Bitcoin was roughly flat over the past 24 hours as buyers attempted to continue to reverse some of last weekend’s losses. Some short-term traders are buying on dips, while others remain cautious about what crypto prices will be over the next month.

“In spite of the shock sell-off, volatility markets remain relatively calm. The knee-jerk spike in BTC and ETH implied volatility faded very quickly and the volatility term structure reverted to an upward sloping one, indicating no heightened fear or panic in the near-term,” crypto trading firm QCP Capital wrote in a Telegram announcement.

Also, Three Arrows Capital, a Singapore-based hedge fund, purchased more than 90,000 ETH worth about $400 million over the weekend, according to wallet data shown on Etherscan. The move comes mere weeks after co-founder Su Zhu “abandoned” Ethereum because of its prohibitively high fees for new users, CoinDesk’s Lyllah Ledesma reported.

Latest Prices

- Bitcoin (BTC): $50,835, +0.81%

- Ether (ETH): $4,422, +3.21%

- S&P 500: $4,701, +0.32%

- Gold: $1,785, +0.07%

- 10-year Treasury yield closed at 1.52%

From a technical perspective, the recent sell-off reflects a “loss of intermediate-term momentum that serves as an impetus to reduce exposure to bitcoin and cryptocurrencies broadly,” Katie Stockton, managing partner at Fairlead Strategies, a technical research firm, wrote in a report this week.

Still, ether’s outperformance of late is unusual in a market where traders are wary of riskier assets, Stockton noted. “ETH’s long-term uptrend has not been impacted by its pullback – long-term momentum is still to the upside,” she wrote.

On the regulatory front, the U.S. House Financial Services Committee grilled six crypto executives about trading and stablecoins in a hearing on Wednesday. Discussions focused on security frameworks, the anonymous nature of crypto transactions and how Congress can incorporate digital assets into existing regulatory standards. Read CoinDesk’s live coverage here.

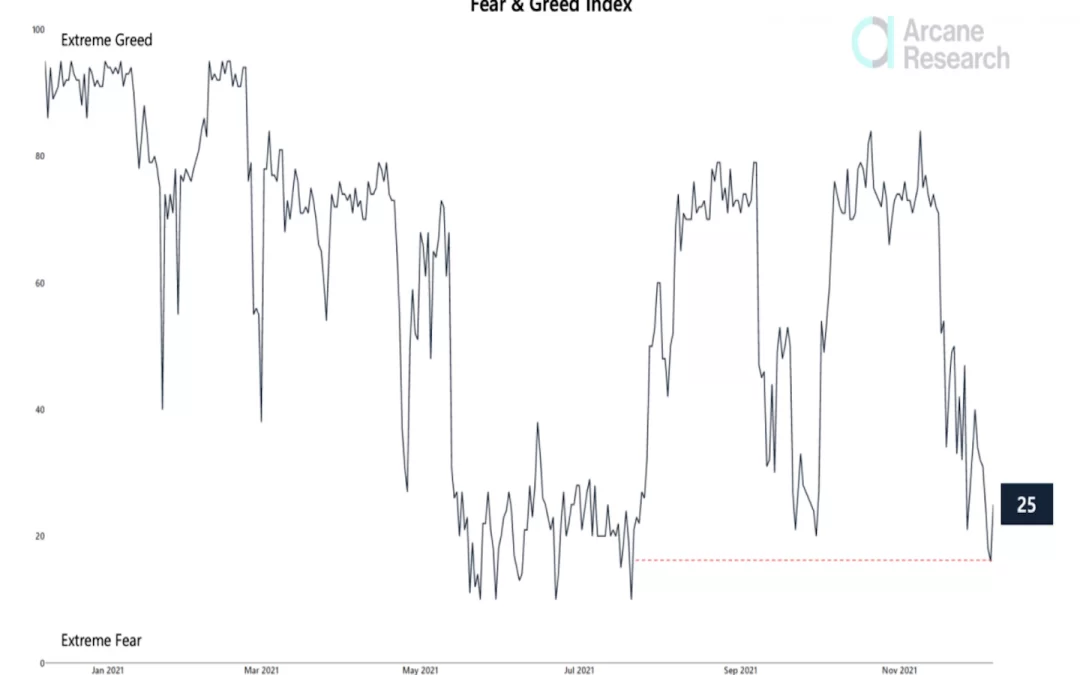

Bitcoin in fear mode

The Bitcoin Fear & Greed Index declined to its lowest level since late July during the weekend sell-off. Some analysts view the index as a contrarian signal, suggesting that buyers could return to buy BTC on price dips. Previous “extreme fear” readings preceded price rallies similar to what occurred in August and October.

