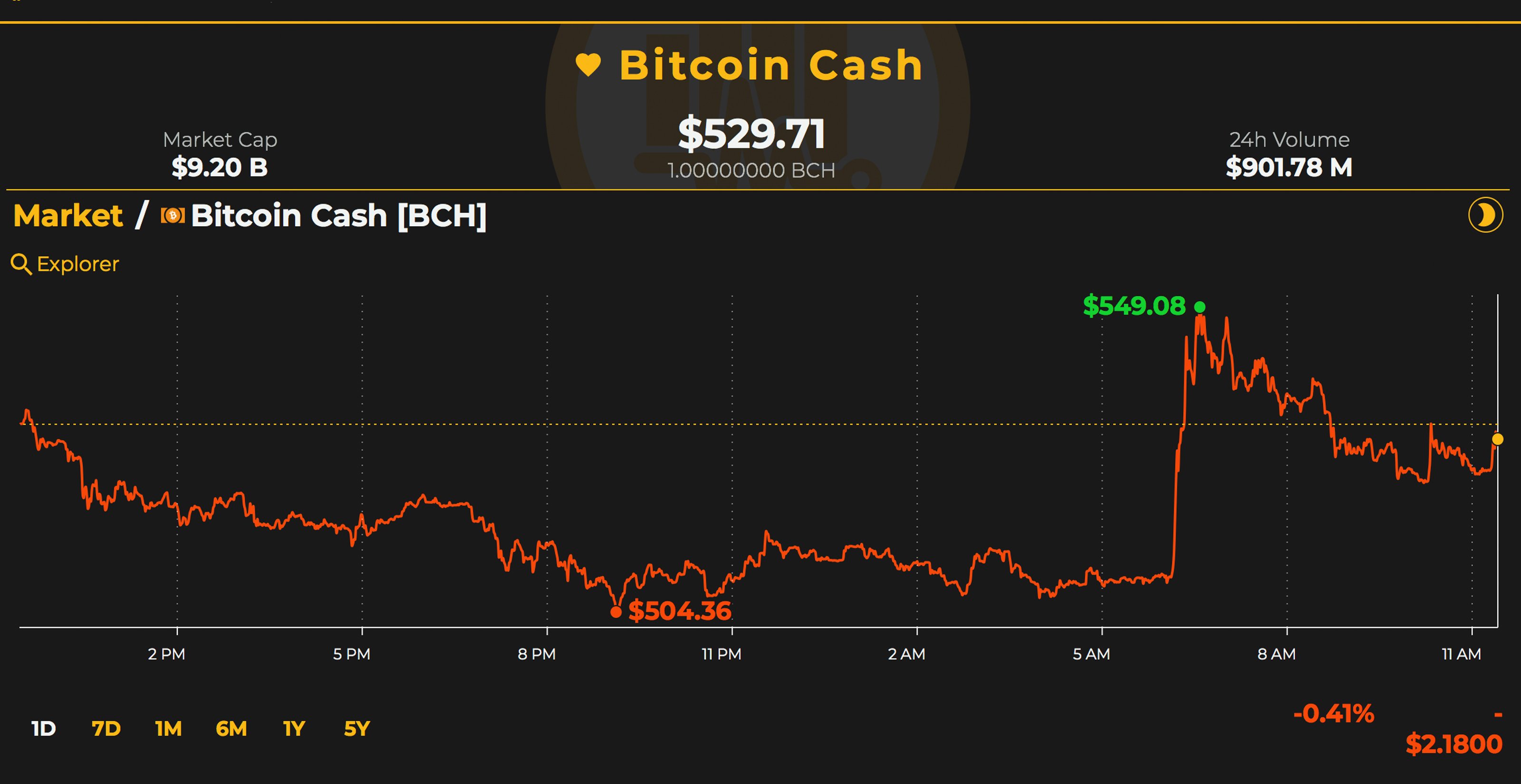

There are less than two days left until the Bitcoin Cash (BCH) network faces a contentious hard fork and BCH markets are showing some unusual activity. They are being driven by heavy trading volumes that have doubled in the last two days, while BCH/USD short positions on Bitfinex have touched an all-time high. At the moment, bitcoin cash is trading for $529 per coin with more than $900 million worth of global swaps in the last 24 hours.

