The price of bitcoin has dropped to its lowest average this month, to a low of $3,426 amid the recent regulatory storm brewing in China. At the moment the price is struggling to stay above the $3,570 range as traders are waiting for the floor to appear and open new positions.

Also read: GMO to Invest 10 Billion Yen in Its Own 7nm, 5nm and 3.5nm Dedicated Bitcoin Chips

China FUD Causes Bitcoin’s Price to Drop Significantly… Again

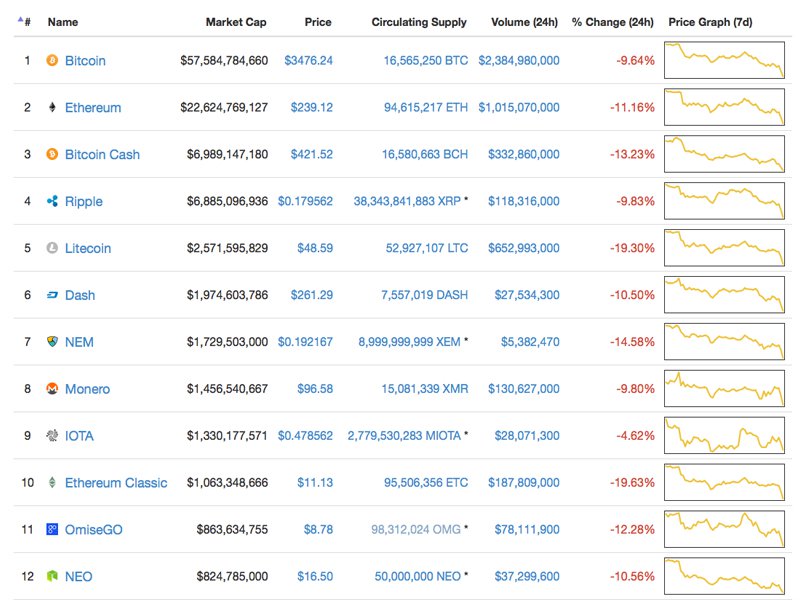

Cryptocurrency markets are blood red on Thursday, September 14 and many speculators say the recent news from China has impacted the price of bitcoin. Chinese authorities have taken issue with the recent ICO madness and have told cryptocurrency trading platforms in the region to cease operations. The price of bitcoin has already dropped significantly on September 13 as uncertainty about the news from China swept the web. Bitcoin’s value dipped from $4,200 to a low of $3,800 before the exchange BTCC made its recent announcement. Following bitcoin’s drop in value, nearly every other cryptocurrency is in the red with losses averaging between 10 and 30 percent.

Technical Analysis

Looking at the charts, bitcoin’s market value has dropped six legs down over the past 12-hours. Bearish sentiment has caused a lot of panic selling and order books are moving fast across many popular exchanges. At the moment the 100 Simple Moving Average (SMA) is coasting along above the 200 SMA, which means a possible rebound could happen in the near future. However, both the Relative Strength Index (RSI) and Stochastic indicators are showing the correction may continue heading south. Order books show a vast amount of sell orders in the $4,000 territory, and the buy side is mountainous as traders want in on the lowest entry points. Trade volume is strong as BTC markets are swapping $2.3B over the past 48-hours

Almost All Crypto-Markets Are Blood Red

Cryptocurrency markets, in general, are feeling the wrath of China’s impending regulatory storm. Nearly every single altcoin below bitcoin has seen a deep correction so far as the total cryptocurrency market cap has reached a low of $120B. Popular altcoins such as ethereum, litecoin, dash, and many others are seeing the biggest losses in months. Bitcoin Cash has also dropped to a low of $410 per BCH but still commands the third most valued cryptocurrency market cap. At the moment it is still more profitable to mine on the legacy chain as Bitcoin’s market dominance is above 48 percent.

The Verdict

Many Bitcoiners are hoping the situation in China will resolve soon and believe people are creating FUD to shake out weak hands. It seems bears are betting against the currency’s price as there are a vast amount of short positions being placed among traders. Currently, the market seems to be consolidating in the $3,550-3,570 range per BTC.

Many Bitcoiners are hoping the situation in China will resolve soon and believe people are creating FUD to shake out weak hands. It seems bears are betting against the currency’s price as there are a vast amount of short positions being placed among traders. Currently, the market seems to be consolidating in the $3,550-3,570 range per BTC.

Bear Scenario: The price per bitcoin could easily sink lower at this point, but there seems to be a decent floor in the $3,350-3,400 range at press time. If more panic selling ensues, then the price could approach the sub-$3,000 territory. Technical indicators like the RSI show the bearish trend may continue over the next 48-hours.

Bull Scenario: If bulls want to push the price back up above the $4K range again they have some work to do this week. Over the next couple of days, the price may consolidate and bounce back after this correction. Charts show the head and shoulders formation is over and the market should follow with a bullish uptrend in the near future.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Reddit, Bitcoin Wisdom, and Bitstamp.

Want to create your own secure cold storage paper wallet? Check our tools section.