Bitcoin’s price stayed roughly flat over the past 24 hours, settling at approximately $54,000 as of Thursday afternoon. The muted price action comes after bitcoin rallied an impressive 8% yesterday, driven by concentrated buying. Analysts expect trading volumes to remain elevated, supporting continued upside into Q4.

Blockchain data shows a large buy order was behind the bitcoin rally yesterday. It remains unclear why these large traders (bitcoin whales) purchased on spot exchanges instead of an over-the-counter desk, according to CoinDesk’s Muyao Shen.

However, some analysts remain cautious, pointing to activity in the bitcoin options market.

“We also continue to see bearish-type trades with the spot rally,” according to QCP Capital. “A total of 1,200x BTC end-October BTC calls were sold yesterday, followed by the buying of over 500x of 50/45k end-October put spread today. In the very short term, we might see some corrective price action in BTC.”

A call option gives the purchaser the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date.

Latest Prices

- Bitcoin (BTC): $53,910, -1.8%

- Ether (ETH): $3,598, +0.5%

- S&P 500: +0.8%

- Gold: $1,755, -0.3%

- 10-year Treasury yield closed at 1.573%

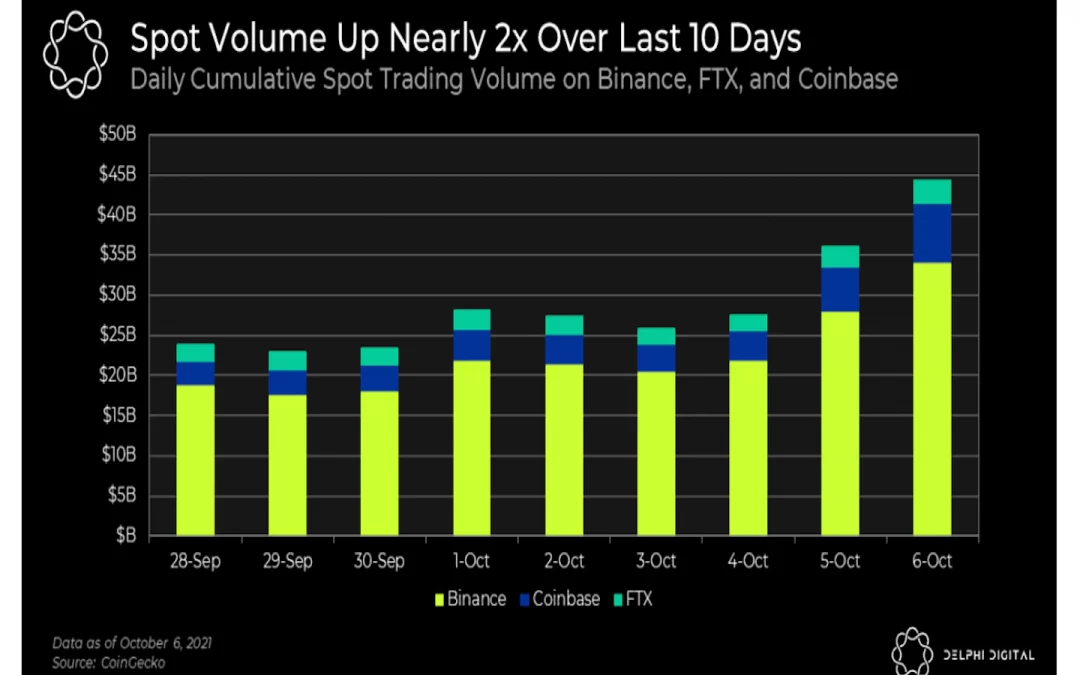

Trading volume rise

Bitcoin’s spot trading volume rose over the past few days, which reflects a resurgence of buying activity. The past few months were relatively quiet in crypto markets, although the sell-off in September may have encouraged some buyers who had been on the sidelines.

Blockchain data shows continued BTC accumulation by both long-term and short-term holders who are starting to realize profits above their cost basis, or the original value or purchase price of an asset or investment for tax purposes. Analysts are monitoring the use of leverage, particularly in the bitcoin futures market, to determine if traders are gaining conviction behind the recent rally.

“A spot rally doesn’t mean there’s no leverage,” Delphi Digital, a crypto research firm, wrote in a blog post. “Exchanges also lend stablecoins to their customers, which are then used to purchase spot assets.”

