Cryptocurrency markets saw some significant gains over the last two days, but prices on Thursday have started to pull back from this year’s all-time highs. When the spikes first initiated, bitcoin cash (BCH) led the pack out of the top 10 cryptocurrencies and still maintains a lead with over 75 percent worth of gains for the week.

Also read: Bitcoin Cash Markets and Network Gather Strong Momentum in Q1

Crypto Prices Fall Back After Touching 2019’s All-Time Highs

Digital assets prices lifted in value significantly this week, making cryptocurrency enthusiasts extremely happy again after more than a year of depressing market sentiment. Now things have changed, and the overall cryptocurrency market cap is about $172 billion today, roughly $8 billion less than April 3rd’s highs. Bitcoin core (BTC) is averaging around $5,036 per coin at press time and is up 0.34 percent since yesterday. BTC also has a weekly advantage as the currency is up roughly 23 percent over the last seven days. It’s also worth noting that the bitcoin dominance metric, the size of BTC’s market cap in comparison to the rest of the cryptoconomy, has dropped to 50 percent.

The second highest valued market cap belongs to ethereum (ETH) which is down 3.9 percent today and trading for $162 per ETH. Ripple (XRP) markets have also dropped significantly by 5 percent during the last 24 hours. XRP is trading for $0.34 a token and its market is still up by 10 percent for the week. Lastly, the fifth market position now belongs to litecoin (LTC) after being nudged out by bitcoin cash (BCH) on Wednesday. LTC is trading for $87 per coin and is still up today by 1.9 percent and 42 percent over the last seven days.

