Cryptocurrency markets are once again riding a long period of consolidation as the last seven days has failed to show any meaningful moves. During our last markets update, digital asset values spiked considerably, gaining billions in one hour on Feb. 8. But a week later cryptocurrencies have offset those gains and most markets have been following a narrow range for more than a week.

Also Read: Bitcoin’s Social Contract Must Be Resilient to the Whims of Future Generations

Crypto Gains Neutralize and Follow a Falling Narrow Range

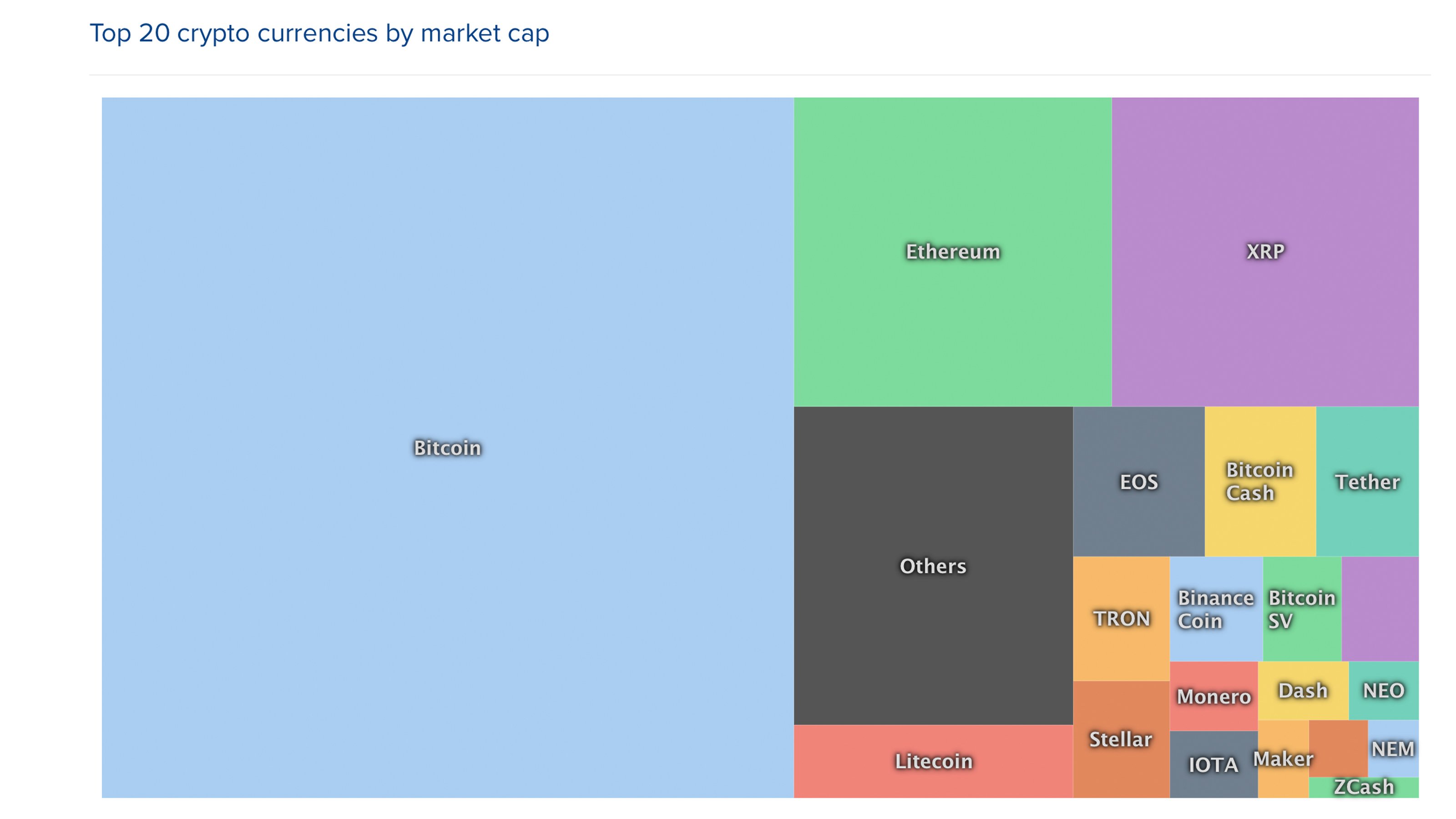

Digital currency prices have been consolidating again into what looks like a falling wedge after seeing a significant jump in value eight days ago. The overall market capitalization of all 2,000+ cryptocurrencies is around $120 billion. Global trade volume is still decent, even though it’s a touch lighter than last week at $18.8 billion over the last 24 hours. Currently, bitcoin core (BTC) is priced at $3,635 with a market valuation of about $63.7 billion at the time of writing. BTC is down around 0.81% over the last week but has managed to gain 0.3% during this morning’s early trading sessions.

The second highest market capitalization belongs to ethereum (ETH) as each token is trading for $123. Ethereum markets have managed to knock ripple (XRP) from the second position as XRP is swapping for $0.30 this Saturday. Litecoin (LTC) captures the fourth position with each coin trading for $43 as markets have gained 3.5% today. Lastly, eos (EOS) prices are up 1.5% as each eos is sitting at $2.83 per coin.

