Bitcoin was roughly flat over the past 24 hours, suggesting that investor enthusiasm over the Bitcoin blockchain’s Taproot upgrade is starting to fade. In October some analysts warned the upgrade might already be priced in given BTC’s near-40% rally over the past few months.

Still, it remains to be seen whether investors will continue to accumulate BTC in hopes of long-term gains. “Historically, bitcoin has risen after past upgrades [to the Bitcoin blockchain], so many see this as possibly history repeating itself,” Marcus Sotiriou, a trader at U.K.-based digital asset broker GlobalBlock, wrote in an email to CoinDesk.

Over the short term, technical indicators show slowing upside momentum in BTC. This means the current pullback could extend into Asian trading hours, albeit limited toward the $57,000-$60,000 support zone.

“While the cryptocurrency market remains in its bullish phase, the tendency towards consolidation is worrisome, shaping the market’s advance in small steps,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk.

Latest prices

- Bitcoin (BTC): 63,867.78, -0.55%

- Ether (ETH): 4,574.09, +0.33%

- S&P 500: 4,682.80, -0%

- Gold: 1,863.06, -0.12%

- 10-year Treasury yield closed at 1.623%

Bitcoin uptrend intact

Some indicators suggest bitcoin’s price could continue higher, similar to the fourth-quarter bull run in 2020.

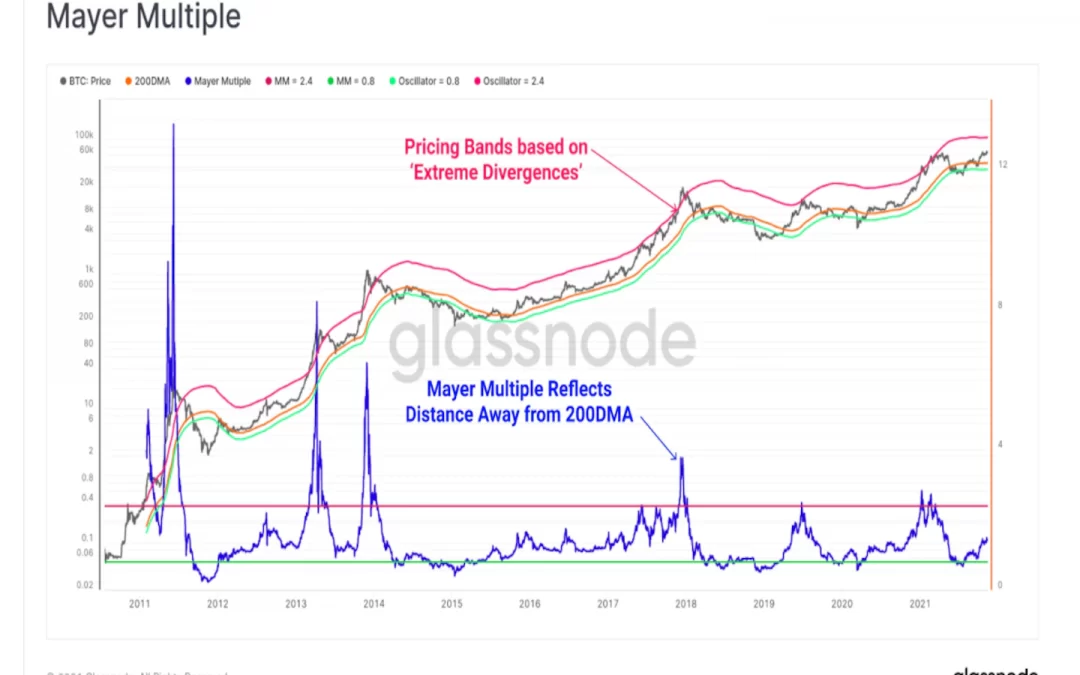

For example, the chart below shows the Mayer Multiple, a simple oscillator that measures the divergence between BTC’s price and its 200-day moving average. The oscillator is still below extreme levels seen earlier this year, indicating further room for BTC to trend higher.

Some analysts also point to increasing transactions by bitcoin whales (large holders) as a sign of growing investor demand. “It’s the largest [movement] I’ve ever seen since 2017 excluding outliers,” Ki Young Ju, CEO of CryptoQuant, wrote in a blog post.

The average bitcoin transaction amount by large holders remains elevated over the past few months, according to blockchain data compiled by CryptoQuant.

Crypto funds see lower inflows

The total flows into cryptocurrency funds declined from the fourth straight week, slipping from $174 million last week, according to a CoinShares report. The amount is still well off the $1.5 billion of inflows notched a few weeks ago when new exchange-traded funds backed by bitcoin futures contracts debuted in the U.S.

Funds focused on bitcoin, the largest cryptocurrency by market capitalization, gained $98 million, up from $95 million the week before and pushing assets under management (AUM) to a record $56 billion, although bitcoin’s dominance against alternative coins (altcoins) has waned over the week.

Meanwhile, alternative digital assets appeared to show waning investor interest.

Altcoin roundup

- DEX aggregator ParaSwap launches PSP token: Decentralized exchange aggregator ParaSwap has announced the launch of its PSP governance token, CoinDesk’s Andrew Thurman reported. The token is currently available for some 2,000 eligible Ethereum addresses and enables users to stake in liquidity pools in exchange for platform rewards. It also enables participation in ParaSwap’s newly formed decentralized autonomous organization governance. The DEX aggregator famously resisted tokenizing for years, saying last month that it was “not planning” an airdrop.

- Solana hits Bloomberg Terminal with Galaxy-backed index: Bloomberg LP and Galaxy Digital have released a Solana index, making SOL the third crypto index with a standalone price tracker developed by the pair after BTC and ETH, CoinDesk’s Danny Nelson reported. The launch signals increased interest in SOL, which has surged over 11,700% in the past 12 months, according to Messari. Bloomberg and Galaxy have now issued five crypto indexes since starting their collaboration.

- Introducing the Filecoin Virtual Machine: Data storage marketplace, protocol and cryptocurrency Filecoin has introduced the Filecoin Virtual Machine, it announced in a blog post last week. The machine, which is compatible with Ethereum, “aims to be a polyglot VM, drawing inspiration from the concept of Hypervisors to establish a multi-VM design,” the blog post said. With the introduction of the machine, Filecoin is looking to revolutionize the decentralized storage ecosystem.

Relevant news

- Marathon Digital to Raise $500M in Convertible Notes

- Galaxy Digital Reports Q3 Earnings of $517M

- Crypto Venture Firm Paradigm Announces $2.5B Fund, Industry’s Largest

- Valkyrie to Launch $100M ‘On-Chain DeFi Fund’

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Stellar (XLM): +1.3%

- Bitcoin Cash (BCH): +0.85%

- Ethereum (ETH): +0.45%

Notable losers:

- Algorand (ALGO): -4.68%

- Aave (AAVE): -3.11%

- The Graph (GRT): -2.46%