Digital asset prices are seeing modest improvements on Monday, Dec. 17 as the top 10 cryptocurrencies have recorded gains between 5-19% over the last 24 hours. The entire crypto-economy has captured a market valuation of $108 billion but global trade volume has remained flat, showing no immediate signs of a market trend reversal.

Also read: A Look at Some of 2018’s Most Popular Cryptocurrency Traders

One Year Ago Today Cryptocurrencies Touched All-Time Highs

Cryptocurrencies have had a tough year considering today is the anniversary of when the price of bitcoin core (BTC) touched an all-time high of $19,600 on multiple exchanges on Dec. 17, 2017. This means BTC has lost 82.65% of its value since that day. In fact, a large majority of digital currencies touched all-time highs last year at this time and have not returned to those levels since. The entire crypto-economy at the time had around 1,600 coins but was valued at close to half a trillion U.S. dollars. Now there are over 2,000 coins and the market is only worth $100 billion, so it’s safe to say there have been some significant changes in the interim.

Digital Currency Markets Show Slight Recovery

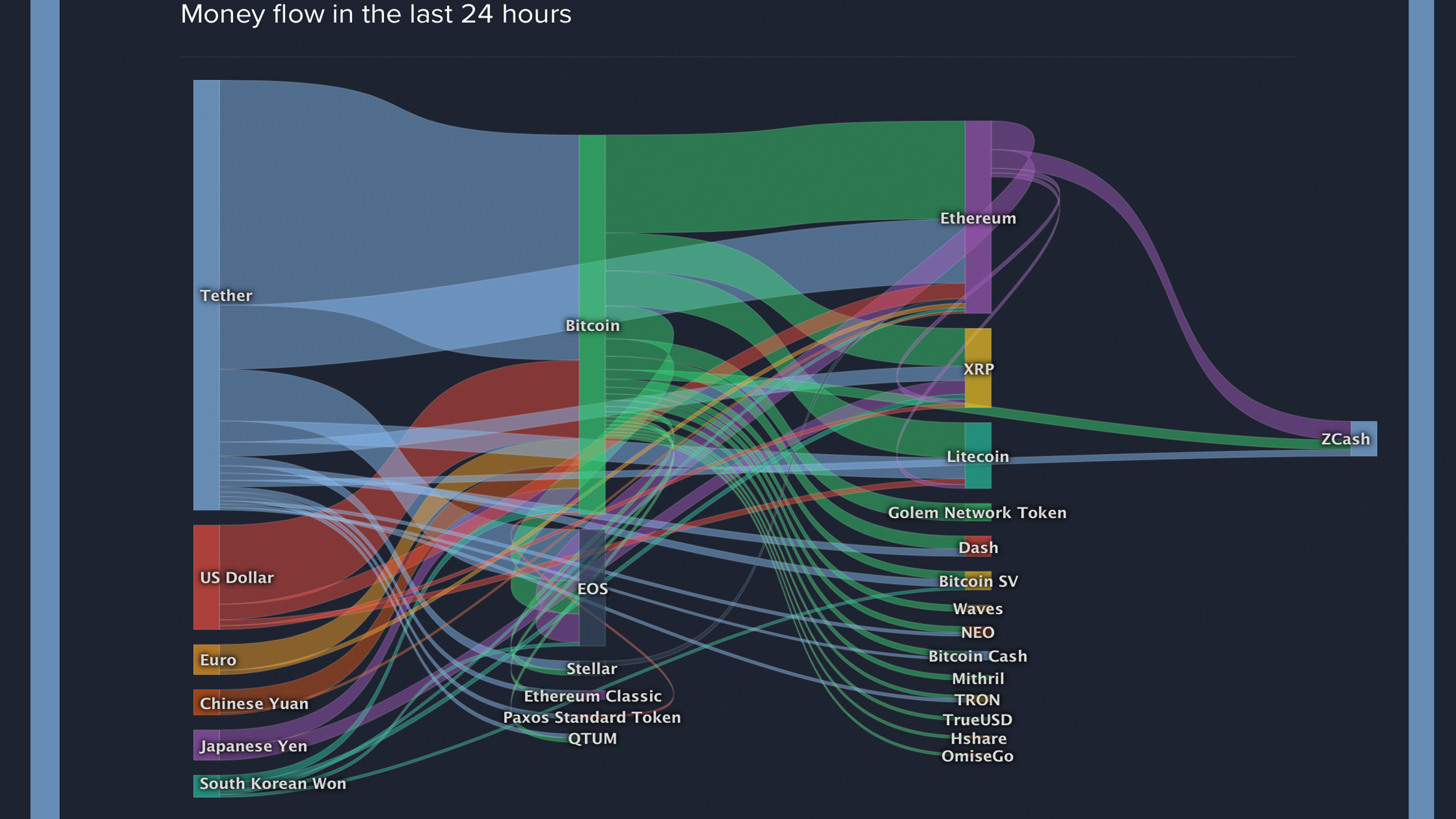

Today the price of BTC is up 5.2% and has been steadily making gains during the early morning trading sessions. The value of bitcoin core is down 2.2% over the last seven days and has an average price of about $3,445 per coin. Ripple (XRP) still holds the second position and its markets have gained 5.4% over the last 24 hours. One XRP is swapping for $0.30 per coin and has erased its weekly losses.

Ethereum (ETH) is trading for $91 per ETH at the moment and markets have jumped 4.9% this morning. The fourth highest value market is held by eos (EOS) and its market is the forerunner today out of the top 10 coins. One EOS is swapping for $2.32 and markets have gained over 19% during the morning trading sessions. Stellar (XLM) is up 7.6% at the moment and is trading for $0.10 per XLM on global exchanges.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) markets are doing much better since our last markets update as BCH has gained over 8.6% over the last 24 hours. However, BCH markets are still down roughly 16% over the course of the last week. The price of bitcoin cash this Monday is $88 and the entire market valuation is about $1.56 billion. BCH has lost 94.77% of its value since the cryptocurrency’s all-time high.

