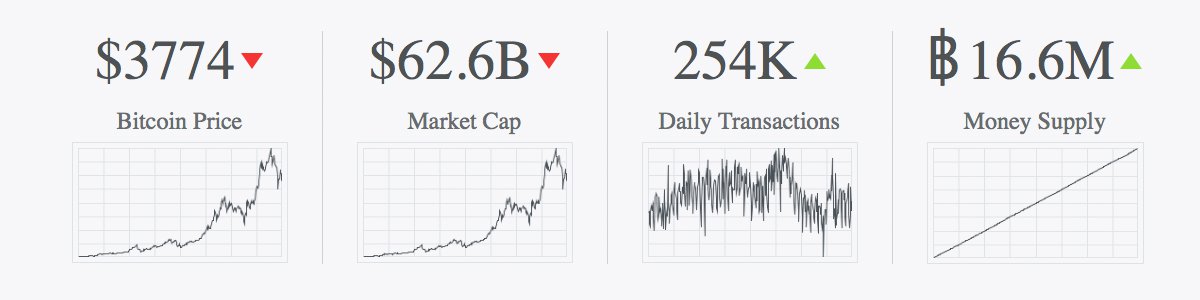

The price of bitcoin has started to trend upwards on Saturday, September 23, after a slight dip in value 24-hours prior. Currently, the price per BTC is roughly $3,775 at press time after rebounding from yesterday’s low of $3,510.

Also read: GMO to Invest 10 Billion Yen in Its Own 7nm, 5nm and 3.5nm Dedicated Bitcoin Chips

Bitcoin’s Price Consolidates After Last Week’s Chinese Exchange Shakeout

The price of bitcoin has been swinging back and forth in value since our last market update report. Overall, bitcoin proponents seem optimistic about the price as China’s regulatory crackdown is slowly turning into a distant memory. After dipping below the $3K zone, the price managed to climb back to the $3,800-4,000 range throughout most of the week. On Friday, September 22, bitcoin’s price stability in that territory headed south – leading to a 5 percent loss in value and a few sub-$3,600 lows. After some consolidation over the past 12-hours, buyers have stepped back into the trading arena and pushed the price up to $3,798 during the early morning hours.

Technical Analysis

Technical indicators and order books from popular exchanges show some strong resistance past the $3,800-3,900 zones at press time. Bitcoin markets look healthier than a few days prior as the price is holding high above the 125-day moving average. The weekly chart shows the short-term 100 Simple Moving Average (SMA) is well below the long-term 200 SMA, which indicates the bearish trend may not be over yet. Relative Strength Index (RSI) levels seem relatively stable, but the Stochastic oscillator suggests that the small uptrend happening right now will likely fizzle out. Indicators show it’s also likely the price will see some more consolidation over the next 12-hours within the current price territory.

Hot Topics in Bitcoin-Land

Over the past two weeks, news of China shutting down exchanges has been an extremely hot topic. At the moment the market effects from the Chinese exchange crackdown seems to be waning, and bitcoin proponents are focusing in on other subjects. One of them is the statements made by JP Morgan’s chief executive Jamie Dimon calling bitcoin a “fraud.” Dimon was reported to the Swedish financial authorities regarding his recent assertions and may face legal scrutiny. Further, Dimon has not stopped talking negatively about bitcoin, as the banker criticized the digital currency again in an interview on CNBC-TV18 Friday morning.

“Right now these crypto things are kind of a novelty,” Dimon tells the broadcast. “People think they’re kind of neat. But the bigger they get, the more governments are going to close them down — It’s creating something out of nothing that to me is worth nothing — It will end badly.”

The Verdict

At the moment the price has kicked up, but volume is relatively low with just $1.1B worth of bitcoins traded over the past 24-hours. Cryptocurrency market volumes across the board are low as the weekend trading lull begins. Alongside this, the upswing in price has pushed up the top twenty cryptocurrencies as well, as altcoins are seeing 5-10 percent gains. Nearly every altcoin has moved concurrently with bitcoins price swings over the past three weeks.

Bear Scenario: Bitcoin’s price could drop below the $3,500 range again and into some lower price zones. Some pessimistic sentiment from traders hasn’t entirely worn off just yet, and some negative news could spur more sell-off in the near future. Traders betting against the price are hoping and praying BTC’s value will fall below the $3K zone again. At the moment, under $3K is not in the cards but we may see some lower price targets this week.

Bull Scenario: Right now bitcoin markets show buyers are in control, but they could become exhausted shortly as volumes are relatively weak. Bulls need to push past the $3,800-4,000 range again, to gain some real momentum towards higher price points. If they do, they still have some battles to fight all the way up to the $5K range. It’s likely for now the current bullish sentiment will continue consolidating.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, and charts.bitcoin.com.

Want to create your own secure cold storage paper wallet? Check our tools section.