The field of sentiment analysis (SA) is evolving rapidly. Since news.Bitcoin.com last covered the subject in May, two new platforms have emerged, each claiming to offer smarter tools to facilitate more informed trading. Gathering accurate sentiment from the web and then using it to create actionable insights is a complex task, but the developers behind Predicoin and Augmento are confident they’ve made a breakthrough.

Also read: Sentiment Analysis Is the Best Trading Tool You’re Not Using

Mining for Feels Is Big Business

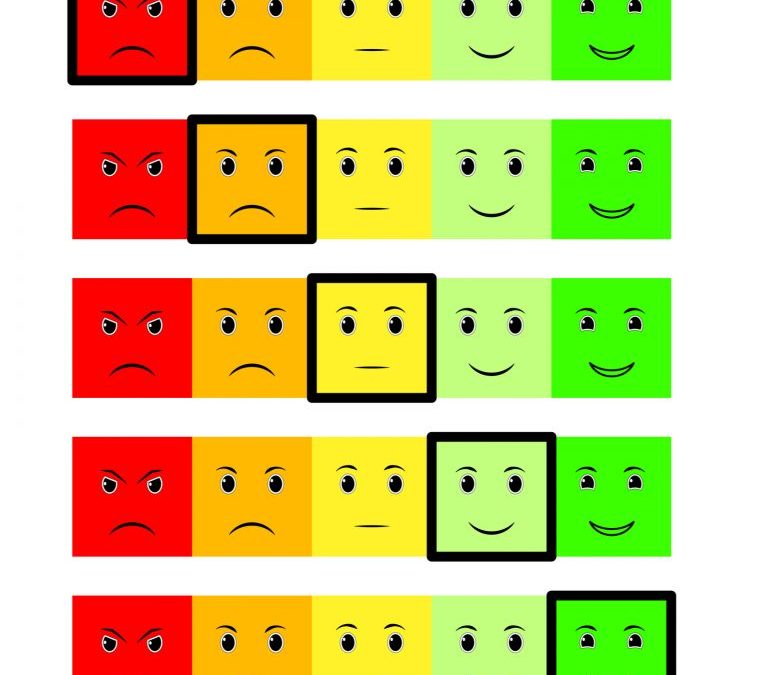

Gauging the current sentiment towards a particular cryptocurrency might seem trivial compared to more conventional trading techniques such as charting, but it has its place. Ascertaining the mood of a market won’t tell you the best entry or exit point for a trade, but as a broader indicator of which way the tide is turning, it’s extremely powerful. Cryptocurrency traders will remember the euphoria that accompanied last December’s bull run and will, in hindsight, concede that sentiment was an indicator it was time to sell. Most of the time, sentiment analysis picks up on more subtle and scattered cues, which is why it’s a task best left to machines rather than humans to process.

Augmento, which pulls in hundreds of thousands of data points, is the product of a Berlin-based team. Currently in closed beta, the platform uses AI to aid with trend detection and sentiment analysis. “Crypto is crowd psychology on steroids,” ventures Augmento CEO Michael Baumgartner says. He sees Augmento as being at the vanguard of “a new generation of AI systems able to capture mood and topics of discussion of millions of users in real time.”

The range of emotions that can be drilled into and analyzed for a particular currency is extensive. Traders who want to get granular on bitcoin can filter by such moods as bearish, FOMO, panicking, and happy. The idea is that traders can use the signals as a contra-indicator to determine, for example, when the market is overheated and it may be time to scale out. Augmento currently draws the bulk of its sentiment from Reddit, but is in the process of adding other crypto hangouts such as Telegram and Twitter. It’s also incorporating an API for hedge fund access. It claims to be able to detect over 100 price-driving emotions and topics of discussion.

Predicoin Promises Advanced Sentiment Analysis

Predicoin is another SA platform that’s soon to launch. It pulls in data from Medium, Twitter, Reddit, Facebook, Youtube, and Telegram and uses data mining and machine learning to analyze news and social media content, saving retail investors time and energy. “The crypto market is growing exponentially, and it’s becoming increasingly difficult for traders and investors to cut through the noisy online chatter and identify quality information,” explains founder Pierre-Alexandre Picard. “Using sentiment analysis, Predicoin’s crypto analytics platform helps traders and enthusiasts access and interpret cryptocurrency information to make better decisions.”

Predicoin is another SA platform that’s soon to launch. It pulls in data from Medium, Twitter, Reddit, Facebook, Youtube, and Telegram and uses data mining and machine learning to analyze news and social media content, saving retail investors time and energy. “The crypto market is growing exponentially, and it’s becoming increasingly difficult for traders and investors to cut through the noisy online chatter and identify quality information,” explains founder Pierre-Alexandre Picard. “Using sentiment analysis, Predicoin’s crypto analytics platform helps traders and enthusiasts access and interpret cryptocurrency information to make better decisions.”

Like Augmento, Predicoin is currently beta testing ahead of a full release. As the market matures, Augmento’s Michael Baumgartner sees the role of SA growing in stature. “Sentiment analysis is crucial when it comes to understanding crowd psychology and market cycles,” he says. “We believe that, if done right, it’s one of the most powerful price predictors in crypto.”

Do you think sentiment analysis is a useful trading tool? Let us know in the comments section below.

Images courtesy of Shutterstock, and Augmento.

Disclaimer: Bitcoin.com does not endorse nor support these products/services.

Readers should do their own due diligence before taking any actions related to the mentioned companies or any of their affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

The post Meet the New Sentiment Analysis Tools Empowering Smarter Trading appeared first on Bitcoin News.