Bitcoin (BTC) and other cryptocurrencies are stabilizing after a sell-off on Wednesday. Some analysts expect crypto volatility to remain elevated this month, especially as investors reduced their exposure to other assets deemed to be risky such as equities.

Wednesday’s sell-off resulted in $800 million in liquidations, which accelerated price moves. Liquidations occur when an exchange forcefully closes a trader’s leveraged position as a safety mechanism due to a partial or total loss of the trader’s initial margin. That happens primarily in futures trading.

Some analysts are watching the recent rise in leverage among bitcoin futures traders, which typically signals more risk in the market.

From a technical perspective, bitcoin could see a countertrend bounce, although upside appears to be limited.

Latest Prices

- Bitcoin (BTC): $43,163, -2.41%

- Ether (ETH): $3,418, -5.71%

- S&P 500: $4,696, -0.10%

- Gold: $1,788, -1.20%

- 10-year Treasury yield closed at 1.72%

Bearish sentiment indicator

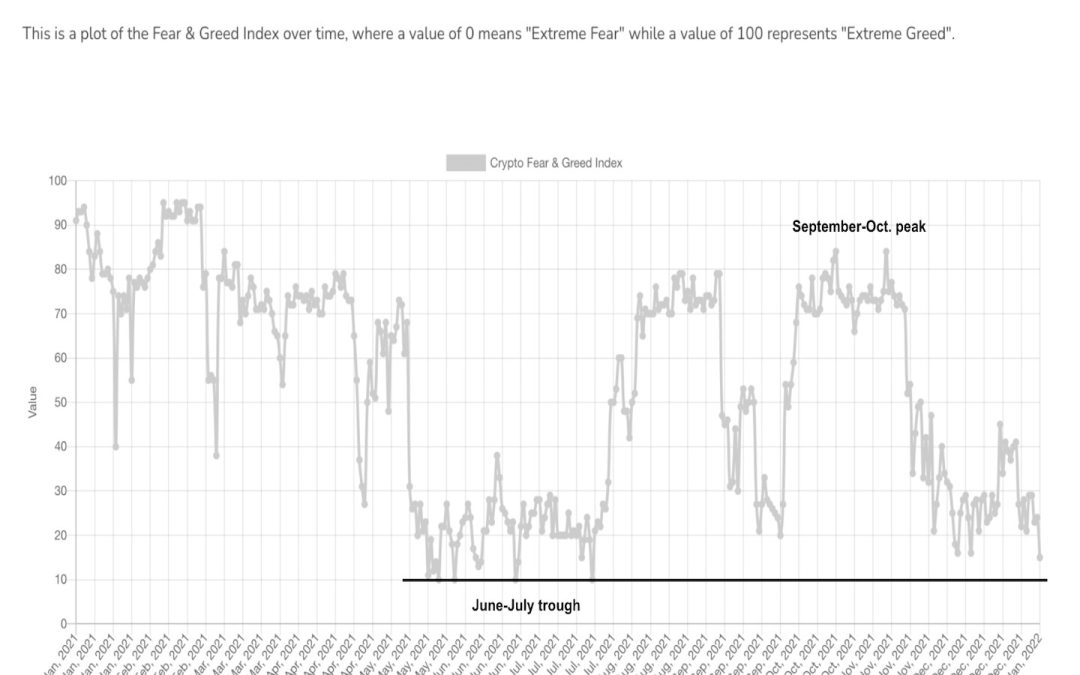

The bitcoin Fear & Greed Index, which measures sentiment among market participants, is at its lowest level since July. The low reading indicates market fear and is often seen as a contrarian indicator among crypto traders.

“The Fear and Greed Index hasn’t signaled greed in more than one and a half months – an unusually long period of negative market sentiment,” Arcane Research wrote in a report.

Still, the index can remain in “fear” mode for as long as a month as prices typically move sideways before a decisive move up or down.

Bitcoin drawdown deepens

Bitcoin is roughly 35% below its all-time high of almost $69,000, which was set in November. The drawdown, or percentage decline from peak to trough, is the largest since July. Previous drawdowns have reached levels of nearly 80% and took several months to recover.

For now, drawdowns have been less severe over the past year relative to prior extremes.

The chart below is from financial data provider Koyfin.

Altcoin roundup

- Polkadot, Solana among biggest losers: The tokens of Ethereum rivals Avalanche (AVAX), Terra (LUNA) and Solana (SOL) – the so-termed ‘SoLunAvax’ trade – fell by as much as 12% in the past 24 hours. Polkadot (DOT), another Ethereum rival, saw its tokens fall by 14% before seeing a slight revival during Asian trading hours on Thursday. Tokens of those networks have risen several hundred percent in the past year, mainly as investors looked for blockchain alternatives outside of Ethereum, according to CoinDesk’s Shaurya Malwa. Read more here.

- Ethereum decentralized finance (DeFi) dominance at risk: The scaling of the Ethereum network, which is needed to maintain its dominance, may arrive too late, JPMorgan said in a report. The final phase of the sharding, which is crucial for scaling the network, won’t arrive before next year. Meanwhile, alternative blockchains such as Terra, Binance Smart Chain, Avalanche, Solana, Fantom, Tron and Polygon have been gaining the most market share in the DeFi sector.

- Dip in decentralized exchange volumes: Despite the recent crypto crash, the total value locked in DeFi tokens has remained stable at around 6% below all-time highs, according to data from Messari. “However, the momentum of the decentralized exchange (DEX) volumes have lagged behind other explosive DeFi activities,” Messari wrote in a Thursday newsletter. Monthly DEX volumes remain below previous all-time highs since June.

Relevant News

- Tencent Adds Digital Yuan Support to WeChat Pay Wallet: Report

- Nas Selling Rights to Two Songs via Crypto Music Startup Royal

- BofA Upgrades Coinbase to Buy, Sees Revenue Diversification Beyond Retail Crypto Trading

- Crypto Crime Hit an All-Time High of $14B in 2021 as Prices Climbed: Chainalysis

- Will DAOs Replace Crypto Venture Capital?

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Largest winners:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Cosmos | ATOM | +4.6% | Smart Contract Platform |

| Cardano | ADA | +1.7% | Smart Contract Platform |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Ethereum | ETH | −5.7% | Smart Contract Platform |

| Filecoin | FIL | −5.5% | Computing |

| Internet Computer | ICP | −4.3% | Computing |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.