The price of bitcoin (BTC) has been suffering from a bearish decline since it reached $19,600 USD across global markets and had touched a low of $15,299 on December 21. Over the past two days, most of the other alternative digital asset markets were stable or made some significant gains. However, now that BTC markets have continued to dive lower, the rest of the cryptocurrency economy is feeling the wrath of the storm.

See also: How to Buy Bitcoin When You’re Underage

Bitcoin’s Price Sees a $4,000+ Correction Since Last Week’s High

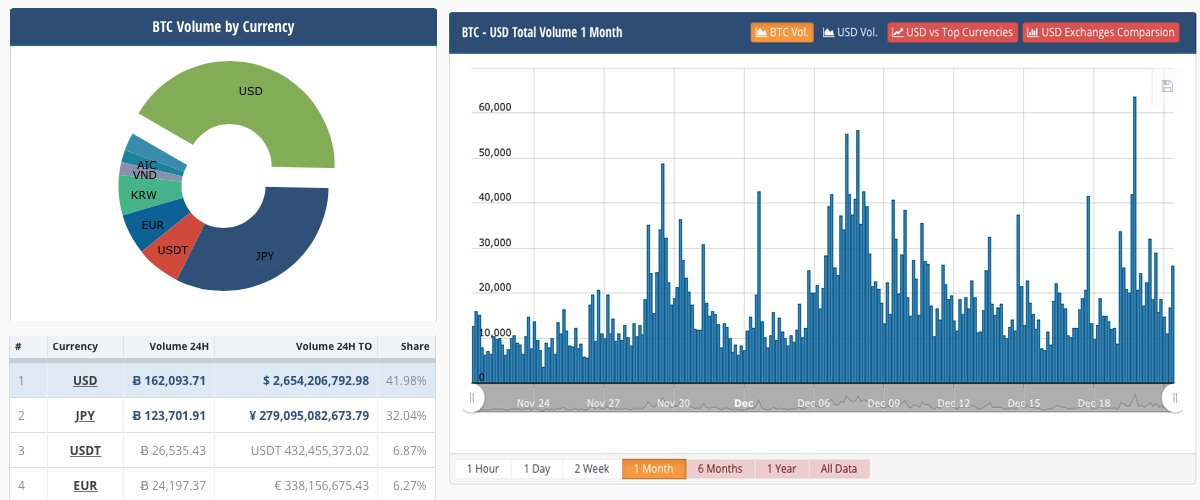

Bitcoin core markets have reached a considerable low after surpassing many new all-time highs over the last two weeks. In fact, after the announcements from Cboe, and CME Group launching BTC based futures products the price of bitcoin gained exponentially for 45 days straight. Now that the futures markets are open, the price of bitcoin across spot market exchanges has dropped over $4,000 in the last five days. However, bitcoin trade volume is pretty high right now as exchanges are swapping anywhere between $17-20bn worth of BTC over the past 24-hours. Bitcoin markets are showing an average of $15,250-15,500 according to Bitcoin.com’s weighted price index.

The USD and Tether: The Top Swapped Currencies With Bitcoin

There’s also been a lot of statistical changes within the bitcoin economy this week. For instance, the Japanese yen and Korean won’s global share over BTC volume has dropped considerably. The USD currently dominates the world’s bitcoin trade volume as it presently captures 41 percent. This is followed by the Japanese yen (32%), tether (USDT 6.5%), the Euro (6.4%), and the Korean won (6%). As usual, during the dumps, traders are once again hiding out in USDT. By putting faith in the claim that the currency is backed by U.S. dollars, traders have pushed tether to the third top currency by volume and is trading at $1.03 per USDT. The top five exchanges swapping the most bitcoin right now includes Bitfinex, Bittrex, GDAX, Bithumb, and Hitbtc.

Technical Indicators

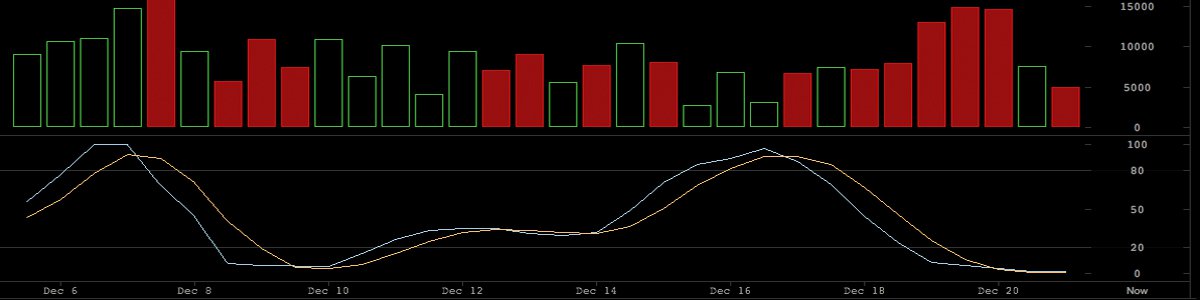

Looking at the weekly, daily and hourly bitcoin core (BTC) charts show a lot of bearish red candle action. The short-term and long-term Simple Moving Averages (SMA) crossed hairs a few days ago, and the 100 SMA is well below the 200 SMA. This indicates the bearish sentiment has taken over the markets for the time being, and the path to the upside will take some time. The Relative Strength Index (RSI) has been dragging downwards consistently for days, alongside the Stochastic oscillator indicator showing oversold conditions. If the price breaks the Displaced Moving Average (DMA) at $15,100 then merging into the $13-14K regions are not out of the question. On the other hand, bulls have a touch less resistance on the sell side and if they can push back walls above $15,900 we might be getting back to the $16.5-17K territories.

The General Digital Asset Economy Loses $22 Billion in Three Days

Overall digital assets below bitcoin’s market cap are now starting to feel the brunt of BTC’s dip. Ethereum markets are down 2.8 percent as one ether is averaging $790 per token. Bitcoin cash (BCH) markets are lower after breaching the $4K zone yesterday as the decentralized currency is down 23 percent at $3,000 per BCH. Ripple (XRP) has reached a milestone as the digital currency is up over 30 percent touching the $1 price region for the first time. Lastly, the fifth highest market cap held by Litecoin (LTC) is down 6.2 percent as one LTC is priced at $300 at press time. Since our last markets update, overall digital asset markets have lost $22bn in valuation.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock

Get our news feed on your site. Check our widget services.

The post Markets Update: Bitcoin Price Continues to Feel Bearish Sentiment appeared first on Bitcoin News.