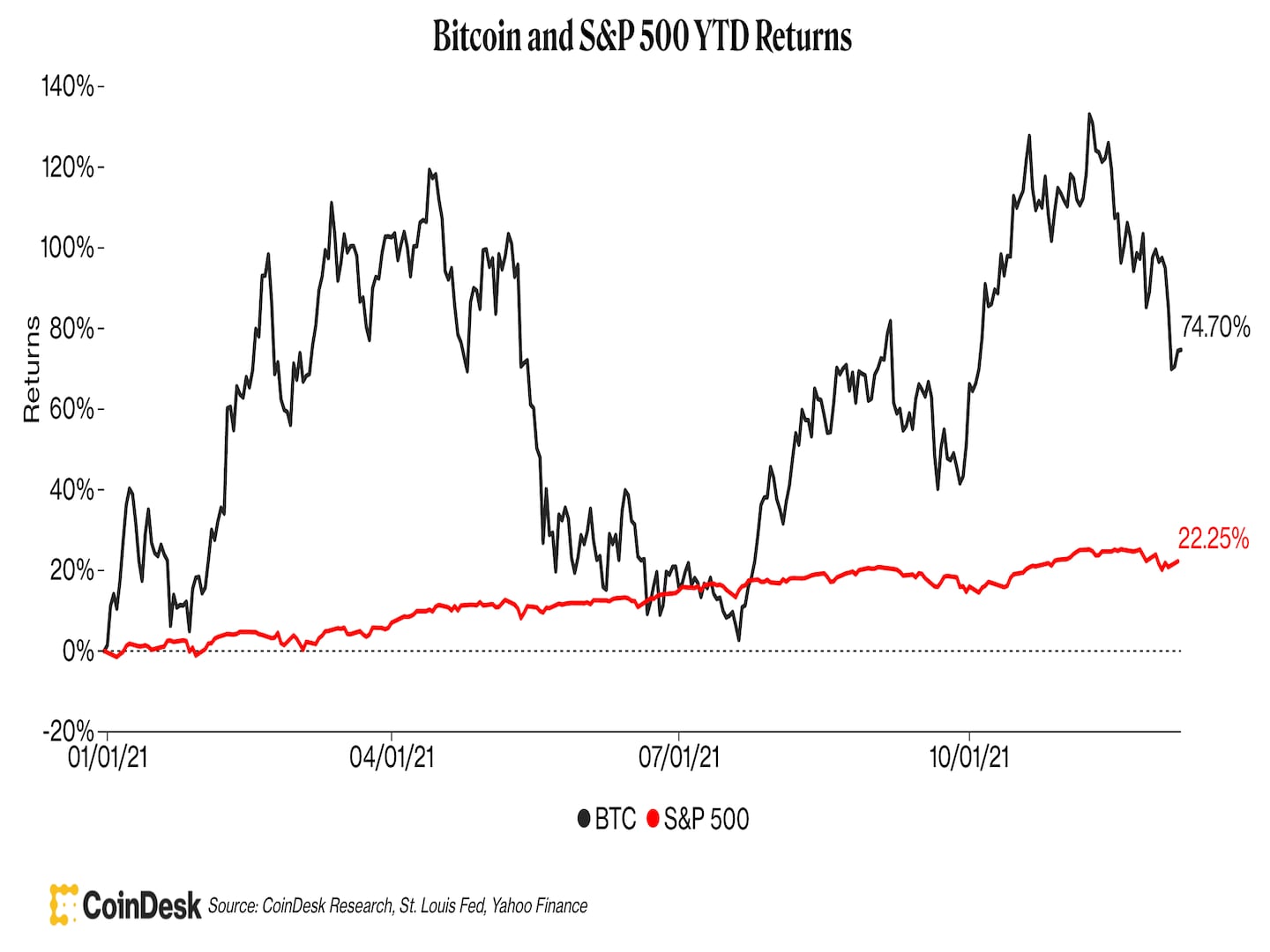

Returns narrow

Bitcoin’s year-to-date return has narrowed relative to the S&P 500 over the past month. Still, despite the recent sell-off, bitcoin is up about 75%, compared with a roughly 22% return in the S&P 500 and a 34% return in the Thomson Reuters Core Commodity CRB Index so far this year.

On a related note, bitcoin’s Sharpe ratio (risk-adjusted return) is comparable to the S&P 500 and Nasdaq over the past year, according to data compiled by IntoTheBlock.

Altcoin roundup

- Polygon’s MATIC token surges amid crypto recovery: MATIC is up about 25% over the past week, compared with an 11% decline in BTC over the same period. The increase occurred as more users have become aware of Polygon’s lower costs and greater efficiency and scalability. Speculation has also mounted over what the firm has called an “exciting announcement” scheduled for Thursday at Polygon virtual “zk day.”

- Not all alternative cryptocurrencies move in stride with ETH: While some decentralized finance (DeFi) tokens are correlated with ether, metaverse tokens such as The Sandbox’s SAND and Decentraland’s MANA have been less correlated with ether, according to a statistical study by Coin Metrics. “Some tokens on Ethereum today seem to be garnering narratives that are less tied to ETH itself, showing the potential benefits to diversification,” Coin Metrics wrote.

- Inside EIP 4488: Last week, Ethereum co-founder Vitalik Buterin introduced Ethereum Improvement Proposal (EIP) 4488, an upgrade that could drive down transaction costs for Ethereum rollups like Arbitrum, Optimism and zkSync. The proposal detailed the immediate steps for pushing gas fees down without sacrificing security, as well as the road map for moving forward post-”Merge.” CoinDesk’s Edward Oosterbaan explored some of the ideas contained in the proposal here.

Relevant News

- CoinDesk Most Influential 2021

- Blame the Bitcoin Bond? El Salvador’s Dollar-Denominated Debt Slides

- Australia Set for Massive Shakeup to Crypto Regulations: Treasurer

- Visa Launches Crypto Advisory Services for Banks as Demand for Digital Assets Grows

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- EOS (EOS), +13.93%

- Chainlink (LINK), +11.91%

- Internet Computer (ICP), +7.41%

Notable losers:

- Polkadot (DOT), -1.16

- Algorand (ALGO), -0.28%