Cryptocurrencies were mostly lower on Friday after buyers failed to sustain the all-time price highs reached in bitcoin and ether earlier this week. Analysts expect trading activity to advance next week ahead of the Bitcoin Taproot upgrade, which aims to improve privacy and efficiency on the blockchain network.

“Bulls may have some power left to push the market higher as a result of the [Taproot] upgrade,” Lukas Enzersdorfer-Konrad, chief product officer at Bitpanda, wrote in an email to CoinDesk.

The upgrade is expected to be implemented in the next few days, although other analysts expect minimal impact on bitcoin’s price. It’s possible some investors have entered long positions ahead of the Taproot upgrade given BTC’s near 30% gain over the past few months.

In the meantime, traders are looking beyond bitcoin for additional profit opportunities, albeit after a possible price correction.

“Bitcoin’s chart has likely become too noisy to remain a reliable indicator of the crypto market, conceding that role to ether,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk. “If so, a break of this strong uptrend could prove to be the first signal of a correction,” which could encourage buying on dips, Kuptsikevich wrote.

Latest prices

- Bitcoin (BTC): $64,192, -0.97%

- Ether (ETH): $4,673, -1.31%

- S&P 500: $4,682, +0.72%

- Gold: $1,865, +0.18%

- 10-year Treasury yield closed at 1.57%

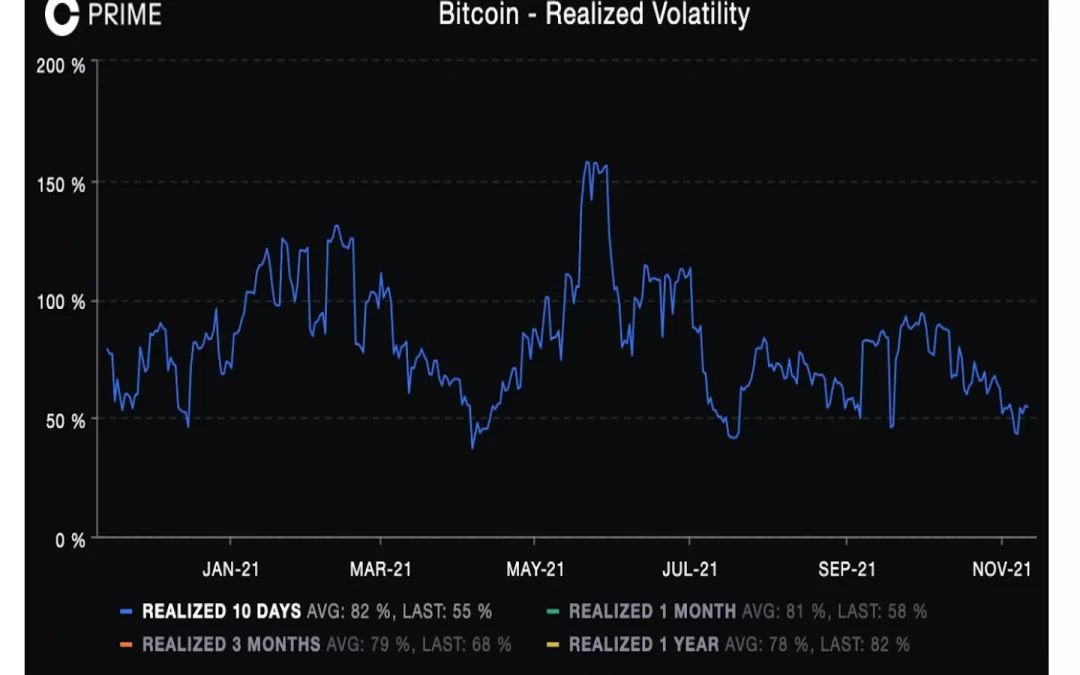

Bitcoin volatility declines

Bitcoin’s realized volatility is slowly drifting back toward a one-year low, according to options data provider Skew. The chart below shows a persistent decline in volatility since May, which was when BTC entered a bear market.

For now, some analysts expect volatility to remain low despite recent all-time price highs. QCP Capital, a crypto trading firm based in Singapore, stated in a Telegram chat that it holds a neutral position in BTC and a short-vega options position in ETH. Short-vega means the trader benefits if implied volatility falls.

