Bitcoin (BTC) was roughly flat over the past 24 hours as trading volume continued to decline.

Still, some alternative cryptocurrencies (altcoins) outperformed BTC on Tuesday. Internet Computer’s ICP token was up about 20% over the past 24 hours, and Chainlink’s LINK token was up about 4% over the same period.

Meanwhile, technical indicators suggest a brief price bounce in BTC could occur if buyers are able to defend a daily close above $47,000.

Some traders appear to be optimistic as leverage as open interest in the BTC perpetual futures market, a type of crypto derivative trading product, increased above November highs.

“The boring market over the last month seems to have attracted traders back to leverage,” Arcane Research wrote in a report.

Also on Tuesday, the U.S. Securities and Exchange Commission (SEC) delayed its decision by 60 days on NYDIG’s spot bitcoin exchange-traded fund (ETF). The delay contributed to a sour mood across crypto markets as some tokens experienced a brief pullback after the announcement.

Latest Prices

- Bitcoin (BTC): $46,238, +0.60%

- Ether (ETH): $3,815, +3.01%

- S&P 500: $4,793, -0.06%

- Gold: $1,814, +0.61%

- 10-year Treasury yield closed at 1.64%

Dull January ahead?

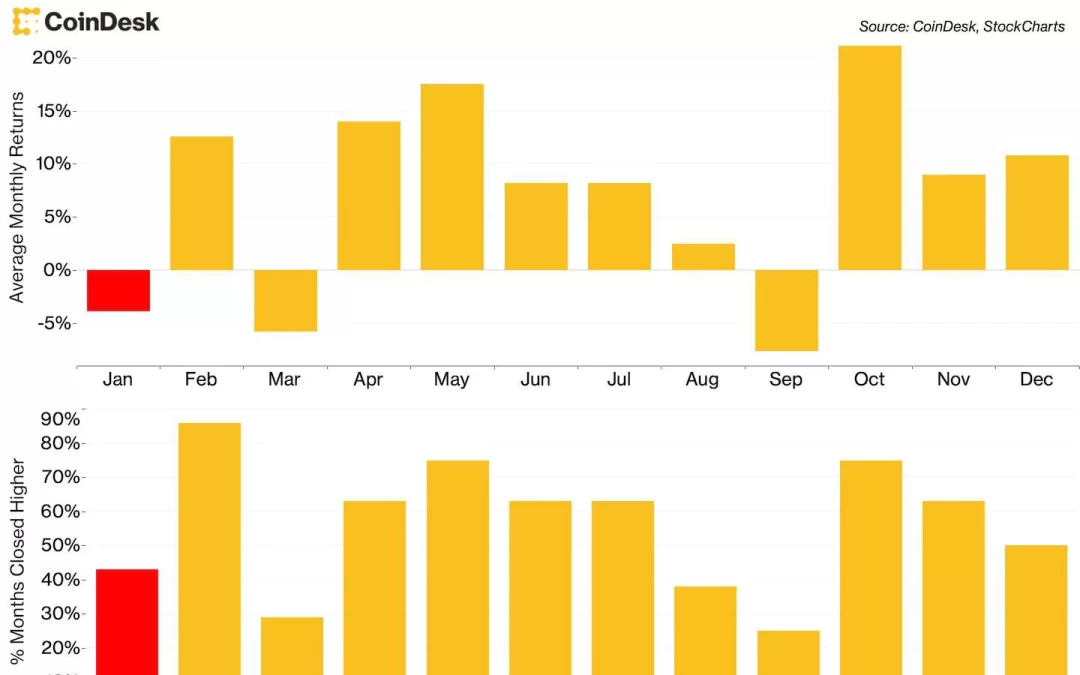

Historically, bitcoin tends to fall in January. The chart below shows the average monthly return in January is -3.3% over the past nine years. Over the same period, however, bitcoin registered a positive return roughly 50% of the time.

The probability of a positive outcome in January is mixed. That suggests some traders who are long BTC might sell ahead of volatility or may choose to accumulate on pullbacks as February shows greater odds for price gains, according to seasonal data.

