For more than six months of 2018, cryptocurrency markets have been extremely bearish considering the massive bull run in 2017. Last month many digital asset prices performed better than they had in months and some enthusiasts thought crypto markets might be on the mend. However, bitcoin markets and many other cryptocurrency values have started to slide and some traders and analysts believe the storm may get much worse.

Also Read: The Bitcoin Cash Network Processed 687,000 Transactions on August 1st

Watch Out — Cryptocurrency Prices Can Invalidate Your Trading Position In a Matter of Minutes

Cryptocurrency bears, love them or hate them, exist in great magnitude this year, for as everyone knows, digital assets have been in a slump. Many cryptocurrencies seemingly have hit the ‘bottom’ at least three times so far, but that may not hold true for very long. A market bottom is what’s considered the lowest the price of a cryptocurrency will go for a period of time until markets rise in value again. For instance, BTC/USD prices touched a high of $19,600 per coin last December and since then BTC values have dipped to roughly $5,700 per BTC a few times. This has led some people to believe that the $5,700 region is the bottom, at least for now, unless things go southbound during a flash crash. Many respected cryptocurrency traders have different types of views when it comes to what will happen next in the land of digital currency markets.

One respected digital asset trader called Mr. Jozza details that right now bitcoin markets are not looking very nice. “The bitcoin market is ugly,” Mr. Jozza emphasizes. “It completely invalidated my previous bullish interpretation. No follow through on break up of a bearish trend.”

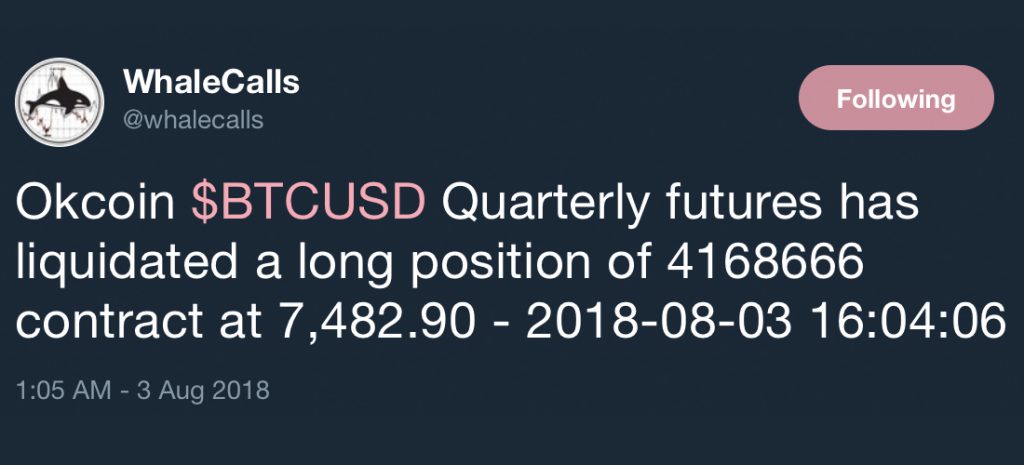

While Okcoin 415 mm contract liquidation sits on the books, expecting $7200 test for support.

Are High-Frequency Trading Firms Joining the Party?

Another respected trader and administrator of the large Telegram trading chat room Whale Club, BTCVIX, says High-Frequency Trading (HFT) firms are trading bitcoin.

“Hey crypto trading noobs — this pattern look familiar? The Judas candle — yeah BTC moves more and more like forex every day — you have the same forex HFT firms joining the BTC party,” BTCVIX details on August 2.

The Greatest Danger in Crypto: Flash Crashes

Because of the volatile movements over the last few days, digital asset margin traders on exchanges like Okex and Bitmex have literally been getting ‘rekt.’ Three days ago on July 31, the exchange Okex liquidated more than $400 million USD worth of Bitcoin futures contracts from just one customer. Two days later the well-known cryptocurrency trader Philakone explained to his 100,000 Twitter followers that people should be careful of ‘flash crashes’ in crypto markets, especially when trading with leverage.

“Here are my positions — I’ve set aside another $200K now in my margin that I can play just in case something violent like a flash crash happens — Always be mindful of that,” Philakone emphasizes.

Always remember the greatest danger in crypto: Flash crashes. If you forget about this, it’s not good. It could happen only ONE time for you to destroy your crypto career. I’ve been there. Be careful baby whales.

