Cryptocurrency markets are feeling a lot of pressure on Thursday, March 12, as the entire cryptoconomy has lost over $50 billion during the last three days. Digital asset prices dropped to the lowest levels since May 2019. Moreover, on five derivatives exchanges, more than $2.2 billion leveraged positions were liquidated in the last 24 hours.

Also read: The 35 Most Influential Bitcoiners Dominating Crypto Twitter by Follower Count

Cryptoconomy Sees $50 Billion Shaved – Derivatives Traders Watch $2.2 Billion Liquidated

Global markets are feeling a lot of weight from investors panic-selling due to lack of liquidity. Cryptocurrency markets have felt the pressure too as most digital assets have been acting more like risk assets than a potential safe haven. Crypto prices have dropped to the lowest levels traders have seen since the spring months of last year. Since news.Bitcoin.com’s last market update three days ago, the entire cryptoconomy of 5,000+ coins has lost $52 billion so far. On Wednesday and Thursday morning, more than $2.2 billion was liquidated from traders on Bitmex, Okex, Huobi, Binance, and FTX. Analysts assume that Bitmex saw between $650 to $750 million in liquidations.

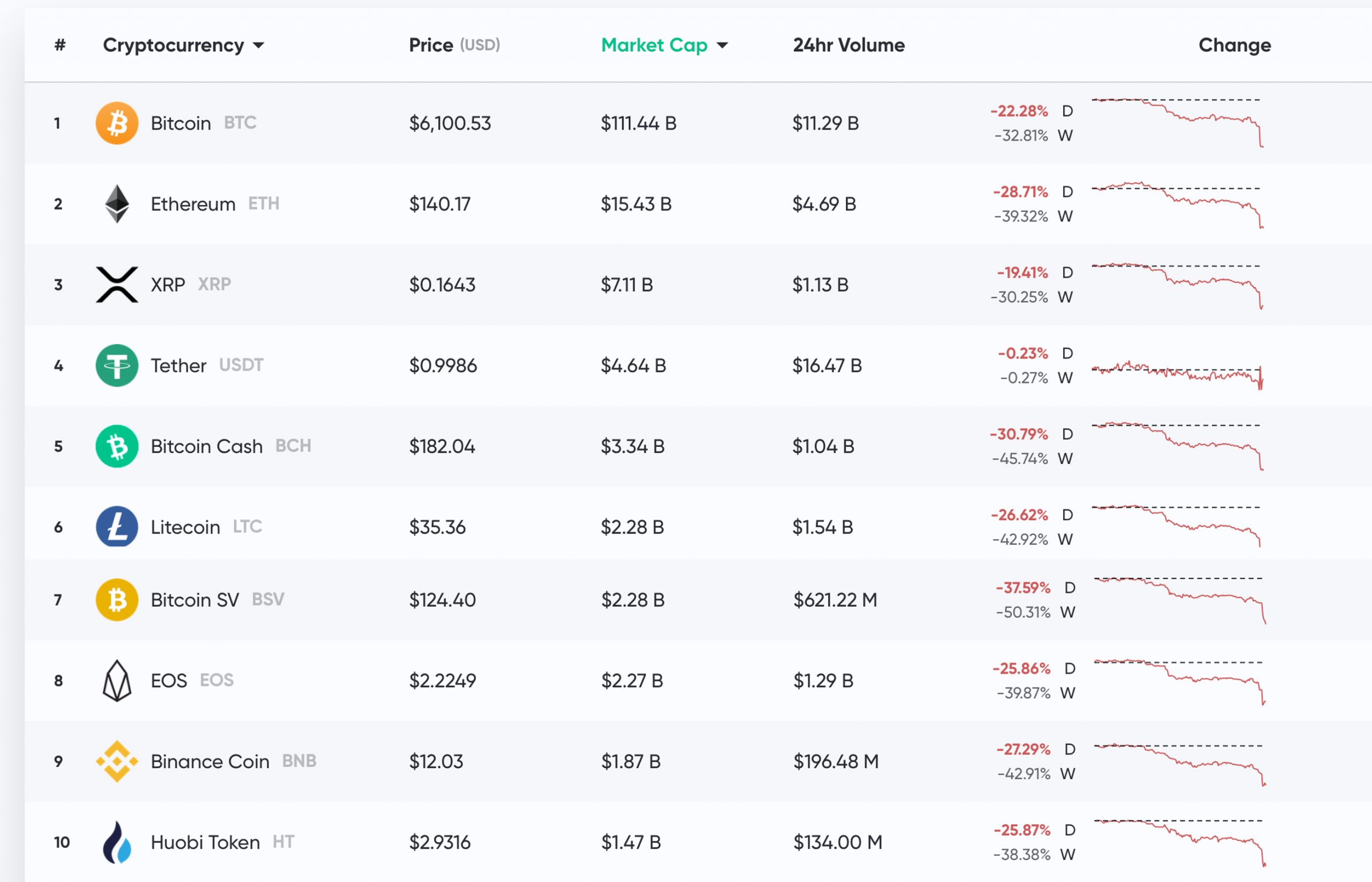

At the time of writing, the largest cryptocurrency by market capitalization, BTC, is down 22% in the last 24 hours and 32% for the last seven days. Reported BTC trade volume shows $42 billion worth of BTC swaps on Thursday but Messari.io’s “real volume” is $1.8 billion. Every coin in the top 10 is down at least 20-30% except for tether (USDT) which is carrying a lot of pressure at the moment too. Tether commands more than 68% of BTC trades today and the stablecoin is capturing more than two thirds of the entire cryptoconomy’s trading pairs.

