The second day of the new year sees cryptocurrency markets come back after another holiday slump over the past few days. Bitcoin core markets are up 4 percent, averaging between $14,600-14,800 across global exchanges. However many other digital assets are seeing more significant gains as ethereum and bitcoin cash markets have risen 13-18 percent during the morning of January 2.

Also read: Japan’s GDP Grows Due to Bitcoin Wealth Effect

Bitcoin Markets Rebound a Touch After the Holidays

Cryptocurrency markets, in general, have dipped in value over the past week and a half seeing record lows compared to last year’s phenomenal gains. However, following New Year’s day digital asset markets are starting to creep northbound once again. After yesterday’s average of $13,400 per token, BTC/USD markets are now trying to forge past the $14,000 zone, but bulls have been hitting resistance. Volume is very high at the moment as bitcoin core markets are commanding over $18Bn in trade volume over the past 24-hours. The top exchanges swapping the most BTC on January 2 include Binance, Bitfinex, Okex, Hitbtc, and GDAX.

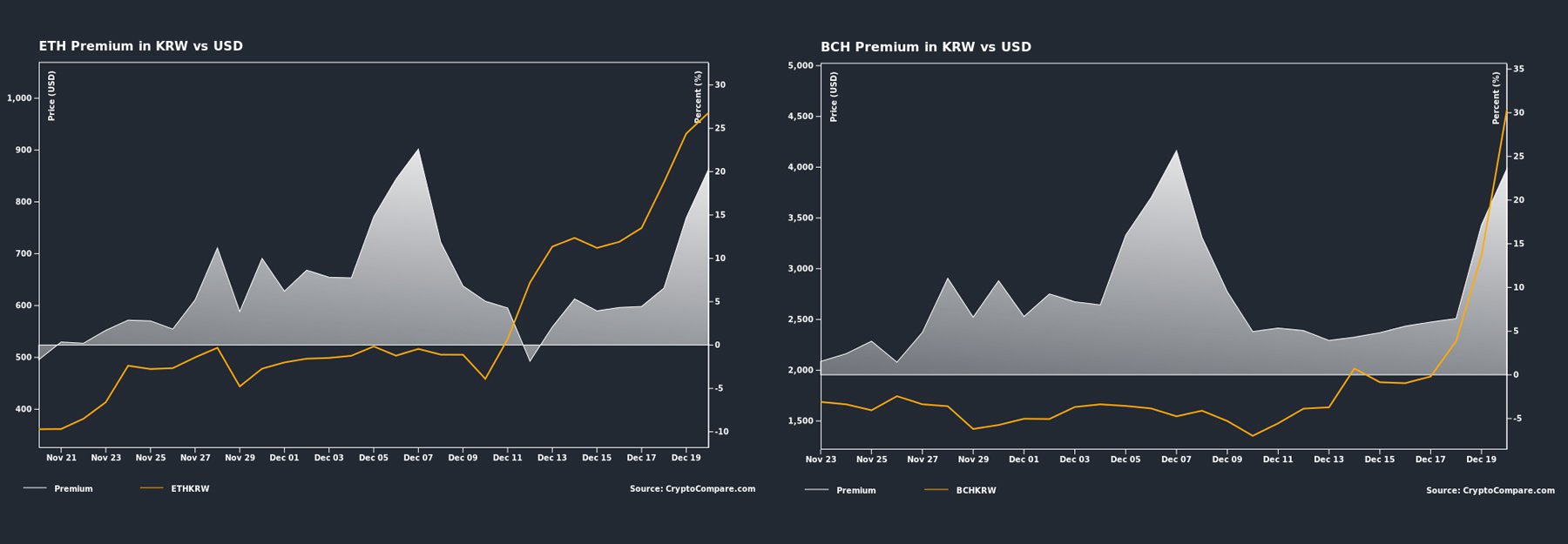

The USD is still the top currency traded with BTC as the tender holds 38 percent of the global share of trades. The Japanese yen has increased its position jumping to 32 percent after dropping in volume last week. The yen is followed by tether (USDT), the euro, and the Korean won leading the top five currencies traded with bitcoin core. According to Cryptocompare data statistics, South Korea has consistently held the world’s top premiums with prices 15-25 percent higher than the global average. Exceptionally high BTC premiums can also be found in India, Zimbabwe, Venezuela, Brazil, and sometimes Japan as well.