Bitcoin Cash (BCH) Market Action

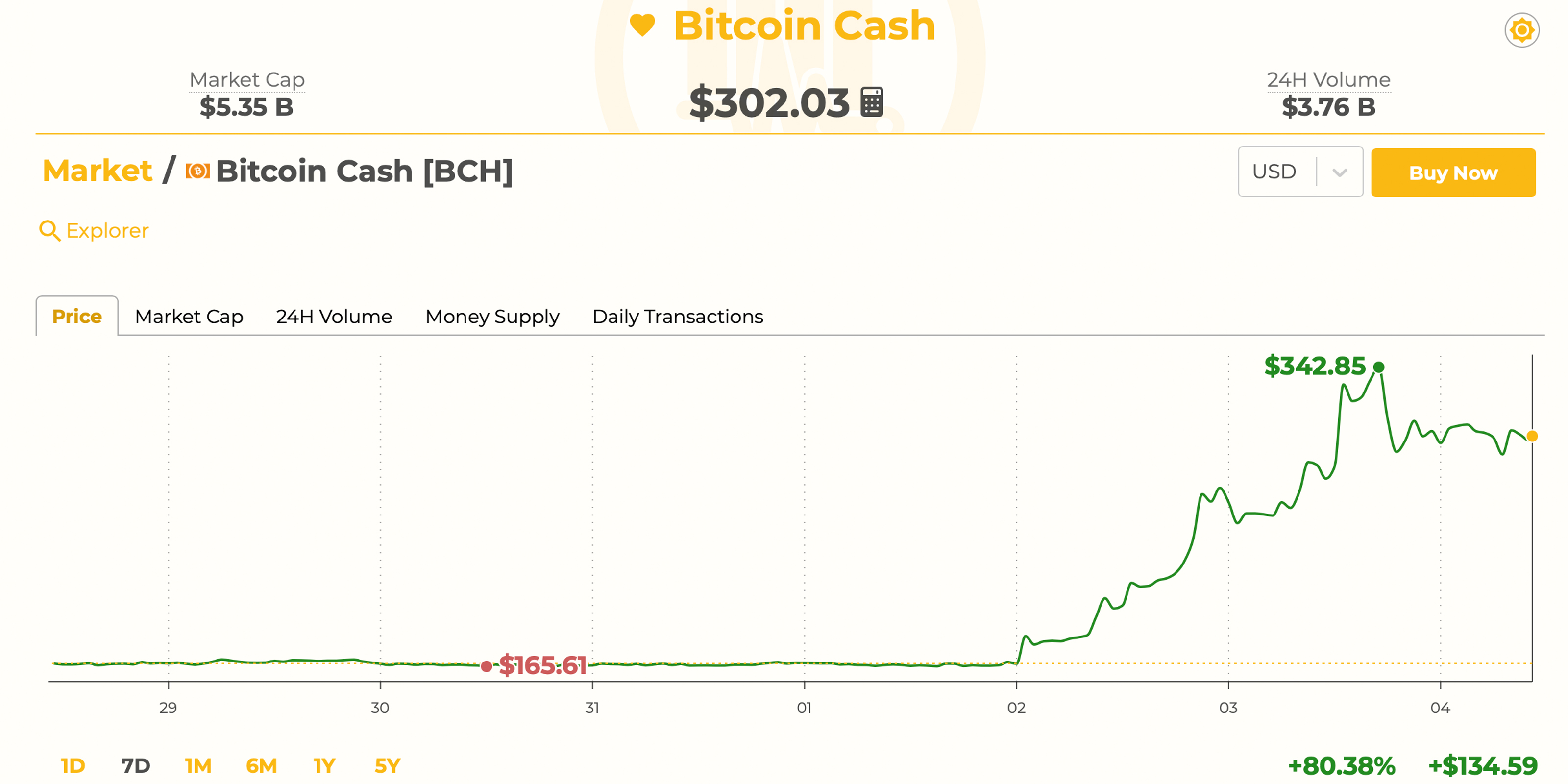

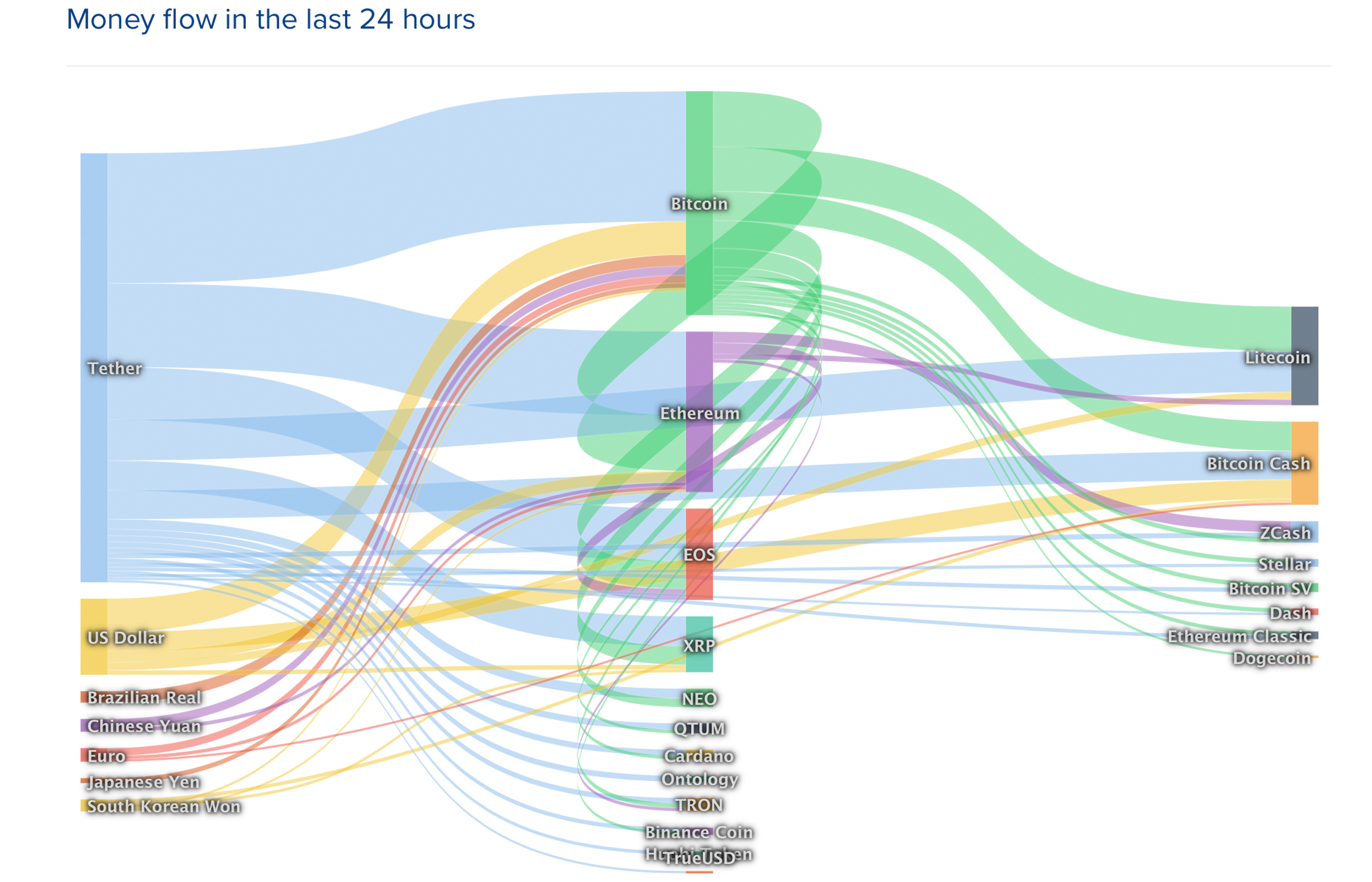

Bitcoin cash (BCH) markets hold the fourth position today within the top 10 coins in the cryptoconomy. BCH spot prices are still up 6.8 percent today and roughly 77 percent for the entire week. At press time BCH is trading for $302 per coin and has a market capitalization of around $5.35 billion. Market statistics show that BCH is the sixth most traded coin by trade volume below EOS and above XRP. The top five exchanges swapping the most BCH on April 4 are Lbank, Binance, Huobi, Bitfinex, and Coinbase. USDT is still the dominating pair traded with BCH today, capturing 47 percent of trades. Tether pairs are followed by BTC (25%), USD (16%), KRW (4.8%), EUR (2.3%), and JPY (1.9%). Just a month ago BCH global trade volume was a mere $500-800 million per day and now trade volume is roughly $3.9 billion over the last 24 hours.

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart on Bitstamp and Kraken shows BCH bulls are in the midst of being beaten back after a big jump on Wednesday. Currently, most oscillators are neutral except for the Relative Strength Index (~89), which is still showing overbought conditions. Stochastic is a bit high at ~78, but still impartial, while the MACd momentum oscillator shows that markets are overbought and a deeper pullback may be on the cards. The two Simple Moving Averages (100 SMA and 200 SMA) and most moving averages like the EMA show markets are still in the buy territory.

