Bitcoin was roughly flat on Tuesday while alternative cryptocurrencies such as ether and Solana’s SOL token were up about 5% over the past 24 hours. LUNA, the native token of the Terra blockchain, rallied about 13% as traders chased incentive programs.

Overall, trading conditions were choppy across global markets after the U.S. Federal Reserve Chair Jerome Powell suggested that monetary policy could tighten faster than expected – potentially a negative for speculative assets, including cryptocurrencies and equities.

Despite short-term price swings, some analysts remain bullish on bitcoin.

Latest prices

- Bitcoin (BTC): $57,622, -1.0%

- Ether (ETH): $4,661, +5.4%

- S&P 500: 4,567, -1.9%

- Gold: $1,775, -0.5%

- 10-year Treasury yield closed at 1.436%

“As BTC is looking good to close November below the expected target of $60,000, investors are optimistic that the cryptocurrency will repeat its historic trend of ending the year on a stellar bullish note,” Nikita Rudenia, co-founder of asset management firm 8848 Invest, wrote in an email to CoinDesk. Rudenia has a $70,000 BTC price target by the end of this year.

Other analysts pointed to bearish bitcoin options activity as a point of concern. “Puts are getting more expensive as market participants turn their focus towards hedging spot [positions] or speculating on further downside. In a recent tweet, Genesis Volatility themselves noted a large amount of short-term put purchases,” Delphi Digital wrote in a Tuesday blog post.

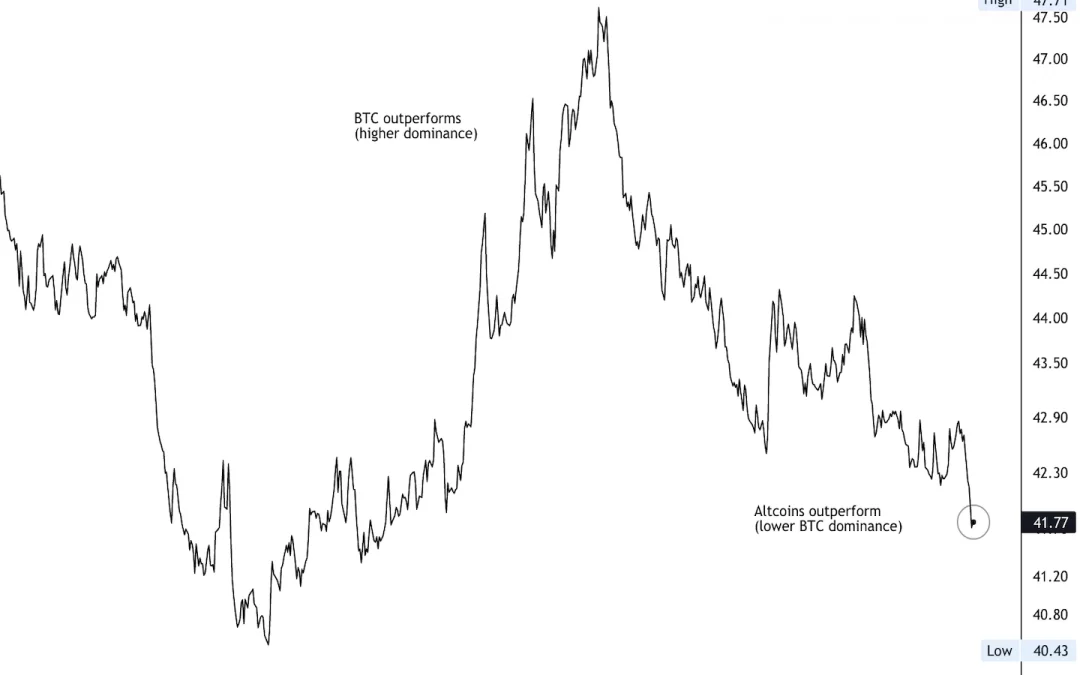

Bitcoin dominance falls

Bitcoin’s market capitalization relative to the total crypto market capitalization, or dominance ratio, has declined about 10% over the past two months to the lowest level since September. The decline in BTC’s dominance reflects the recent outperformance of alternative cryptocurrencies (altcoins).

Some analysts view the rotation from bitcoin to altcoins as an indicator of greater appetite for risk among investors.

Ether outperforms

Ether, the world’s second-largest cryptocurrency by market capitalization, was approaching $4,800, near its all-time high, and was up about 5% over the past 24 hours. BTC was roughly flat over the same period. Technical indicators suggest further upside is likely for ether relative to bitcoin.

The chart below shows the ETH/BTC ratio, which is attempting to break above a five-year trading range. Two consecutive daily closes above 0.080 could yield further upside in ETH/BTC.

Altcoin roundup

- Grayscale launches new trust dedicated to Solana: Digital asset manager Grayscale Investments announced its newest investment vehicle will be passively invested in Solana, reported CoinDesk’s Jamie Crawley. This marks the firm’s 16th investment vehicle, following similar products that offer exposure to bitcoin, ether, bitcoin cash, litecoin and stellar lumens. SOL has enjoyed huge growth in 2021, increasing from around $1.50 at the start of the year to $214 as of Tuesday morning. Grayscale is a subsidiary of Digital Currency Group (DCG), the parent company of CoinDesk.

- November’s biggest gainer is Crypto.com’s CRO token: Crypto.com’s CRO token more than tripled in November after a slew of prominent advertising deals, which include buying the naming rights to the Staples Center, reported CoinDesk’s Lyllah Ledesma. The cryptocurrency exchange and credit-card issuer founded in 2016 now has a market cap of more than $17 billion, making it the top performer in November among digital assets with a market cap above $10 billion, according to Messari. As of Tuesday, the CRO price was around $0.70, up 226% on the month.

- Cook Finance launches DeFi Index platform on Avalanche: Decentralized asset-management platform Cook Finance is bringing a suite of decentralized finance (DeFi) indexes to Avalanche. Similar to index products in traditional finance, Cook’s index products are composed of a list of tokens and track the performance of the underlying assets, making it easier for investors to buy a diversified allocation of cryptocurrencies in a single transaction. “We see this launch as providing an easy way for new users who want to get into DeFi indexes but were held back by high gas fees on Ethereum,” said Adrian Peng, CEO of Cook Finance.

Relevant news

- Coinbase Acquires Cryptographic Security Firm Unbound for Undisclosed Sum

- Huobi Tech Launches Crypto Lending Services in Hong Kong

- Yellen Says Stablecoins Require Proper Regulations

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Ethereum (ETH): +5.5%

- Polkadot (DOT): + 4.9%

Notable losers:

- The Graph (GRT): -4.7%

- Filecoin (FIL): -2.9%