Over the last 24 hours, there’s been a total of $91 million worth of global BCH trades on popular trading platforms. The top five exchanges swapping the most BCH today are Lbank, Binance, Huobi, Bithumb, and Coinbase. The top currency pairs swapped with BCH on Dec. 17 include BTC (39.6%), ETH (29%), USDT (23.2%), USD (3.8%), and the EUR (1.5%). Furthermore, the Japanese yen is right behind the euro at 1.3% of BCH global trades.

BCH/USD Technical Indicators

Looking at the four-hour BCH/USD chart on Bitstamp shows bulls have been attempting to push higher over the last 12 hours. Relative Strength Index (RSI) is resting at -53, just above previously oversold conditions. The current formation on the 30-minute BCH/USD chart and the RSI/MACd levels shows a touch of bullish divergence. The long-term 200 Simple Moving Average (SMA) however is still riding above the short-term 100 SMA.

This indicates that the path toward least resistance is still the downside, but the two trendlines look as though they may cross hairs which could signal further price upswings. Order books on Bitstamp show bulls need to surpass the current vantage point and walls above the $95 price zone. On the backside, there are some seemingly solid foundations between now and the $75 range.

Has the Crypto Speculation Period Run Dry?

Many cryptocurrency traders are still skeptical even though there’s been some slight recovery today. For instance, there’s been a lot going on within the global economy with tech stocks and equities starting to slump. Many people are starting to think the cryptocurrency speculation era is ending. Galaxy Digital founder Mike Novogratz explained earlier this week that crypto participants are seeing things more clearly now. “The audience is more sober now – the drug is gone … but it’s not going to zero — we’re at the methadone clinic,” Novogratz emphasized.

The CEO of Bitpay, Stephen Pair, hopes to see actual utility rise in the next five years because this is what his firm concentrates on. “A very big component of the price is certainly speculation. It’s investors that are speculating on the future usage and adoption of this technology — I’m sure a small component of that price is the actual utility,” Pair stated during an interview with CNBC on Dec. 13.

Overall, long-term cryptocurrency proponents are quite confident in the value of digital assets over the next five years to a decade. The biggest question right now is how long the current bearish trend will lead the crypto-economy and whether or not the bottom is really in.

Where do you see the price of BCH, BTC and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Coinlib.io, Bitstamp, the Coinbase Dashboard, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrencies Start the Week With Modest Gains appeared first on Bitcoin News.