Bitcoin traded sideways at around $46,000 on Monday and is down about 8% over the past week.

Bullish sentiment appears to be low despite bitcoin marking its 13th birthday. On Jan. 3, 2009, Satoshi Nakamoto mined the first block, the Genesis Block, which marked the beginning of the Bitcoin blockchain.

For now, technical indicators suggest nearby support could encourage short-term buying activity. Still, long-term momentum has slowed, which could point to low or negative crypto returns this month.

Some analysts are monitoring blockchain data for clues on BTC’s future price direction. For example, net exchange flows have increased recently, signaling a bearish shift in investor sentiment similar to the one seen before the price crash last May.

Other metrics, however, show improvements that could boost overall market sentiment.

The Bitcoin blockchain’s hashrate set new highs on Sunday night after crossing previous highs from mid-2021. Hashrate refers to the amount of computational power used by miners dedicated to the minting of new bitcoins and verification of new transactions on the Bitcoin network.

Latest Prices

- Bitcoin (BTC): $45,941, -2.18%

- Ether (ETH): $3,701, -2.76%

- S&P 500: $4,796, +0.64%

- Gold: $1,801, -1.46%

- 10-year Treasury yield closed at 1.63%

Lower blockchain transactions

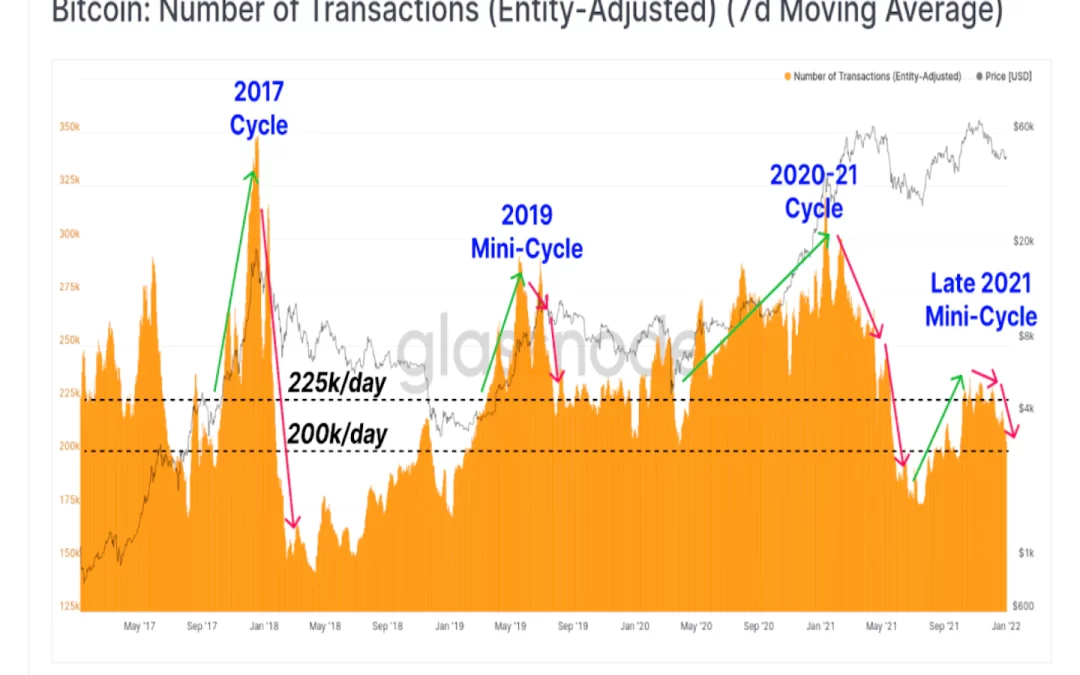

The chart below shows the recent decline in transaction counts on Bitcoin’s blockchain. In previous cycles, an initial burst of activity supported rallying prices, but recently, transactions failed to sustain any meaningful momentum, according to crypto data firm Glassnode.

“Until there is further expansion in demand for Bitcoin block space, it can be reasonably expected that price action will be somewhat uneventful, and likely sideways at a macro scale,” Glassnode wrote in a blog post on Monday.

Altcoin roundup

- Shiba Inu launches beta version of DAO: The dogecoin rival is aiming to provide its users with more control over crypto projects and pairs on the ShibaSwap platform. The first phase called “DAO 1″ will be implemented within the next few days.

- Convex Finance crosses $20B in locked value: The decentralized finance (DeFi) protocol allows users to earn fees without locking Curve’s native tokens, a feature that has helped attract billions of dollars in capital. Convex’s native token (CVX) traded at $47 at the time of writing, down about 4% over the past week.

- Altcoins outperformed in 2021: Tokens linked to the metaverse, “Ethereum-killers” and meme coins dominated gains during another bullish year for cryptocurrencies. Prices for the top-performing coin rose 162-fold. Read more here.

Relevant News

- Bitcoin Hashrate Mints New All-Time Highs

- Salvadoran President Bukele Expects Bitcoin to Reach $100K This Year

- Jamaica Completes CBDC Pilot, Expects Rollout Later This Year

- Bitcoin Whales Were Active on Coinbase Amidst a Quiet Holiday Week

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Largest winners:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Algorand | ALGO | +9.3% | Smart Contract Platform |

| Cosmos | ATOM | +6.4% | Smart Contract Platform |

| Chainlink | LINK | +2.7% | Computing |

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Solana | SOL | −4.1% | Smart Contract Platform |

| Polygon | MATIC | −3.6% | Smart Contract Platform |

| Filecoin | FIL | −3.4% | Computing |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.