and exercise due diligence before making decisions related to the mentioned company.