Bitcoin traded lower on Friday along with equities as demand from buyers faded.

The brief price bounce over the past two days was limited as bitcoin (BTC) eventually dipped below $48,000, although charts suggest pullbacks could stabilize around the $46,000 support level, or the level at which buyers tend to purchase or enter into a stock.

BTC is roughly flat over the past week, compared with a 1% drop in ether (ETH), a 5% rise in Solana’s SOL token, and a 38% rise in Avalanche’s AVAX token over the same period. The wide dispersion in crypto returns this week suggests that investor appetite for risk remains strong. Typically, the overall crypto market begins to trend higher when alternative cryptocurrencies (altcoins) start to outperform bitcoin.

For now, several risks remain, which could weigh on crypto prices.

For example, the U.S. Financial Stability Oversight Council published a report on Friday warning Congress about stablecoin and decentralized finance (DeFi) risks. Meanwhile, the U.S. Securities and Exchange Commission (SEC) delayed its decision on Grayscale and Bitwise spot bitcoin exchange-traded funds (ETF), which also contributed to the sour mood in crypto markets on Friday.

Latest prices

- Bitcoin (BTC): $46,273, -3.8%

- Ether (ETH): $3,849, -4.5%

- S&P 500: -1.5%

- Gold: unchanged at $1,798.20

- 10-year Treasury yield closed at 1.41%, down 0.01 percentage point

Cautious bitcoin options market

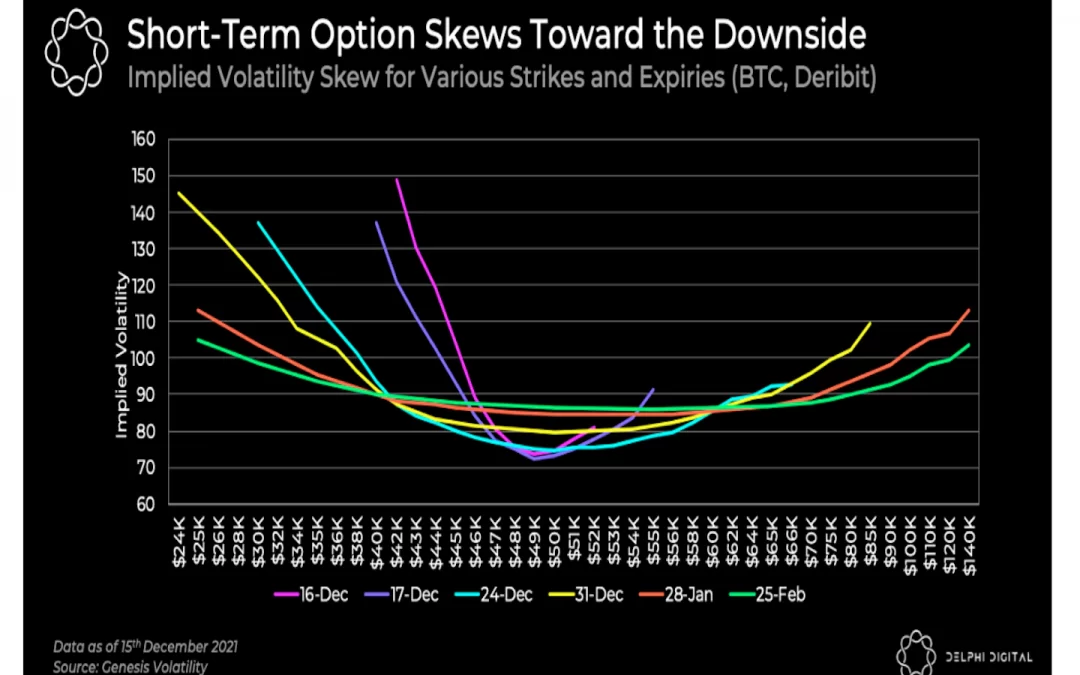

The bitcoin options market is leaning more neutral/bearish over the short term. The chart below shows that “implied volatility for near-term options are skewed towards puts, indicating that market participants have concerns and are either buying protection or speculating that price will deteriorate further,” crypto research firm Delphi Digital wrote in a blog post.

Meanwhile, option expiries slightly further out between January and February 2022 are less skewed, indicating a more neutral price outlook into next year. Crypto options exchange Deribit tweeted on Tuesday about heavy selling of call premium, or income received from selling an option that has not yet expired.

Altcoin roundup

- Justin Sun is retiring from Tron: The polarizing crypto entrepreneur said Friday he is leaving his brainchild Tron to holders of the blockchain’s native TRX tokens. Sun said in an interview with CoinDesk that he is moving to focus on crypto legitimization in Latin American countries – after witnessing El Salvador’s success in making bitcoin legal tender, CoinDesk’s Muyao Shen reported.

- Terra was one of the few cryptos rising: The LUNA token of Terra, a high-speed blockchain, was among the only cryptocurrencies to post gains, with a 6% increase over 24 hours. LUNA rose to a high of $67 Thursday before retreating to $64 on Friday. Tokens associated with Elrond, Mina and XDC Network were the biggest losers among all coins with a market capitalization of above $1 billion, data from CoinMarketCap showed. Their tokens – EGLD, MINA and XDC – have lost 14%, 7%, and 12% in the past day, respectively, CoinDesk’s Shaurya Malwa reported.

- $200 million fund created with Polygon for Web 3: Reddit co-founder Alexis Ohanian’s venture capital firm Seven Seven Six and Polygon Network have created a $200 million fund to invest in social media and Web 3-based projects.The initiative will back projects that explore better ways for humans to connect online, Polygon announced Friday.

Relevant news

- Goldman Sachs Says Blockchain Is Key to Metaverse and Web 3 Development

- Kraken Ventures Raises $65M for Early-Stage Crypto Fund

- Former Head of Crypto-Skeptical SEC Gets Blowback for Pro-Blockchain Op-Ed

Other markets

All members of the CoinDesk 20 (except stablecoins) were lower on Friday

Notable losers:

- Polkadot (DOT): -7.7%

- Internet computer (ICP): -6.8%

- Chainlink (LINK): -6.1%