Bitcoin Cash (BCH) Market Action

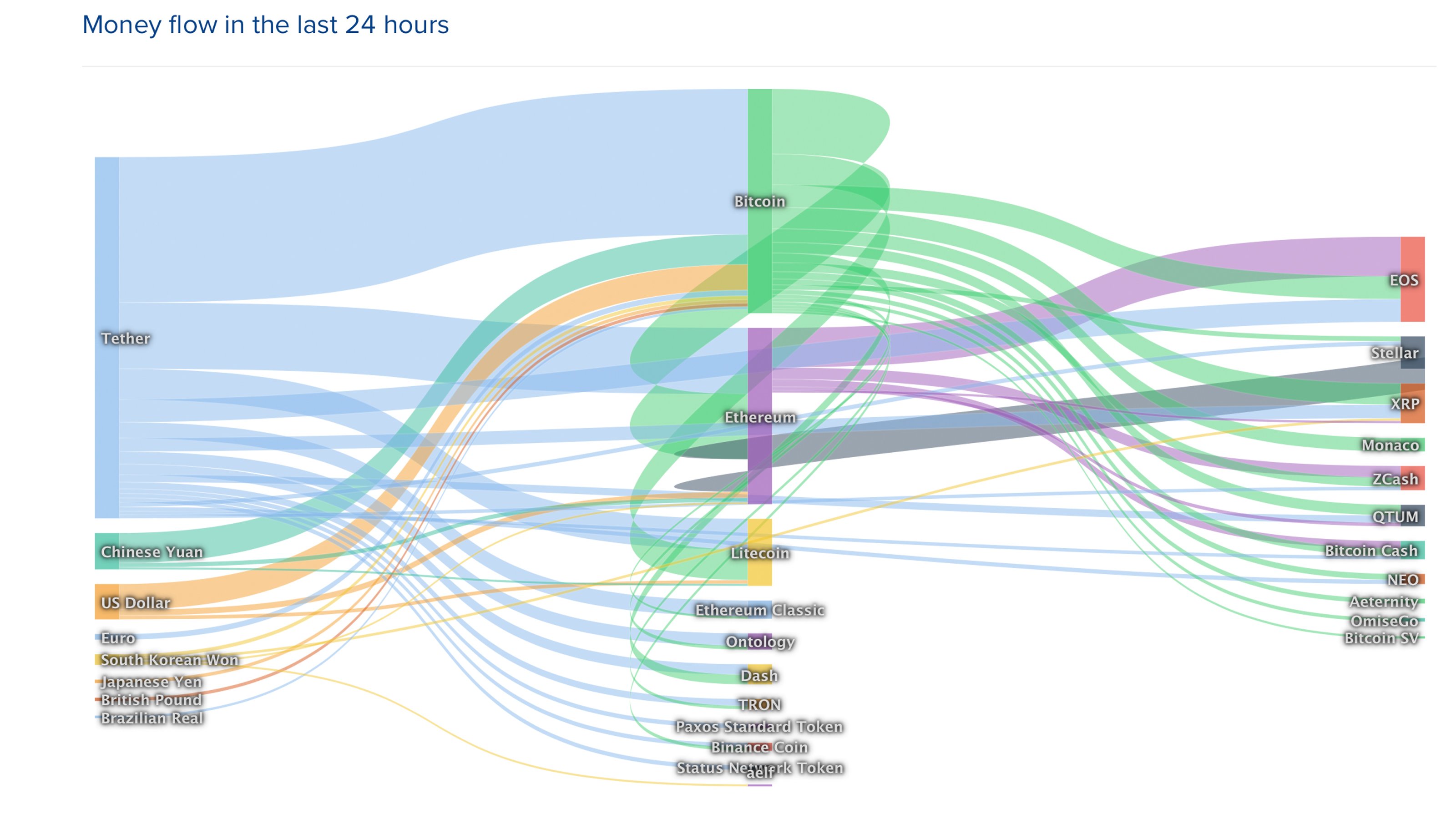

Bitcoin cash (BCH) prices have been coasting along at $122 per coin this weekend and markets are up 0.44%. BCH has an overall market valuation of around $2.1 billion and about $192 million traded over the last 24 hours. The top five exchanges trading the most bitcoin cash today are Lbank, Hitbtc, Fcoin, Binance, and Upbit. The top trading pair with BCH this weekend is ETH by 42.2% over the last day. This is followed by USDT (30.1%), BTC (17.4%), USD (4.2%) and KRW (3.7%). Over the last few weeks, larger concentrations of KRW/BCH pairs have been increasing. This weekend BCH is the ninth most traded cryptocurrency below dash and just above qtum.

BCH/USD Technical Indicators

Looking at the 4-hour chart on Kraken and Bittrex shows the momentum from BCH bulls has neutralized. Over the last seven days, heavier resistance was able to build up and will make things more difficult for northbound movements. The two Simple Moving Average (SMA) trendlines show the long-term 200 SMA is still above the short-term 100 SMA. This solidifies the fact that the path toward the least resistance is still the downside. Although as noted in prior market updates, the two moving averages look to be converging in the near future unless some big changes await.

Moving on to the Relative Strength Index (RSI), Stochastic, and MACd indicators we can see things meandering back and forth. RSI and the Stochastic oscillator levels are coasting along at 48.4 on the 4-hour chart, indicating traders seem to be cautious at the moment. MACd shows signals