The price of bitcoin has been trending higher since our last markets update and is currently hovering around the $4,275 – $4,295 zone on September 30 at 11:00 pm EDT. The decentralized cryptocurrency has climbed roughly 2 percent on a daily basis over the course of last week as buyers steadily chew through market resistance.

Also read: Cayman Investment Forum Focuses on Rise of Bitcoin and Failing Dollar

Bitcoin Markets Feel a Quick Upwards Rush

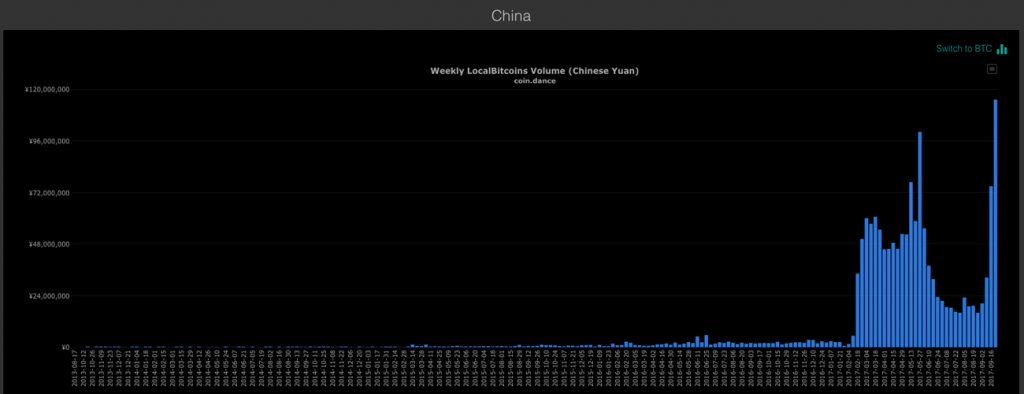

Bitcoin markets and traders betting on bitcoin’s uptrend had an active week closing out the month of September. Currently, traders and bitcoin proponents seem optimistic, as there have been a few positive announcements this week like 11 Japanese exchanges being approved by the FSA. News from China seem optimistic as cryptocurrencies are expected to be regulated on October 1. Bitcoin trade volume has ticked up a tad capturing $1.3B in daily trade volume, with global Localbitcoin’s trade volumes at an all-time high. Since the announcement of Chinese exchanges closing, Localbitcoin’s volumes in China have been the highest in recorded history.

Technical Analysis

Bitcoin’s price has been ascending higher over the course of the day, reaching a high of $4,340. The price has been meeting some resistance around this range and is being pressed downwards at the time of writing this. Technical indicators show the 100 Simple Moving Average (SMA) is still well above the 200 SMA which means some upside is still in the cards. Order books show deep resistance at the $4400 territory and buyers will have to work a touch harder to move past the sell walls.

The Relative Strength Index (RSI) oscillator is meandering south at the moment, showing buyers are tiring out from the day’s spike. The two-week daily trendline is on the upswing, and we may see some consolidation between the $4150 – $4300 range over the course of the next 48 hours. If the support is broken and the Displaced Moving Average (DMA) breaks between $4150 – $4000, it’s possible markets could get bearish again.

Regulations and More Regulations

Currently, regulators from all around the world are more talkative than ever when it comes to bitcoin and other cryptocurrencies. The U.S. Securities and Exchange Commission has been upping its regulatory action over the course of the past few weeks, mostly geared towards Initial Coin Offerings (ICO) that violate federal securities laws. The regulatory agency charged an ICO with fraud as the startup purportedly claimed its tokens were backed by real estate and diamonds. Additionally, three companies this week, CME, Grayscale, and Van Eck associates withdrew or stopped pursuing mainstream investment funds based off of bitcoin derivatives.

The Verdict

Overall the market seems upbeat, but the heated drama within the ‘community’ is hotter than ever. The battle between Core supporters and Segwit2x supporters has become a match of wits, choice words, and blatant insults strewn across social media. Over the next two months, things in bitcoin land are sure to get interesting as the 2MB hard fork approaches and the suspicious launch of the Bitcoin Gold project nears.

Bear Scenario: At the moment, bitcoin is fighting to get back to the $4300 zone, and bears are trying to push it lower. Markets have been fairly volatile over the past two weeks and intra-range traders will easily make profits off future scalps and breaks. If DMA goes below $4150 or $4K, then it’s possible that we could see some shorts around $3800 – $3900.

Bull Scenario: Buyers work hard today and push the price up to the $4340 territory, but they have to work harder and break the key zone of $4400. If this is attainable, we could see some smoother sailing as the price coasts upwards. With the November fork approaching, it’s likely traders will be moving more back into bitcoin, and we could see a price lift from this event. Over the next few weeks, prices in the $4800 – $5000 range again could very well happen from this vantage point.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Coin Dance, and Bitstamp.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.