Crypto fund flows rise

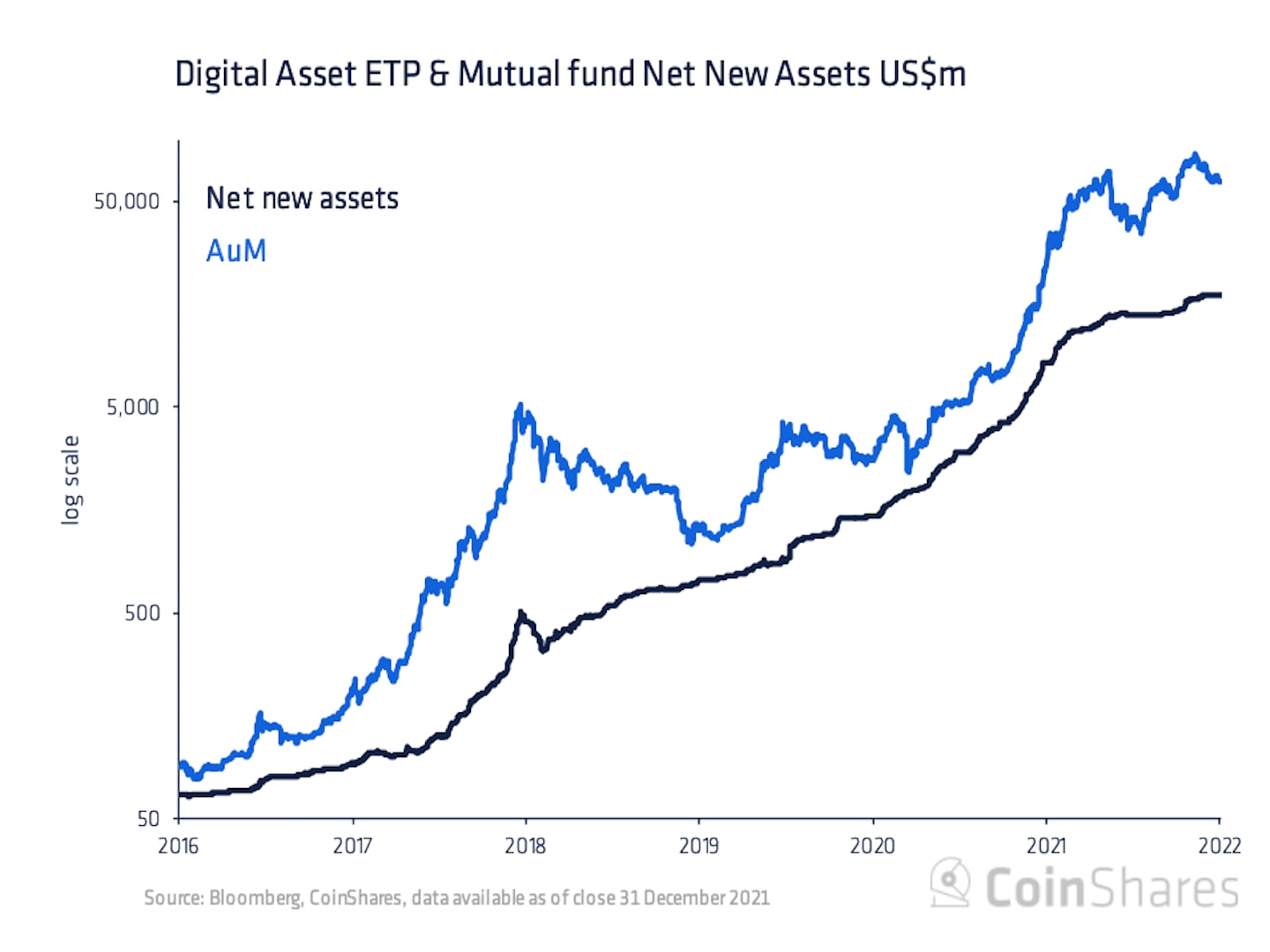

Digital asset investment products saw inflows totaling $9.3 billion in 2021, a 36% increase from 2020, according to a new report from CoinShares.

Some investors pulled money out of crypto funds during the final week of 2021, as outflows totaled $32 million. The third consecutive week of outflows suggests some nervousness among short-term investors after the crypto sell-off in early December.

Bitcoin investment products saw a year-over-year increase in flows of 16%, while Ethereum products saw inflows double during the same period.

Altcoin roundup

- Polkadot gets DeFi building block: Decentralized finance (DeFi) tool Dot Finance is launching on separate parachains on the Polkadot and Kusama blockchains, moving away from its previous deployment on Binance Smart Chain (BSC). Dot Finance automates and maximizes rewards for its users and helps them earn fees from other DeFi services, such as lending, trading and borrowing. Read more here.

- Fantom (FTM) surges, NEAR sets highs: A revived interest in layer 1 bets is fueling growth in some tokens even as bitcoin shows signs of weakening. For example, the native tokens of the Fantom and Near blockchains surged more than 20% over the past week. Read more here.

- CRV extends rally as ‘curve wars’ intensify: CRV, the governance token of decentralized exchange (DEX) Curve.Fi, is extending its five-month winning streak as the battle between DeFi protocols for control leads to a demand-supply imbalance. More protocols are building off of Curve, and an entire ecosystem is emerging, engaged in the so-called Curve Wars, one executive said. Read more here.

Relevant News

- Estonia Regulator Says No Plans to Ban Crypto

- Cosmos-Based Exchange Osmosis Crosses $1B in Locked Value

- European Markets Regulator Seeks Feedback on Regulation of Tokenized Securities

- Kevin O’Leary-Backed DeFi Platform WonderFi to Purchase Bitbuy for $162M in Cash, Shares

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Largest winners:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Internet Computer | ICP | +22.1% | Computing |

| Cosmos | ATOM | +15.9% | Smart Contract Platform |

| Filecoin | FIL | +7.2% | Computing |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Algorand | ALGO | −6.8% | Smart Contract Platform |

| Stellar | XLM | −1.3% | Smart Contract Platform |

| Bitcoin Cash | BCH | −0.5% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.