Cryptocurrencies were mostly lower on Tuesday, tracking losses in equities after the U.S. Senate failed to act to extend the debt ceiling and avoid a partial federal government shutdown as soon as Oct.15.

The 10-year Treasury bond yield rose to 1.50%, the highest level since June, accompanied by a rally in the dollar as investors position themselves for a potential government default. When bond yields go up the bond price falls, and vice versa.

“In equities, we are about to enter the most dangerous month of the year – October has been the month where crashes and major corrections take place,” Charlie Silver, CEO of Permission.io, wrote in an email to CoinDesk.

“Crypto is vacillating between resistance and support, waiting for regulatory clarity in the U.S. and central bank moves around the Chinese debt crisis,” Silver wrote, referring to the turmoil over real estate developer Evergrande.

Bitcoin was trading around $41,000 at press time and is down nearly 3% over the past 24 hours, compared to a loss of over 3% in ether over the same period.

Latest Prices

- Bitcoin (BTC), $41,814, -2.5%

- Ether (ETH), $2,871, -3.4%

- S&P 500: -2.0%

- Gold: $1,734, -0.9%

- 10-year Treasury yield closed at 1.548%

Ether option expirations

Ether, the world’s second-largest cryptocurrency by market capitalization, dipped below $3,000 this week, causing some traders to seek ways of cutting their losses.

The trading volume of ETH put options expiring on Oct. 8 has soared, according to data from Deribit, a crypto futures and options exchange. A large number of put options is seen around the $2,700 price level, which, if breached, can trigger long liquidations. A put option is a contract giving the owner the right, but not the obligation, to sell, or sell short, a specified amount of an underlying security at a pre-determined price within a specified time frame.

For now, technical charts show initial support for ether at the 100-day moving average, currently around $2,760, although upside momentum has significantly slowed.

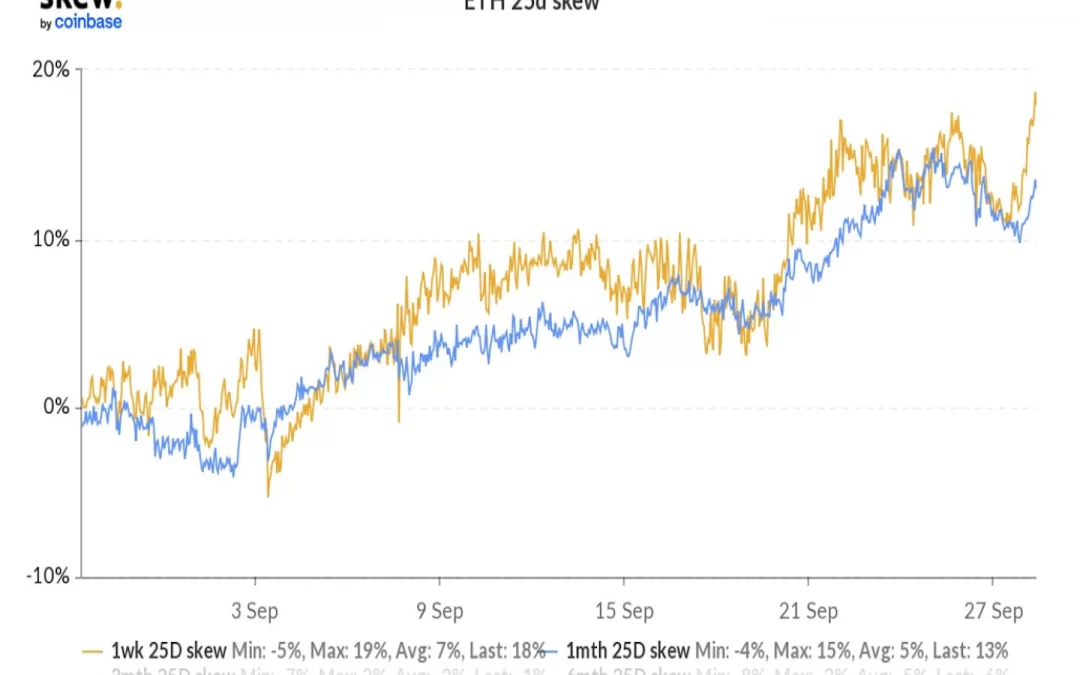

“The market aggressively paid for over 13,000x contracts of Oct. 8 ETH puts since Asia morning, and front-end risk reversal skewed heavily toward puts once again,” crypto trading firm QCP Capital wrote in a Telegram announcement.

“We remain wary of ETH downside for any near-term potential leg down,” QCP wrote.

Uniswap peak growth

Uniswap, an automated decentralized finance (DeFi) exchange, transacted a total of 67.5 million trades since the release of the first version of the protocol in 2018, according to data compiled Coin Metrics.

However, daily trades peaked around 271,0000 during the May 2021 crypto sell-off. Since May, trades on Uniswap have fallen to around 100,000 per day.

“Recently, there have been ~30,000 unique addresses transacting daily, and to date Uniswap has been one of the most popular dapps on Ethereum,” Coin Metrics wrote in a Tuesday newsletter.

Earlier this month, The Wall Street Journal reported that regulators are investigating Uniswap Labs after U.S. Securities and Exchange Commission Chairman Gary Gensler stated that DeFi projects are not immune to regulations.

Despite regulatory risk and the decline in trading activity over the past few months, some analysts see long-term potential for DeFi exchanges (DEXs).

“Powered by the proliferation of new tokens, composable DeFi protocols, and an ever-increasing user base, DEXs are gaining a formidable share of total crypto asset trading volume,” Coin Metrics wrote.

Altcoin roundup

- Aave proposal enlists Fireblocks to aid DeFi protocol’s mainstream finance push: In a proposal on Aave’s decentralized autonomous organization (DAO) governance forum on Monday morning, user “salmanblocks” called for adding Fireblocks as the first whitelister on the compliant implementation of Aave, reported CoinDesk’s Andrew Thurman. Rob Salman, the head of business development for Fireblocks, submitted the proposal on behalf of the company, a spokesperson told CoinDesk. Whitelisters would ensure that users of these permissioned lending pools comply with relevant laws depending on the user’s jurisdiction. Until now, the permissionless nature of DeFi, where lenders do not know to whom they’re lending , has been a key blocker for corporate legal teams.

- Stablecoin pegged to Peru’s currency, the sol, launches on Stellar: Latin American digital token issuer Anclap launched the stablecoin, which is 100% backed by local currency, reported CoinDesk’s Jamie Crawley. The digital sol can be purchased from wallets, such as Solar, and is exchangeable for the Argentine peso, the Brazilian real, the U.S. dollar and other currencies. The launch follows that of the digital Argentine peso in early 2020.

- Solana-based prediction market uses DeFi yields to finance ‘no loss’ betting: Hedgehog Markets, a fledgling blockchain-based prediction market platform, is testing a novel type of wager where bettors have nothing to lose, reported CoinDesk’s Marc Hochstein. Known as “no-loss markets,” these bets combine prediction markets with several big cryptocurrency trends: decentralized finance (DeFi), stablecoins and “play-to-earn” gaming.

Relevant News

- Leading Crypto Mining Machine Maker Bitmain Said to Halt Sales in China

- Ethereum Developer Virgil Griffith Pleads Guilty to Conspiracy Charge in North Korea Sanctions Case

- CFTC’s Berkovitz to Become Top Lawyer at SEC

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Uniswap (UNI), +7.2%

Notable losers of 21:00 UTC (4:00 p.m. ET):

- Filecoin (FIL), -7.2%

- The Graph (GRT), -4.6%