After hovering around the $16,500 zone for most of the day on December 12, bitcoin jumped in value to around $17,100 during the early hours of December 13. Bitcoin markets were coasting along in that range for a few hours, and then around 12 pm EDT the price started heading south and dropped one deep leg down to the $15,400 territory. At the moment the price has rebounded, and bullish traders are desperately trying to command prices ranges above the $16K region.

Also Read: Lightning Network’s New Infrastructure and Interoperability

Bitcoin Markets See Turbulent Price Swings

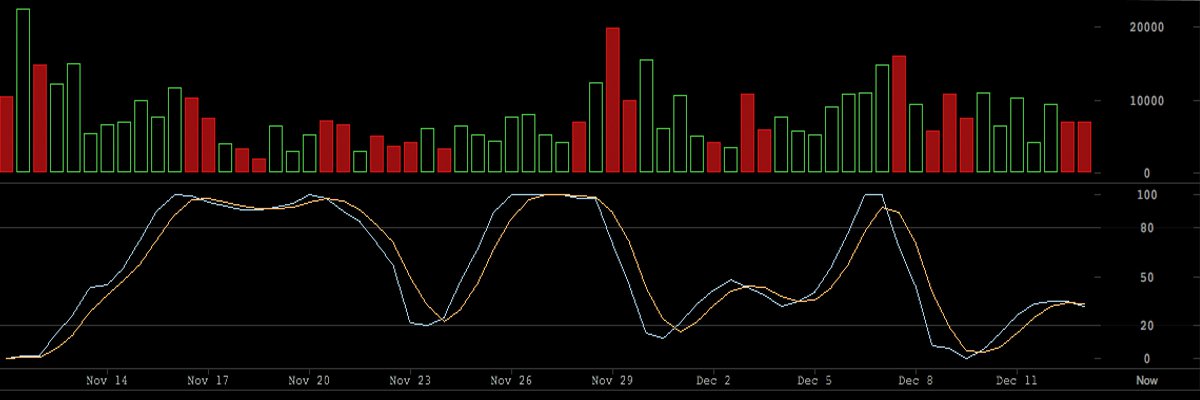

Bitcoin markets and the cryptocurrency’s price has been exciting to watch as spectators around the world wonder what will happen next. At the moment bitcoin core (BTC) markets are recovering from a massive dip that took place around midday eastern standard. The price is hovering around $16,000-16,200 after falling nearly $1,500 in value over the past two hours. Volume is high as global trade volume has seen roughly $13bn over the past 24 hours. The top five exchanges swapping the most BTC volume are Bitfinex, Bithumb, GDAX, Bittrex, and BTCC. The drop also sent many other digital assets into the red zone as they followed bitcoin’s temporary dive. The top ten digital currency market capitalizations have bounced back as well with only a few of them still nursing their wounds.

Technical Indicators

Looking at the charts shows that bulls have a lot more work to do if they want to grasp prices they held earlier this week. Looking at order books on the sell side shows there are some significant walls to hurdle above the $16,500-$17,000 range. However, on the flip side, the backdrop of buy walls show some stronger foundations, but traders should be careful if the price breaks below $15,250.

The short-term 100 Simple Moving Average (SMA) is way above the 200 SMA which means the price will likely see some more uptick northbound. RSI and Stochastic oscillators still show oversold conditions, but both indicators have been telling this story regularly. The most prominent hurdle bulls face will be three key zones which include $16,500, $17,200, and $17,500 in order to break new ground.

Digital Asset Markets Closing In on a $500 Billion Market Cap

Three out of the top five digital assets with the largest market caps have recovered from bitcoin’s price dive. The three cryptocurrencies doing slightly better include ethereum, bitcoin cash, and ripple. Ethereum (ETH) markets are up 15 percent as the price per ETH is around $700. Bitcoin cash (BCH) has had a pretty decent day as markets are now up over 5 percent with one BCH priced at $1,600. The currency ripple (XRP) probably had the best day out of all the cryptocurrencies on December 13 as one XRP is now $0.45 after gaining over 70 percent in value. Lastly, litecoin (LTC) is down 6 percent and the price per LTC is roughly $300 at the moment.

Novogratz Says Sell Your Litecoin and Sees Bitcoin Hitting $40K While Cboe Futures See a Low

Bitcoin proponents and community sentiment still seems fairly positive, and many still believe the price will see even more all-time highs this coming year. For instance, the macro hedge fund manager at Fortress Investment Group, Michael Novogratz, is more optimistic about bitcoin after seeing litecoin’s recent spike. According to an interview with CNBC, Novogratz says he would sell litecoin holdings after LTC spiked over $300, and sees bitcoin reaching $40,000 in a mere two months.

However other mainstream investors don’t seem so confident as Cboe’s bitcoin-based futures markets are way down. After skyrocketing to a high of $18,650, futures markets are now seeing lower predictions in the $16,750 price range. On the first day of Cboe’s bitcoin futures trading markets were halted due to a large price swing. The same thing happened today on December 13 as the sudden drop in value had Cboe’s bitcoin markets cease operations temporarily.

Bitcoin spectators, skeptics, proponents and avid cryptocurrency enthusiasts have no idea what will happen next, but it’s safe to say most of them have been glued to the market action over the past few weeks.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Cboe, Bitcoin Wisdom, and Bitstamp.

Get our news feed on your site. Check our widget services.

The post Markets Update: Bitcoin’s Price Takes a Quick Dive appeared first on Bitcoin News.