Bitcoin surged toward $54,000 on Wednesday, the highest level in almost five months. The cryptocurrency is up about 8% over the past 24 hours, compared with a 3% rise in ether over the same period.

Analysts pointed to renewed bullish sentiment ahead of the U.S. Securities and Exchange Commission’s (SEC) decision on a bitcoin ETF, which could occur in the coming weeks.

In the bitcoin futures market, front-month contracts based on the Chicago Mercantile Exchange (CME) were trading at an annualized premium of 12.8% to the spot price, which is the highest level since mid-April. A futures-based ETF, if approved, could bring more buying pressure for the CME futures, CoinDesk’s Omkar Godbole reported.

For now, some analysts see room for continued upside for BTC as momentum improves.

“I have to say, looking at the daily chart, the rise looks healthier this time as momentum has built steadily from the $40,000 area without facing rejection before crossing $50,000, as it has done many times before,” Daniela Hathorn, an analyst at DailyFX, wrote in an email to CoinDesk.

Latest Prices

- Bitcoin (BTC), $54,913, +7.3%

- Ether (ETH), $3,581, +2.6%

- S&P 500: +0.5%

- Gold: $1,765, +0.2%

- 10-year Treasury yield closed at 1.524%

Bitcoin dominance

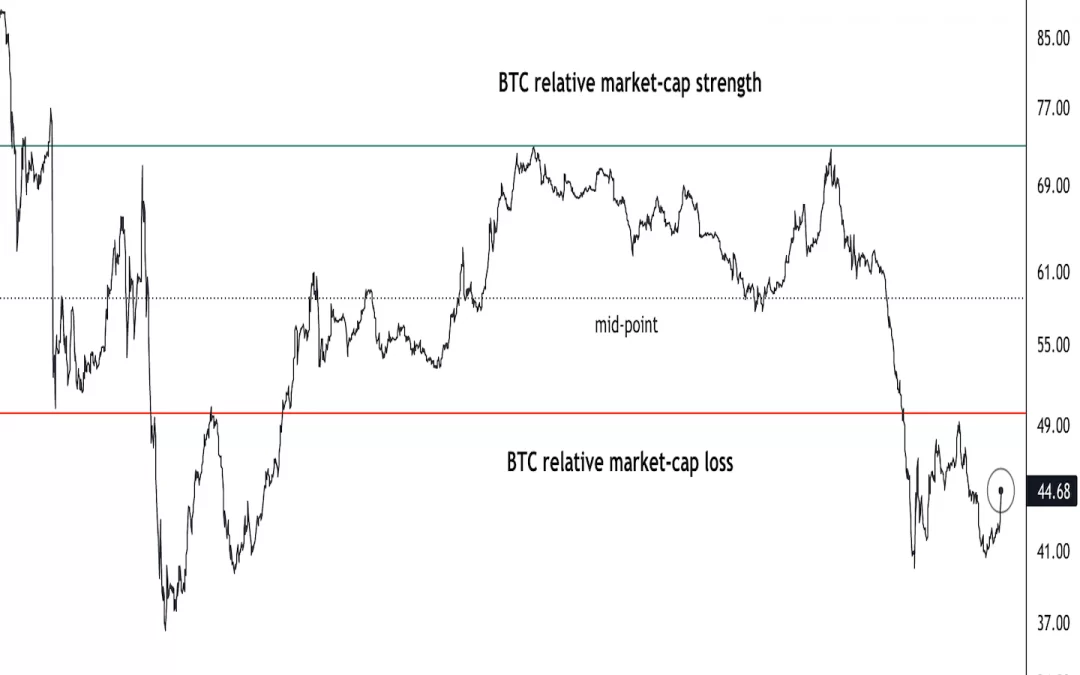

The bitcoin dominance ratio, which measures BTC’s market capitalization relative to the total crypto market capitalization, increased to about 44%, from a low of about 40% last month. The rise in the dominance ratio reflects bitcoin’s recent outperformance versus alternative cryptocurrencies (altcoins) – a trend that some analysts expect will continue this quarter.

“There has been fresh spot buying activity in BTC, and looking at the price action we expect to see a fresh all-time high in the coming weeks,” Pankaj Balani, CEO of Delta Exchange, wrote in an email to CoinDesk. “We also expect BTC to outperform altcoins and the money to rotate into BTC from alts going forward.”

The bitcoin dominance ratio had declined in recent months as altcoins outperformed. During the sell-off last month, investors may have rotated out of altcoins and into bitcoin.

Ether underperforms

Ether, the world’s second-largest cryptocurrency by market capitalization, is underperforming bitcoin. The ETH/BTC price ratio is attempting to break below 0.065, which provided support for ether relative to bitcoin in August. Failure to hold current support could trigger further downside toward 0.057, although oversold signals are starting to appear on the charts.

Outside of bitcoin, ether’s market capitalization continues to dominate other altcoins. The adoption of non-fungible tokens (NFTs), decentralized finance (DeFi) and other blockchain applications have helped push the narrative that ETH’s market capitalization could continue to grow, according to a report by CoinDesk Research.

Altcoin roundup

- National Bank of Georgia to test central bank digital currency next year: The National Bank of Georgia, which in May said it was exploring the possible development of a central bank digital currency (CBDC), plans to launch a pilot program next year, reported CoinDesk’s Sheldon Reback. Initial testing will be aimed at retail use, Interfax first reported, citing Papuna Lezhava, a vice governor at the central bank. A digital lari is not crypto currency, but is the evolution of cash, Lezhava said. It will improve the efficiency of the Georgia’s payments system and broaden financial inclusion.

- Strips Finance closes $8.5 million funding round for DeFi derivatives project: Strips Finance, a fixed-income platform, raised the funds in a token sale with participation from Fabric Ventures, Morningstar Capital, Multicoin Capital and Sequoia Capital India, CoinDesk’s Andrew Thurman reported. Strips is planning to launch in November with initial functionality that will enable interest rate swaps (IRSs) via automated market makers (AMMs), the decentralized exchanges over which much of DeFi is transacted.

- Binance registers three more firms in Ireland as crypto regulation heats up: Binance (APAC) Holdings, Binance (Services) Holdings and Binance Technologies were all formally established in the country on Sept. 27, according to a report by Ireland’s Independent news outlet on Wednesday. The move follows mounting pressure from regulators against the Binance brand, including in countries such as Australia, the U.S. and the U.K., CoinDesk’s Sebastian Sinclair reported. Company documents list the Binance firms’ place of business as an accounting firm’s office above a sports shop in a building in Dublin, according to the report. Binance’s $BNB token was trading at $436 on Wednesday afternoon.

Relevant News

- Mexican Stock Exchange Is Considering Listing Crypto Futures, CEO Says

- Gensler’s Crypto Testimony: 6 Key Takeaways

- Art Blocks Raises $6M From True Ventures, Galaxy on Strength of Generative NFTs

- DOJ to Launch National Crypto Enforcement Team: Report

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Bitcoin (BTC), +7.3%

- Bitcoin Cash (BCH), +5.3%

Notable losers:

- Algorand (ALGO), -3.7%

- The Graph (GRT), -2.4%