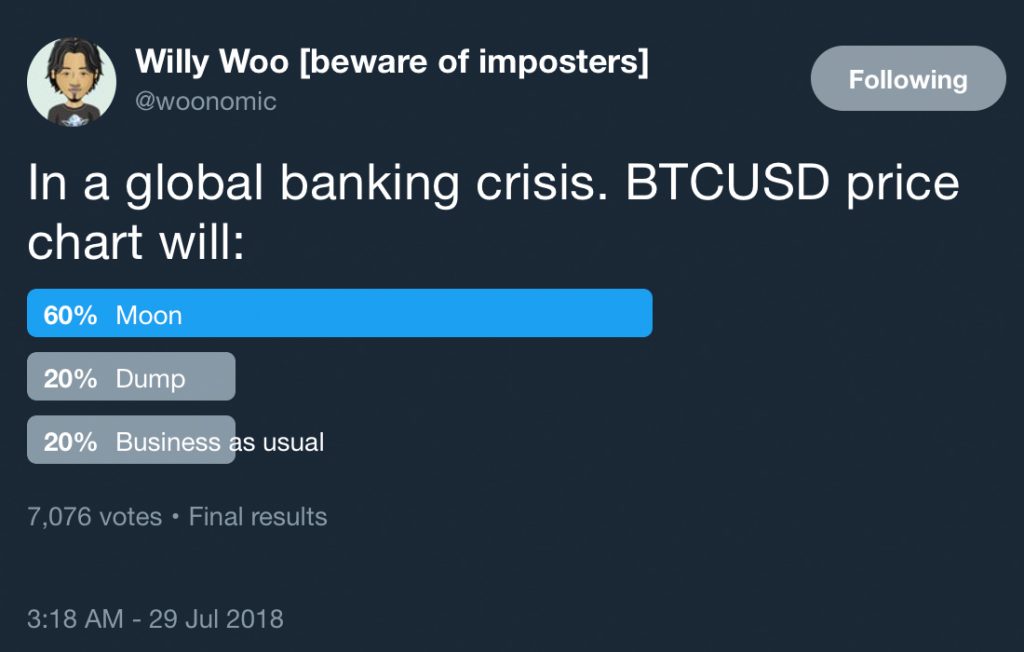

On August 1 the respected cryptocurrency analyst Willy Woo explained to his Twitter followers that he thinks BTC will “flash dump, then moon” during a global banking crisis. People believe the analyst because Woo has predicted cryptocurrency variances correctly a few times in the past.

“Interesting to see most think BTC will moon,” Woo details. “I think BTC will flash dump, then moon afterward, just like with Gold in WFC 2008.”

“Interesting to see most think BTC will moon,” Woo details. “I think BTC will flash dump, then moon afterward, just like with Gold in WFC 2008.”

Flight to safety: everything else sells off to USD, then used to unwind leveraged positions, then afterward havens like Gold and BTC have a bull run.

“Probably also contingent on how many institutional players are in the BTC market over that period. Normal retail HODLers won’t tend to have large leveraged positions to unwind from, apart from maybe mortgages,” Woo notes.

The Last Dead Cat Bounce? Short Positions Begin to Pile Up Before the Weekend Trading Sessions

Currently, most cryptocurrency markets are still in the red seeing losses over the last 24 hours. Bitcoin core (BTC) has been trading between $7,250-7,520 over the last day, while bitcoin cash (BCH) is swapping for $660-740 per coin. Both markets have seen consistent drops in trade volume (BCH $375M, BTC $4.4B), and billions shaved off their market capitalizations. Many leverage traders lost their shirts over the last three days due to margin liquidations, as there were some very quick drops in value this week. As we approach the weekend short contracts are already starting to pile up on Bitfinex, Kraken, and Bitmex once again.

The last few weeks of gains gave traders a breath of fresh air, but the bullish sentiment didn’t last long. Unlike the slew of Wall Street bigwigs that believe bitcoin will touch $50K or zero by the year’s end, there are many traders out there who are more in touch with reality and telling people they should trade carefully.

Where do you see the price of BTC, BCH and other cryptocurrencies headed from here? Let us know in the comment section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Pixabay, and the various traders mentioned above on Twitter.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Monster Liquidations and Flash Crash Fear appeared first on Bitcoin News.