Delphi also noted that a bitcoin rally on high spot volume would “imply that overall leverage is much lower than it would be on a futures-driven move.”

Outside of the spot market, other analysts saw a surge in trading volume in bitcoin’s perpetual futures market, a type of derivative in cryptocurrency markets similar to futures contracts in traditional markets.

“Whales (large traders) bought up BTC in the perpetual futures markets yesterday mostly at Binance, Huobi and Bybit,” wrote Ki Young Ju, CEO of CryptoQuant, in a blog post.

So far, analysts are not too concerned about the sudden rise in trading activity. “Overall, the leverage ratios do not look overextended nor overheated, as we feel investors have been relatively cautious in their trading playbook,” StackFunds, a cryptocurrency investment firm, wrote in a Wednesday newsletter.

Bitcoin resilience into year’s end

Historically, the fourth quarter of the year tends to produce positive returns for bitcoin, which is one reason why some analysts remain optimistic.

October is typically more volatile than September (average annualized volatility of 66% versus 61%), and BTC tends to finish about 13% higher when looking at historical averages, according to data compiled by Kraken.

“This, along with the fact that we saw sentiment rebound late last month following global markets derisking on Evergrande fears and negative headlines out of China, suggests that BTC is arguably becoming more resilient against traditional market turbulence,” Kraken wrote in a research report.

And while further upside is likely this quarter, some analysts expect the possible approval of a bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission later this month could stall the upside in price over the short term, as has happened after previous important events.

“While we’ve had two down 83% bear markets already, I believe those are a thing of our primordial past – future bear markets will be shallower; the previous two have been -61% and -54%,” Dan Morehead, CEO of crypto investment firm Pantera Capital, in a Thursday newsletter.

Morehead expects a repeat of previous significant crypto events such as the launch of the Chicago Mercantile Exchange (CME) bitcoin futures in Dec. 2017, which preceded a downturn in the BTC price.

Still, Pantera maintains a long-term bullish outlook for bitcoin.

Altcoin roundup

- Meme coin $SHIB continues October rally: Self-claimed “DOGE killer” shiba inu (SHIB) has pumped by nearly 400% in the past week, pushing the token to the 13th most valued cryptocurrency by market capitalization, reported CoinDesk’s Muyao Shen. Data from blockchain data firm Santiment shows that the number of SHIB transactions worth more than $1 million has been going up dramatically along with the price rally. “I would say it’s just crypto being crypto,” Ashwath Balakrishnan, an associate at crypto analytics firm Delphi Digital, said. “When markets go risk-on, the meme coins tend to benefit.”

- Yield Guild Games invests $175K in Merit Circle to expand scholarship program: Yield Guild Games (YGG), a decentralized gaming startup, said it invested $175,000 in Merit Circle to help “bring play-to-earn to the masses,” reported CoinDesk’s Tanzeel Akhtar. YGG said its users can interact with the gaming guild by applying and receiving a scholarship for Axie Infinity or by purchasing Merit Circle’s soon-to-be-released governance token “$MC” to be a part of the DAO.

- Automated market maker Tinyman to launch on Algorand: Tinyman, an automated market maker (AMM) on the Algorand blockchain, recently raised $2.5 million and is expected to launch in full on Thursday, reported CoinDesk’s Josh Fineman. Tinyman raised its $2.5 million from 20 investors, including Borderless Capital, Arrington Capital and The LAO. It joins a crop of projects seeking to attract decentralized finance (DeFi) users to new chains. Be it Trader Joe on Avalanche or Fantom quickly surpassing $5 billion in locked value, traders are increasingly finding alternatives to the high fees associated with Ethereum-based DeFi.

Relevant News

- US FDIC Said to Be Studying Deposit Insurance for Stablecoins

- One of Germany’s Oldest Banks Taps Fireblocks to Custody Customers’ Crypto

- Analytics Platform Nansen Expands to Fantom, Spotlighting Emerging DeFi Ecosystem

- Dapper Labs Taps Chainalysis to Fight NFT Money Laundering

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Stellar (XLM): +6.1%

- Polkadot (DOT): +5.7%

Notable losers:

- Dogecoin (DOGE): -3.5%

- EOS (EOS): -3.4%