Bitcoin bounced toward $49,000 on Wednesday as traders reacted to the U.S. Federal Reserve’s decision to accelerate its stimulus withdrawal. Some analysts suggested the Fed decision was already priced in, which means some traders already sold long positions, which created attractive price levels for short-term buyers.

The central bank will reduce its bond purchases by $30 billion every month to wind them down early next year, twice as fast as the current pace of withdrawal of $15 billion every month. Some crypto investors say the $120 billion-a-month program helped to bolster bitcoin’s appeal as an inflation hedge, CoinDesk’s Brad Keoun wrote.

For now, crypto prices are still stabilizing after the sell-off earlier this month. Bitcoin is up about 3% over the past 24 hours, compared to a 4% rise in ether and a 14% rise in Solana’s SOL token over the same period.

“The most likely path forward is more choppy/sideways price action heading into year end, though any major risk-off event or volatility spike that punishes risk assets would likely drag on BTC and the broader crypto market as well,” Delphi Digital, a crypto research firm, wrote in an Wednesday memo.

Latest prices

- Bitcoin (BTC): $49,251, +3.06%

- Ether (ETH): $4,057, +5.87%

- S&P 500: $4,709, +1.63%

- Gold: $1,778, +0.32%

- 10-year Treasury yield closed at 1.46%

Bitcoin losses accelerate

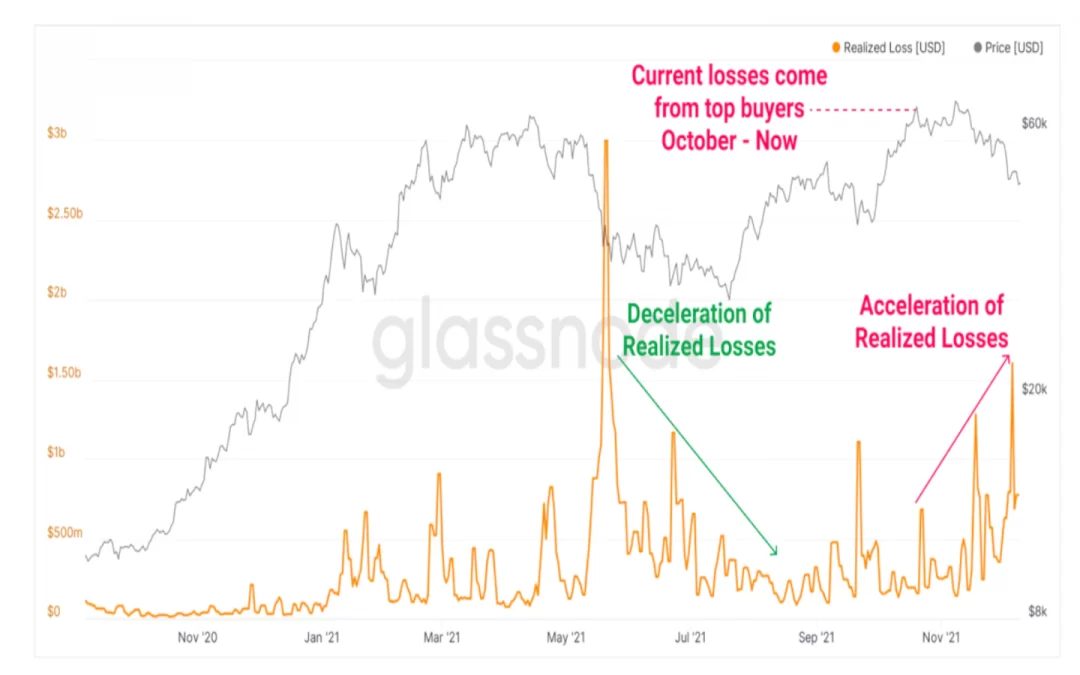

During the recent correction, bitcoin holders have experienced an acceleration in realized losses (price declines below their initial cost basis). Oftentimes, negative returns can encourage selling as traders become fearful of further market declines.

“We’re currently observing an acceleration of realized losses among BTC holders, trending above $1 billion daily on two occasions during this correction,” crypto data firm Glassnode wrote in a blogpost.

The BTC price decline from an all-time high around $69,000 triggered a more cautious tone in the market. And the acceleration of realized losses is indicative of nervousness of another sell-off, according to Glassnode.

Despite higher losses, however, blockchain data suggests that some investors continue to hold bitcoin. For example, the balance of BTC on exchanges has continued to decline this year, which could mean investors prefer to hold bitcoin in their wallet instead of making it available for sale on the exchange.

Altcoin roundup

- Galaxy, Bloomberg debut Solana fund: Galaxy and Bloomberg prepared for this fund’s launch with their creation of a Solana index one month ago. The new fund seeks to track the performance of that index, the companies said. Investors must pitch a minimum of $25,000, according to Galaxy’s website. The company said Coinbase will custody the coins, CoinDesk’s Danny Nelson reported.

- Avalanche’s scaling capabilities: Smart-contract platform Avalanche’s ability to scale while remaining secure and decentralized makes it a credible alternative to Ethereum for DeFi projects, NFTs, gaming and other assets, Bank of America said in a research report. Avalanche’s AVAX token is now the 12th largest by market value.

- Aave’s community votes to prevent forks: A governance proposal floated by the Aave community centered around the platform’s code licensing ended on Tuesday, with 55% voting for the ecosystem to apply for a “business license.” This vote “is essentially a signal on whether or not the Aave community wants to protect its Intellectual Property from unauthorized use, or simply allow anyone to use the code in any way they prefer,” the proposal’s pseudonymous author explained. Read more here.

Relevant news

- Valkyrie Launches ETF to Track Bitcoin Balance Sheet Stocks

- Crypto Firms Get a Slap From UK Advertising Regulator Over Misleading Ads

- Celsius’ Chief Revenue Officer Launched a Business With a Convicted Money Launderer: Report

- India’s Crypto Bill Likely to Be Delayed for Several Weeks: Reports

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polygon (MATIC): +17%, Sector: Smart Contract Platform

- Solana (SOL): +15%, Sector: Smart Contract Platform

- Chainlink (LINK): +8.26%, Sector: Computing

Notable losers:

- Dogecoin (DOGE): -1.07%, Sector: Currency

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.