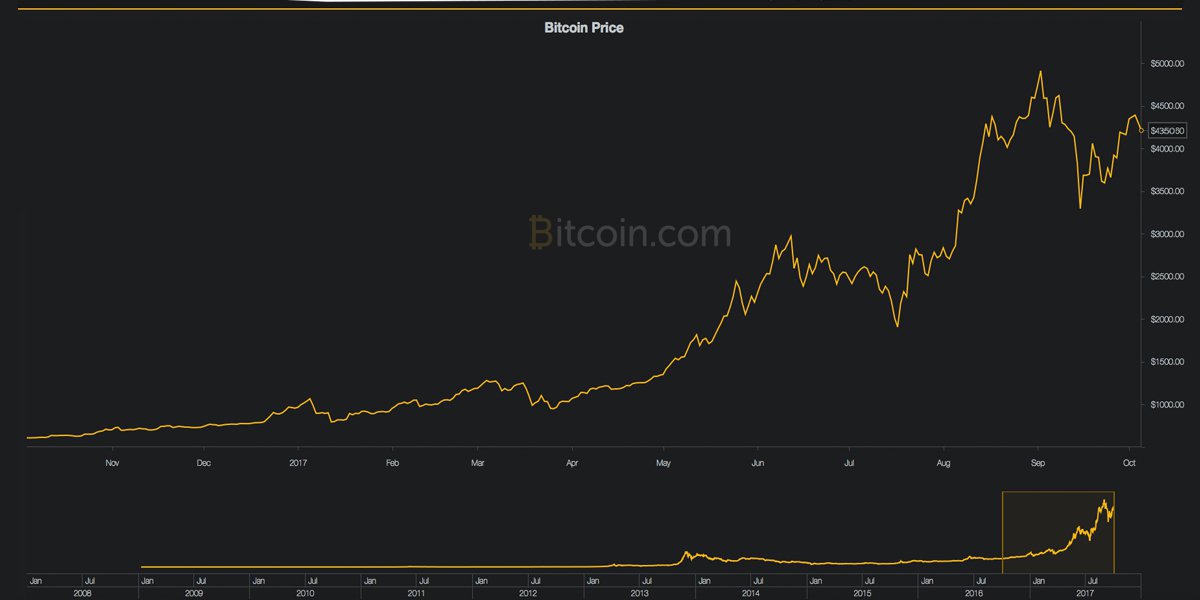

Bitcoin markets are kicking up a notch as the price tested the US$4,425 zone today, after spiking past the $4,300 territory the day before. The currency’s value has been trending higher, but slowly because there’s been a lot of resistance along the way. Presently bitcoin’s price action seemed poised to pounce another leg upwards regaining stamina from the past three weeks of hurdles.

Also read: Cayman Investment Forum Focuses on Rise of Bitcoin and Failing Dollar

Little Bullish Pops in Price in the Midst of Weak Trade Volumes

Currently, buyers have been pushing the BTC price upwards and today’s bitcoin value is testing the $4,389 mark at the time of writing. A significant portion of volume is stemming from Asia in countries like Japan and South Korea, but trade volume globally has been quite low lately. In contrast to a few weeks ago when bitcoin was trading $2-2.5B worth of daily volume, it’s now only capturing half that average at $1-1.5B in 24-hour trade volume. Localbitcoin’s global volumes have also simmered down this week claiming $52M worth of OTC trades. Exchange’s like Bitflyer, Bitfinex, Bithumb, Poloniex, and Hitbtc are capturing the lion’s share of BTC trade volume.

Technical Analysis

Technical indicators show the price of bitcoin surpassed the $4,300 zone yesterday, but broke short-term support during the overnight, meeting resistance near the $4,400 region. According to Fibonacci retracement lines (the golden ratio) between the peak and trough, charts show an upward bounce could be in the cards if the price can surpass this current upper resistance. Order books show on popular exchanges like Bitfinex and Bitstamp, that there is significantly more substantial resistance at the $4,500 mark. After that key-zone, markets could see smoother sailing towards higher price points. Presently, the 200 Simple Moving Average (SMA) is a good distance above the 100 SMA trendline, which tends to reveal bearish sentiment going forward. Both the Stochastic and Relative Strength Index are also dipping south which indicates the current upwards momentum may be short-lived.

‘Community’ Sentiment and the New Segwit2x Future Markets

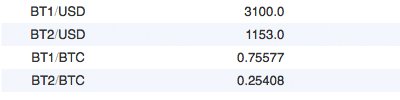

Just like last July, the market doesn’t seem to be phased by the upcoming fork coming this November. However, the Segwit2x hard fork discussion is currently the ‘talk of the town’ between quite a few bitcoin proponents and crypto-luminaries across the web. As far as markets are concerned the Hong Kong-based cryptocurrency exchange Bitfinex just listed BT1 (Core) and BT2 (Segwit2x) futures markets. Currently, BT2 prices are trading for 0.254BTC ($1100), and BT1 prices are valued at 0.755BTC ($3,275) indicating Segwit2x futures capture a quarter of the legacy chain’s market share. Of course, future markets on just one exchange with very little liquidity is a poor prediction of what the prices will be after November.

The Verdict

Furthermore, global bitcoin markets do seem optimistic, and the price has been seeing steady gains. Similarly to the fork this past summer its likely more traders will be selling altcoins for bitcoin to get in on the split tokens. Bitcoin could easily catapult into the $4,800-5K range as the hard fork(s) approach but where it goes from there is anyone’s guess. Alternative digital assets are also seeing weak volumes over the past two weeks, but are seeing price percentage increases this week in unison with bitcoin’s slow rise.

Bear Scenario: The price of bitcoin could dip down into the $4,100-4,200 range if bulls get exhausted during the short-term price spikes. Further if panic ensues, we could see prices go below sub-$4K into the $3,800-3,900 region after some hefty sell-off. The SMA, RSI and Stochastic seem to indicate bearish sentiment, but it could also be a strong consolidation period as well.

Bull Scenario: Bitcoin’s price has had a few steady pops upwards before meeting stiff resistance. Bulls need to keep attacking these key zones and at least push the price higher than $4,500 to get a better vantage point. As stated above with the fork approaching in just over a month more buyers may enter the market in order to gain from a possible split. Prices in the $4,800-$5K zones are attainable and could be reached within the next few weeks.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Bitcoin.com, and Bitfinex futures.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.