Technical Indicators

Looking at the charts today for BTC/USD looks better than the days prior. The two Simple Moving Averages (SMA), both short and long-term, have converged early this morning. The 100 SMA is now above the longer term 200 SMA which means buyers could take the upside after breaking some more resistance. There is some stiff resistance above the $13,950-14,100 territory and another sizable wall around $14,500. If BTC prices can continue to climb above $15,500 some smoother seas may be in the cards. On the back side, there’s a strong foundation between $13,400-13,500. Further back, support begins to weaken again, but there are definitely pit stops in the $12,000-13,000 range. Both the RSI and Stochastic oscillators show the path to resistance is on the upside. For now, bulls seem to be applying pressure, volume is substantial, and bitcoin core markets look healthier after the week and a half worth of price dumps.

Alternative Digital Assets Steal the Show

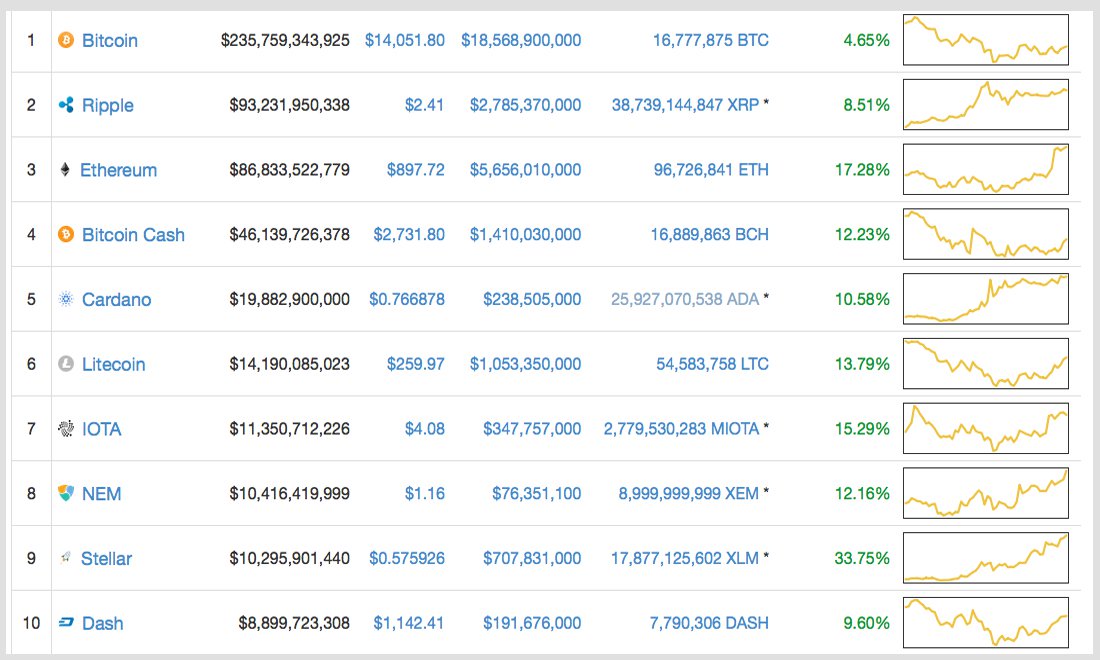

Other digital assets have had much better trading sessions on January 2, and some coins are touching all new price highs. Ripple (XRP) is still making some gains, and each token is worth roughly $2.40. The third largest market capitalization held by Ethereum (ETH) is riding out an all-time high touching $900 per ETH. The currency’s markets are up 18 percent and are seeing $5.7Bn in trade volume over the past 24-hours. Bitcoin cash (BCH) prices are doing exceptionally well and are up roughly 13 percent since yesterday. The price per BCH is $2,800 at the time of writing, and BCH markets have $1.6Bn in daily trade volume. The fifth highest valued market cap is still held by Cardano (ADA), and its markets are seeing 11 percent gains today. The rest of the top ten capitalizations are in the green as well with stellar (XLM) commanding the top performing digital asset on January 2 with its markets up by 25 percent.

Many traders still don’t know what to expect to happen with bitcoin core markets and the rise of other digital currencies into the new year. Right now cryptocurrency markets have amassed a whopping $656Bn valuation, but bitcoin only captures 35 percent of that share. All of the digital assets have very high trading volumes as general markets are seeing $49Bn in crypto-swaps over the past 24-hours. Right now the top-most traded cryptocurrencies on the second day of 2018 include bitcoin core (BTC), ethereum (ETH), ripple (XRP), tether (USDT) and bitcoin cash (BCH).

Where do you see the price of bitcoin and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock, Bitcoin Wisdom, Pixabay, and Bitstamp.

Get our news feed on your site. Check our widget services!

The post Markets Update: Cryptocurrencies See Big Gains After New Year’s Day appeared first on Bitcoin News.