Bitcoin continues to decline after buyers failed to sustain last week’s all-time high of around $66,900. Analysts pointed to extreme optimism, leverage and profit-taking as possible reasons behind the latest pullback in BTC’s price.

Support, or the level at which buyers tend to invest, is around $53,000.

A pullback was overdue and more downside volatility could be in the offing, CoinDesk’s Omkar Godbole reported. For example, the estimated bitcoin leverage ratio, which is calculated by dividing futures’ open interest across all exchanges by bitcoin reserves on exchanges, is at the highest level since September, which preceded a crypto sell-off.

Bitcoin’s near-40% price rally over the past month was largely due to investor enthusiasm for the first bitcoin futures-linked exchange-traded fund (ETF) introduced by ProShares last week. But some analysts expect the ETF hype will fade.

“Once investors realize that these futures ETFs create no new demand for BTC and are only a side bet on short-term price appreciation we may see significant price erosion,” Charlie Silver, co-founder of Blockforce Capital, a crypto multi-strategy trading firm, wrote in an email to CoinDesk.

Latest prices

- Bitcoin (BTC): $59,378.49, -3.92%

- Ether (ETH): $4,014.58, -4.43%

- S&P 500: $4,551.68, -0.51%

- Gold: $1,797.91, +0.25%

- 10-year Treasury yield closed at 1.536%

“After a week of fresh highs, today’s sell-off is a warning not to be complacent in this market, especially when high levels of volatility are always around the corner,” Nicholas Cawley, an analyst at DailyFX, wrote in an email to CoinDesk.

Still, technical indicators show bitcoin’s pullback could stabilize. “We expect the pullback to mature quickly, within days, above initial support (~$52.9K) for bitcoin,” Katie Stockton, managing director of technical research firm Fairlead Strategies, wrote in an email to CoinDesk.

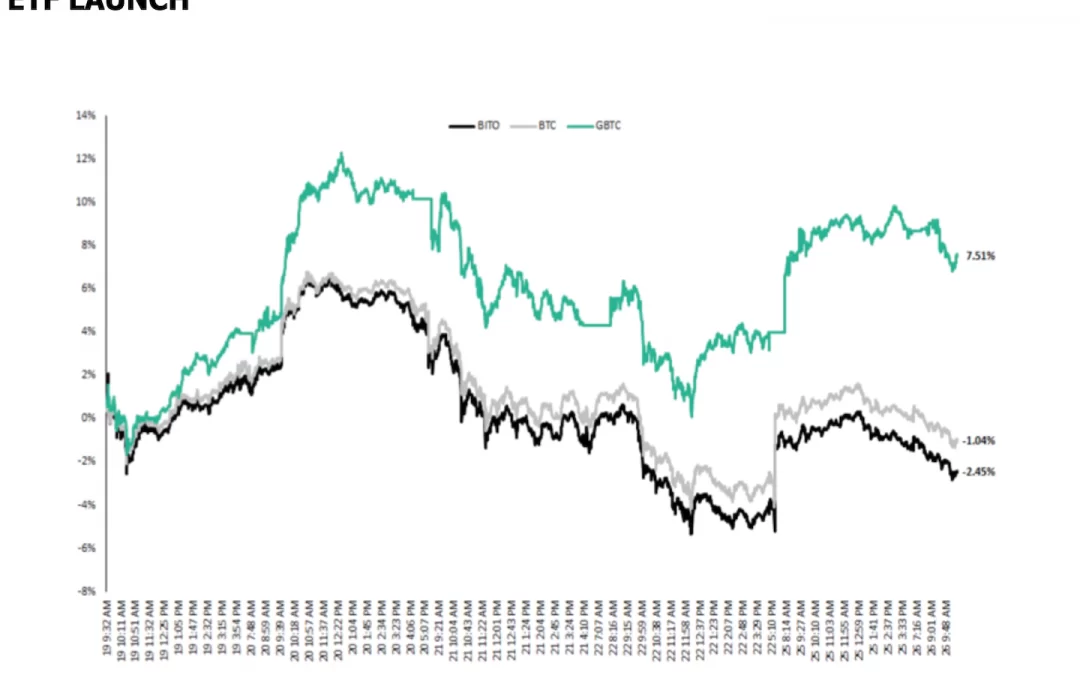

BITO lags bitcoin

So far, the new ProShares fund’s returns are falling short of the performance of bitcoin in cryptocurrency markets – the very thing the ETF was supposed to track. BITO is also underperforming the Grayscale Bitcoin Trust, or GBTC, which at $35.23 billion is the world’s largest bitcoin fund, CoinDesk’s Lyllah Ledesma reported.

From Oct. 19, when the ProShares ETF started trading, through Tuesday, BITO shares were down by 2.45%, based on a chart shared by Grayscale, the company that sponsors GBTC. Bitcoin was down 1% over the same period and GBTC was up 7.5%. (Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.)

Read more here.

Short-term bitcoin holders take profits

Similar to long-term bitcoin holders (discussed in yesterday’s Market Wrap), blockchain data also shows short-term holders are starting to take profits after the ETF-driven price rally. This suggests market participants are uncertain about bitcoin’s short-term price direction.

The chart below shows a spike in short-term holder selling activity on Wednesday, as noted by CryptoQuant. Still, some analysts expect buyers to remain active on price dips, which typically occur during the early stages of a bull market.

“For the first time in a long time, a significant profit-taking has come in bitcoin, giving the market a short-term buying opportunity,” wrote one analyst on CryptoQuant’s live feed on Wednesday.

Altcoin roundup

- Shiba inu briefly surpassed dogecoin: The self-proclaimed dogecoin killer, shiba inu, briefly surpassed DOGE in market value on Wednesday, CoinDesk’s Muyao Shen reported. Both coins now have a market cap of over $31 billion, and are toggling between 10th and 11th on the CoinGecko’s rankings page. Blockchain data shows that while SHIB continues to attract retail investors around the globe, more sophisticated crypto traders fueled the latest rally. Since the start of this week, addresses labeled as “smart money” started buying SHIB, according to Nansen research analyst Daniel Khoo.

- DBS joins Hedera Governing Council: Singapore’s DBS bank has become the first Southeast Asian lender to join the Hedera Governing Council, CoinDesk’s Sebastian Sinclair reported. The bank joins a council that includes 39 other organizations including Boeing, Deutsche Telecom and Google in supporting Hedera’s Hashgraph, a software that can process transactions and store a public ledger of those transactions. Council members serve three-year terms that can be extended to a maximum of two terms.

- Solana-based yield aggregator Tulip raises $5 million: Solana-based decentralized finance (DeFi) app Tulip has closed a $5 million funding round to expand its yield aggregation and crypto lending products, CoinDesk’s Danny Nelson reported. Tulip, which holds over $800 million in crypto assets according to Jump Capital and Alameda Research, is looking to use the investment to double its five-person team, which could prove difficult due to a Solana-focused engineers shortage amid heated competition for DeFi developer talent, CEO “Senx” said in a phone interview with CoinDesk.

Relevant news

- The Evolution of Ethereum’s Monetary Policy

- Blockchain Development Platform QuickNode Raises $35M

- Brazilian Ride-Hailing Giant 99 to Enable Bitcoin Trading

- CoinList Valued at $1.5B as Lending, Staking Join Business Mandate

- WWE, Blockchain Creative Labs Ink Deal to Launch NFT Marketplace

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Aave (AAVE): +1.58%

- Tether (USDT): +0.05%

- USD Coin (USDC): +0.03%

Notable losers:

- The Graph (GRT): -12.6%

- Chainlink (LINK): -12.35%

- EOS (EOS): -11.5%