The 4-hour chart shows the 100 SMA is still above the long-term 200 SMA trendline indicating the path toward the least resistance is still the upside. Ichimoku Cloud (9, 26, 52, 26) baseline is impartial at the moment as most indicators currently display a mixture of support and resistance at the time of publication. Order books show some heavy sell walls between the $350 range and even bigger near the $400 region. On the backside, if bears gain some control we will likely see some pitstops between $250 and $215.

The Next Bull Run: This Time Around Scaling Will Matter

Overall cryptocurrency enthusiasts are still exuberant about the rising prices even after some small corrections. On Wednesday, BCH supporters were pleased to see BCH rocket ahead of most coins in the economy, believing it was due a trend reversal. Some crypto enthusiasts think that BTC’s failure to scale will cost the network considerably during the next bull run.

Furthermore, many BCH supporters think bitcoin cash is undervalued at the moment compared to coins that have difficulty scaling when crypto interest rises. On Wednesday, Bitcoin.com CEO Roger Ver said he thinks people will see more demand for BCH going forward. This is because the cryptocurrency just works and its ability to transact in a censorship-resistant manner for less than a penny per transaction outpaces the competition.

“People love to use cash as a store of value — Since bitcoin cash works like cash, it also works as a store of value,” Ver noted during the market spike yesterday. “I think we’ll continue to see bitcoin cash outperform bitcoin core.”

What do you think about the massive spike BCH markets witnessed over the last two days? Let us know what you think in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Bitcoin.com Markets, and Coinlib.io.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: BCH Maintains Strong Lead as Crypto Prices Record Slight Pullback appeared first on Bitcoin News.