Bitcoin has traded mostly sideways over the past two weeks, prompting some traders to consider alternative cryptocurrencies such as ether for greater profit potential.

“Our models are still full risk-on ETH (whereas our bitcoin model started reducing exposure last week) but we are starting to see some slowing in conviction buying,” Ben McMillan, chief investment officer at quantitative research firm IDX Insights, wrote in a research report.

BTC’s price has been roughly flat over the past week compared to a 4% rise in ETH and a 23% rise in Solana’s SOL token over the same period.

“Investors are likely looking for the next catalyst for another leg higher, but the absence of such is likely to leave bitcoin vulnerable to a break below $60,000,” Daniela Hathorn, an analyst at DailyFX, wrote in an email to CoinDesk.

“Typically, we tend to see BTC sell off a bit after breaking to a new all-time high as traders front-run the hype,” crypto research firm Delphi Digital wrote in a blogpost on Thursday, referring to traders dealing on advance information .

But some analysts expect further upside despite signs of slowing price momentum.

“With MVRV [bitcoin’s market value relative to its realized value] currently trading at 2.72, far off from its recent peak of 3.96″ in February, crypto investment firm StackFunds said in a report it is “expecting further room for growth as [MVRV] retests the 4.0 handle,” along with blockchain metrics showing strong bitcoin accumulation.

Latest prices

- Bitcoin (BTC): $61,162, -2.95%

- Ether (ETH): $4,486, -3.17%

- S&P 500: $4,675, +0.32%

- Gold: $1,793, +0.95%

- 10-year Treasury yield closed at 1.52%

Why this bull run is different

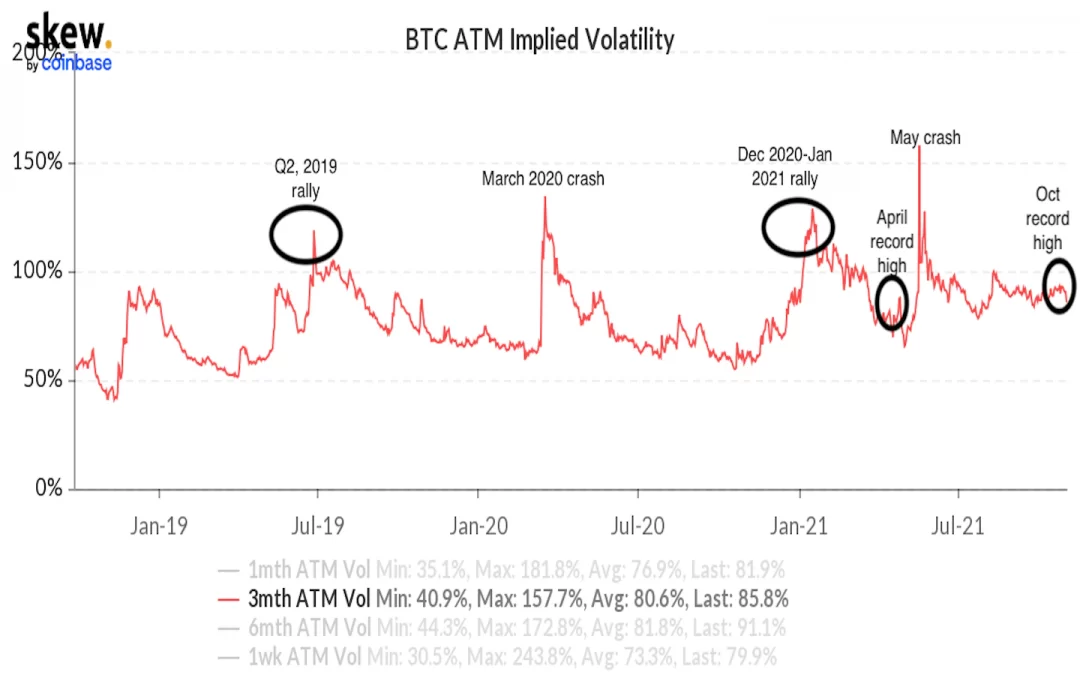

Bitcoin’s two bull runs of 2021 have differed from those in past years. One key distinction has been decreased volatility expectation, CoinDesk’s Muyao Shen reported.

This metric, which shows the cryptocurrency’s expected price swings, did not spike when bitcoin’s price hit record highs in April and then in October, indicating that bitcoin may be evolving into a more mature investment asset.

Prior to 2021, bitcoin’s three-month implied volatility (IV) – investors’ expectation of how turbulent prices will be over the ensuing three months – spiked during both bull and bear runs, according to data from crypto data firm Skew. But this year, a similar spike only occurred when the market crashed in May.

Ether to extend outperformance

Some analysts remain bullish on ether, the world’s second-largest cryptocurrency by market capitalization. The price reached an all-time high around $4,600 on Wednesday.

FundStrat, a global advisory firm, expects ether to rally as high as $4,951 “with little to no resistance” after outperforming bitcoin recently and breaking through September highs.

“While weekly and monthly momentum do show overbought conditions, this won’t be a big deal until near-term technicals begin to show evidence of upside exhaustion,” Mark Newton, FundStrat’s global head of technical strategy, wrote in a research note on Wednesday.

Newton also sees further upside in ETH relative to BTC (ETH/BTC price ratio) if price resistance near 0.08 is broken. “At present, the most likely outcome is a bit more outperformance, followed by a stall out,” Newton wrote.

Altcoin roundup

- SHIB slumps amid speculation about large investor’s holdings: An increased SHIB sell-off on centralized exchanges occurred as the hype around the meme token has been tapering off, CoinDesk’s Muyao Shen reported. The canine-themed token has logged losses for three consecutive days after a SHIB whale (or large holder of the token) made a move on their holdings of 40 trillion SHIB, which was worth roughly $2.8 billion at the time.

- Ethereum alternatives and gaming tokens outperform: Tokens associated with Solana and Polkadot – both alternatives to the Ethereum blockchain – are outperforming along with gaming tokens like Axie Infinity’s AXS, CoinDesk’s Lyllah Ledesma reported. “Currently, it is a very mixed market, with coins moving pretty uncorrelated from each other,” said Patrick Heusser, head of trading at Crypto Finance AG. This presents more trading opportunities, Heusser said.

- Enjin forms $100M fund to support Metaverse projects: The Efinity Metaverse Fund will aim to support work on metaverse projects on Enjin and Polkadot, CoinDesk’s Jamie Crawley reported. The fund will focus on cross-chain non-fungible token (NFT) assets, digital collectible applications, gaming that harnesses mixed reality, virtual events and building multi=chain infrastructure.

Relevant news

- In Craig Wright Trial, Plaintiffs Lay Out Pattern of Fraud, Deceit and Hubris

- MetaMask, Phantom Wallet Users Targeted in Crypto Phishing Scam: Report

- US Lawmakers Call for Bitcoin Spot ETF in Letter to SEC Chair Gensler

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- The Graph (GRT), +3.52%

- Aave (AAVE), +0.32%

Notable losers:

- Polygon (MATIC), -6.97%

- Algorand (ALGO), -4.84%

- Cardano (ADA), -4.58%