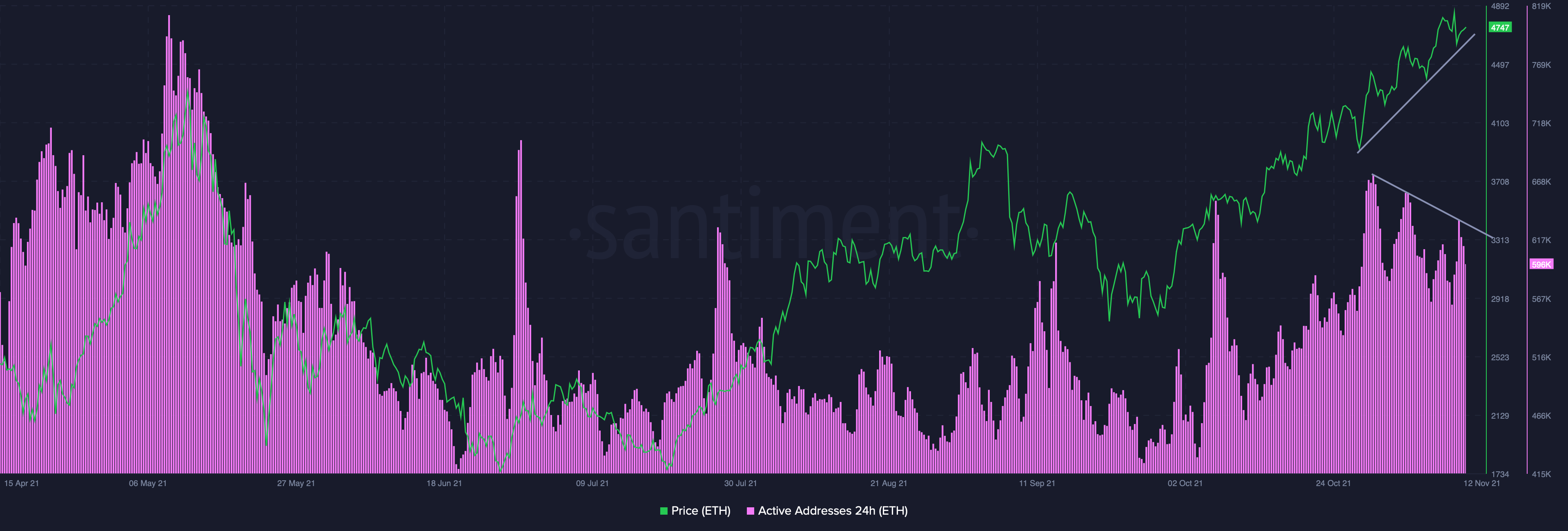

Ether pullback expected

Ether, the world’s second-largest cryptocurrency by market capitalization, could face a pullback toward the $4,000-$4,2000 support zone. Technical indicators show initial signs of upside exhaustion after ether reached an all-time price high around $4,800 earlier this week.

ETH is up about 3% over the past week, compared with a 4% rise in BTC over the same period. The chart below shows a slight drop in the ETH/BTC price ratio this month, although the downside appears to be limited toward the 0.067 support level.

Click here for technical analysis on BTC.

Additionally, blockchain data shows ether’s active addresses and trading volumes have decoupled from rising prices, which could indicate scope for a pullback in ETH, CoinDesk’s Omkar Godbole reported.

Altcoin roundup

- OMG tanks over 25% as exchanges see record inflows: OMG, the native token of the OMG Network layer 2 scaling protocol for Ethereum, crashed on Friday, CoinDesk’s Omkar Godbole reported. The cryptocurrency, which promises faster and cheaper transactions, fell 27% to $12.70 in what appeared to be a classic “sell the fact” reaction to Boba Network’s completion of a snapshot for an airdrop to OMG holders. OMG hit its lowest price since Oct. 28, falling below the 50-day moving average support after 3 ½ months, CoinDesk 20 data shows.

- Binance freezes DOGE withdrawals: The largest cryptocurrency exchange, Binance, temporarily suspended withdrawals of DOGE due to minor issues that occurred following an upgrade, CoinDesk’s Muyao Shen and Anna Baydakova reported. Some users experienced significant problems after the update, claiming the exchange first initiated the withdrawal of dogecoin without their consent and now is asking them to return the DOGE they don’t have in their accounts.

- Sam Bankman-Fried says Solana is better than Ethereum: FTX founder and CEO Sam Bankman-Fried believes Solana is a better blockchain than Ethereum, Markets Insider reported. During a conference held by Yahoo Finance and Decrypt, the 29-year old crypto billionaire argued that Solana is one of the few blockchains that can handle mass adoption by accommodating a large number of users and transactions. “Solana is one of the few currently existing public blockchains that has a really plausible roadmap to scale millions of transactions per second at, you know, fractions of a penny per transaction,” Bankman-Fried said.

Relevant news

- SEC Rejects VanEck’s Spot Bitcoin ETF Proposal

- BlackRock iShares Exec Says Firm Has ‘No Current Plans’ to Launch Crypto ETFs

- AMC Theatres to Accept Bitcoin, Ether for Online Payments

- Bakkt Shares Fall After Crypto Firm Posts Third-Quarter Loss

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Algorand (ALGO), +12.42%

Notable losers:

- Polkadot (DOT), -5.08%

- The Graph (GRT), -4.02%

- Uniswap (UNI), -3.78%