Bitcoin was in recovery mode on Monday as bearish sentiment waned. The cryptocurrency was up about 6% over the past 24 hours compared with a 7% gain in ether over the same period. Generally, some traders are looking to buy on price dips given seasonal strength into year’s end.

“If indeed [the sell-off] is over, such a pullback could clear the way for growth to new highs, as bulls were allowed to lock in profits and shortly after to buy the dip,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk.

“On the other hand, BTC remains below its 50-day average (currently around $60K), which has acted as resistance for the past 10 days. A failed breakout would indicate the end of bitcoin’s bullish trend,” Kuptsikevich wrote.

Some analysts expect crypto volatility to continue lower, which means limited downside with the potential for higher price gains.

“We are betting that the market will consolidate instead of breaking lower. So we are taking the opportunity to short [volatility] in BTC and ETH,” crypto hedge fund QCP Capital wrote in a Telegram announcement.

Latest Prices

- Bitcoin (BTC): $58,221, +5.9%

- Ether (ETH): $4,426, +6.9%

- S&P 500: +1.3%

- Gold: $1,786, -0.5%

- 10-year Treasury yield closed at 1.514%

Volatility is relatively low

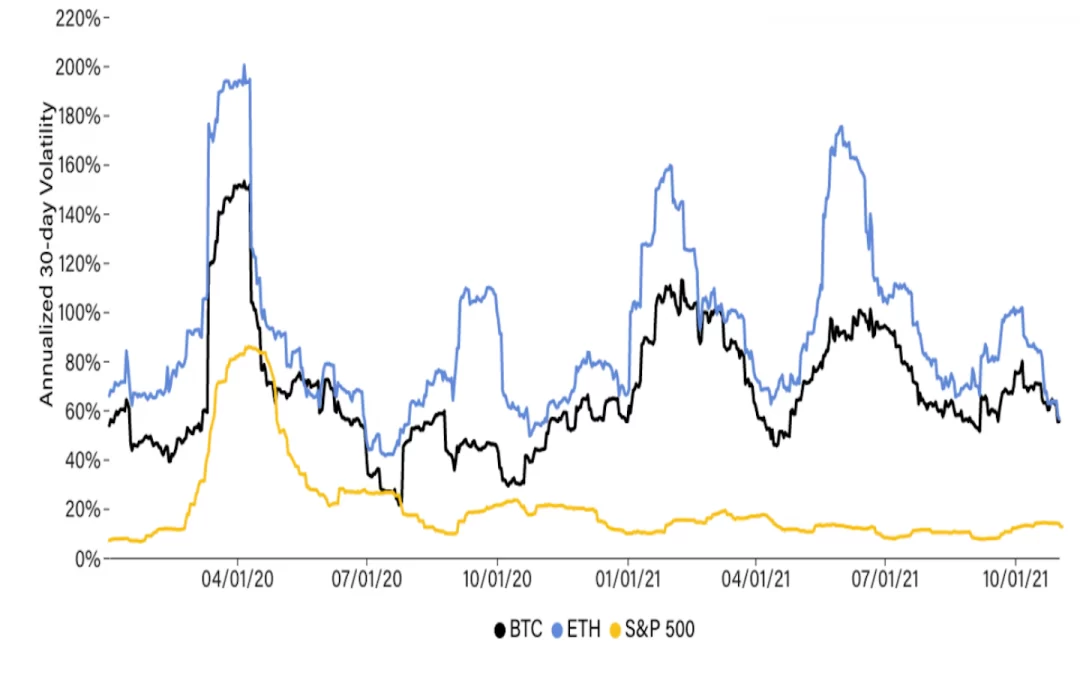

On an annualized basis, bitcoin and ether’s 30-day volatility remains low compared with earlier this year. Meanwhile, despite the latest spike, the S&P 500′s annualized volatility has declined from its March 2020 peak.

Some analysts expect volatility to eventually rise next year, especially as the correlation between bitcoin and the S&P 500 remains elevated. For now, pullbacks in assets deemed to be risky, such as cryptocurrencies and stocks, appear to be limited given strong seasonal trends.

Bitcoin drawdown deepens

Bitcoin dropped nearly 20% from its all-time high near $69,000 last week, which was the largest drawdown (percentage decline from peak to trough) since September. Historically, bitcoin experienced sharp drawdowns around all-time highs, which suggests the current correction could be short-lived.

The chart below shows previous sell-offs resulting in drawdowns as deep as 24% have quickly recovered toward the all-time price high.

Crypto fund inflows rise

Crypto investment fund inflows rose to $306 million last week despite the overall market pullback. Bitcoin-focused funds saw the largest inflows in five weeks, totaling $247 million following the launch of another investment product in Europe, according to a report by CoinShares.

Multi-asset investment products and funds focused on alternative cryptocurrencies also saw inflows last week.

Altcoin roundup

- Binance resolves DOGE wallet issue, unfreezing over 1,000 user accounts: Binance said on Monday it has resolved technical issues with its dogecoin wallet that resulted in users’ accounts being frozen, reported CoinDesk’s Anna Baydakova. In a blog post, Binance blamed the issue on “a combination of unlikely factors” related to the dogecoin blockchain upgrade from the previous version. “What began as a fairly straightforward upgrade turned into an issue where Binance users were unable to withdraw DOGE for the last 17 days,” the exchange said.

- Mean DAO raises $3.5 million for Solana-based DeFi payments project: Mean DAO has raised a $3.5 million funding round to boost Solana’s decentralized finance (DeFi) ecosystem with a new payments protocol focused on money streaming. Money streaming is a service that automates payment and banking workflows and allows for flexible payment schedules, explained CoinDesk’s Eli Tan. Mean DAO announced the funding round on Monday, led by Three Arrows Capital, SoftBank and DeFiance Capital, with participation from Skyvision Capital, Solar Eco Fund, Sesterce Capital and Gate.io.

- Algorand partners with Citi veteran for $1.5B crypto fund: Hivemind Capital Partners, founded by former Citi exec Matt Zhang, announced its inaugural $1.5 billion venture fund to invest in blockchain and digital asset ecosystems, reported CoinDesk’s Brandy Betz. As part of the fund launch, Hivemind partnered with blockchain Algorand to provide technology and network ecosystem infrastructure. “The launch of Hivemind’s venture represents an exciting new milestone in serious players entering the Algorand and broader blockchain ecosystem,” Algorand Chief Operating Officer W. Sean Ford said in a statement.

Relevant News

- Twitter CTO Parag Agrawal Replaces Jack Dorsey as CEO

- MicroStrategy Bought About 7K Bitcoins in Fiscal Fourth Quarter for $414M

- Russians Conduct $5B Worth of Crypto Transactions a Year, Central Bank Says

- Crypto Exchange Kraken to List Shiba Inu, Fulfilling Nov. 1 Twitter Promise as SHIB’s Fortunes Fall

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Polygon (MATIC): +11.0%

- Algorand (ALGO): +8.9%

Notable losers:

- The Graph (GRT): -0.4%