that BCH bears are getting exhausted and a reversed MACd divergence suggests the bottom may be in and market trends seem to be on the verge of change. Order books indicate some thick resistance between the current vantage point and prices above $150. The bears will struggle between today’s spot prices and numerous areas of support until $95.

Traders Still Speculating on the Next Bull Run

Last week’s run-up in prices had given some cryptocurrency traders a new breath of optimism but others still think it was just another dead cat bounce. Many digital asset traders are selecting positions and just hoping they found the right seats during this game of musical chairs. One trader who goes by the name “Financial Survivalism” on Twitter thinks BTC prices might drop considerably before a big reversal in his “Hyperwave” price analysis. The trader suggests that BTC could fall to $1,165 before a large jump to $10,000.

Furthermore, Zhu Fa, the cofounder of Poolin, a China-based mining operation, believes the price of BTC will skyrocket 10–20x higher than its prior all-time high of $20,000. The Poolin cofounder thinks that BTC will be priced between $70,000 or 5 million yuan ($738,000). Other traders also believe the next big cryptocurrency bull run will be the last huge run-up and the crypto economy’s subsequent years of life will see much slower growth.

Where do you see the price of BCH, BTC, and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Coinlib.io, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Crypto Traders Still Uncertain After a Week of Consolidation appeared first on Bitcoin News.