Also read: Cryptocurrency ATM Growth Spikes Exponentially to 4,000 Machines Worldwide

Cryptocurrency Rally Stalls

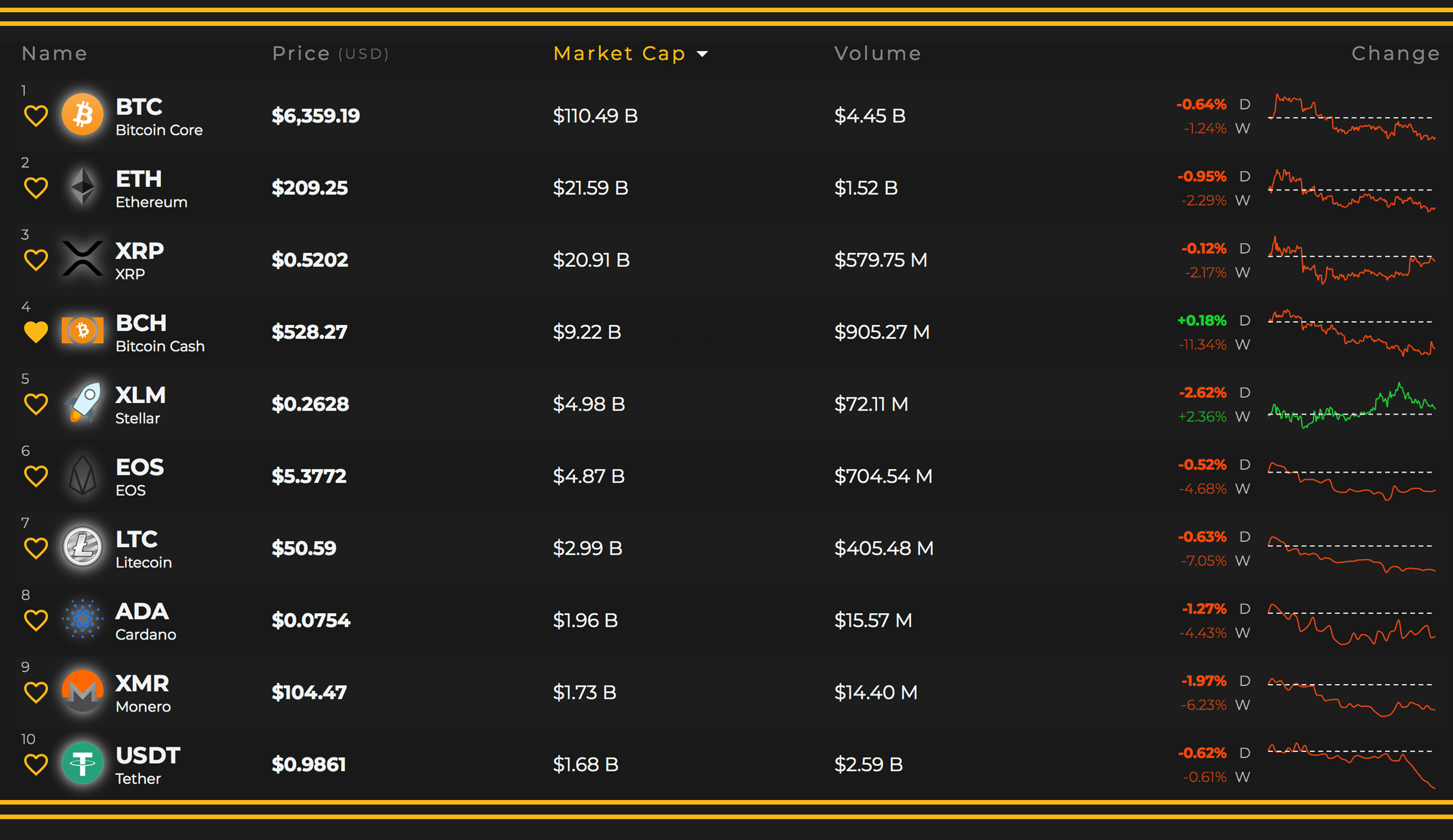

As news.Bitcoin.com stated during our last markets update, all eyes are on bitcoin cash prices before the pending fork and this is still the case. On Tuesday, Nov. 13, the overall cryptocurrency economy is valued around $214 billion with over $13.3 billion in global trade volume over the last day. Currently, bitcoin core (BTC) prices are hovering around $6,359 with a market valuation of about $110.4 billion. BTC prices are down 0.64% over the last 24 hours and down 0.95% for the last seven days. The second highest valued market held by ethereum (ETH) is valued at $21.5 billion today and one ETH is swapping for $209. Ripple (XRP) has dipped in value as well and the token is down 0.12% over the last 24 hours. Spot markets show one XRP is trading for $0.52 and ripple trade volume is around $579 million. Lastly, stellar (XLM) markets are down quite a bit as markets have lost over 3% today and one XLM is trading for $0.26.

Bitcoin Cash (BCH) Market Action

Even though it looks as though some of last week’s BCH spurred digital asset rally has stalled, a lot is going on behind the scenes. One BCH is trading for $527 per coin and the total market valuation is around $9.9 billion this Tuesday. According to statistics, bitcoin cash has the fourth largest trade volume just below tether (USDT) and ETH. This is because BCH trade volume has spiked considerably over the last day as the 24-hour volume is steadily approaching $1 billion. The trading platforms swapping the most BCH today include Lbank, Okex, Binance, Hitbtc, and Bitfinex. BTC is the largest pair trading with BCH and captures 39.5% of the market. This is followed by USDT (30.9%), USD (12.4%), ETH (7.1%), and QC (3.8%).

BCH/USD Technical Indicators

Looking at the BCH/USD 4-hour chart and the daily on Bitfinex and Bitstamp shows BCH bears have managed to push the bitcoin cash price down and suppress the value over the last few hours. Similar to our last markets update, the short term 100 Simple Moving Average (SMA) is still well above the long-term 200 SMA trendline. This confirms the path toward the least resistance is still the upside at the time of writing. On the 4-hour chart, the Relative Strength Index oscillator is meandering in the middle (44-56) and not giving much indication toward the next move.

Order books show bulls need to surpass the current suppression and prices above the $560 range to gain some more leeway. On the backside, order books show some solid foundations between the current vantage point and $485. Again, there is a massive buy wall at $445 which could hold for a decent period of time. However, the moving averages and current MACd show things may not be so dismal in the short term and the massive trade volume injected in the BCH ecosystem in the last 24 hours suggests a quick and unexpected trend change could definitely be in the cards.

Chain Split Token Markets and Short Positions

As mentioned above, the clock is ticking towards the pending Bitcoin Cash network fork slated for Thursday, Nov. 15. Additionally, BCH/USD short positions on Bitfinex are still riding extremely high at the moment with people betting the currency’s value will plummet. Yet some traders believe the massive BCH daily trade volume coupled with short positions at an all-time high is a recipe for danger for margin traders without equity and many short positions could get “rekt.”

Many traders have also been watching the BCH futures markets on Poloniex with BCH-ABC and BCH-SV being swapped against USDC and BTC pairs. At the moment, BCH-ABC is trading for $385, USDC and BCH-SV is around $139 per token. Moreover, Bitfinex has announced introducing new “chain split tokens” (CSTs) on Nov. 13 allowing traders to swap futures with the CSTs that have the dedicated ABC and SV symbols “BAB” (ABC implementation) and “BSV” (SV implementation). It’s safe to say that lots of eyes will continue to remain focused on the BCH market activity and possible reaction before the fork.

Where do you see the price of bitcoin cash and other coins headed from here? Let us know in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Bitcoin Cash Price Rally Stalls but Trade Volume Spikes Hard appeared first on Bitcoin News.