ETH is swapping for $140 per coin as the second-largest cryptocurrency by market cap is down 28% today. ETH lost 39% of its value during the course of the week and there’s $18.3 billion in reported trades ($872M real volume). XRP is trading for $0.16 per token and the coin has suffered a loss of 19% today and 30% for the week. Tether issued another $60 million USDT on March 11, 2020, and it’s issued $180 million ($120M on March 5th) throughout this month alone.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin cash (BCH) has dropped to the fifth coin cap position as it’s currently trading for $182 per coin. BCH markets have lost 30% in a single day and 45% for the week. This has managed to wipe out the 90-day gains BCH held and BCH is now down 9% for the last 90 days. Yearly percentages show that BCH is still up 47% for the last 12 months but down 8% against BTC.

65% of BCH swaps today are paired with USDT and the stablecoin is followed by BTC, capturing 16% of BCH trades on Thursday. BCH like most of the top cryptocurrencies is now trading well below the daily 200 moving average and the recent falling wedge pattern never came to fruition.

A Possible Global Recession and Coronavirus Fear Touches Crypto Prices

Global stock markets, equity market indices, and futures worldwide have plummeted into bearish regions. On Wednesday, Nasdaq Composite lost 392 points, NYSE Composite lost 615 points, and the Dow Jones Industrial Average dropped by 1,465 points by the end of the trading day. The S&P 500 shaved 4.5% and after 9 p.m. EST, Asian stock and equity market indices dipped significantly. Asian markets continued to slide after U.S. President Trump placed a 30-day travel ban between the U.S. and Europe over coronavirus fears. On Wednesday evening, BTC was hovering around $7,995 per coin but after 8 p.m. EST, the price saw a continuous slide. Marcus Swanepoel, CEO of the crypto company Luno, detailed in a note on Thursday that the market downturn is no surprise.

“There is no surprise that as coronavirus has been classified as a global pandemic, and for the first time the US has acknowledged the seriousness of the situation, that all markets are coming under pressure,” Swanepoel explained. The coronavirus fears coupled with the crypto market downturn have led people to dismiss bitcoin’s safe haven narrative. “Bitcoin is down 8% in the last day, much more than global equities,” explained bitcoin critic and economist Nouriel Roubini. The Nobel prize-winner further stated:

Another proof that bitcoin is not a good hedge versus risky assets in risk-off episodes. It actually falls more than risky assets during risk-off.

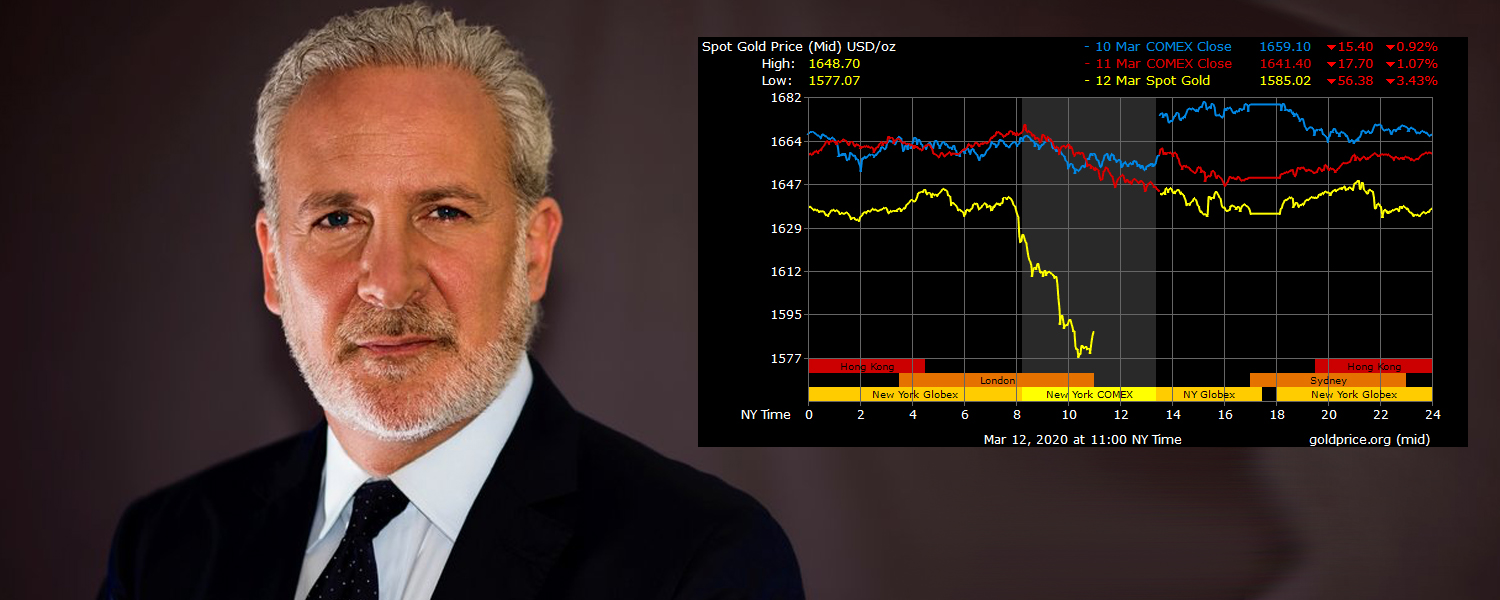

Gold Bug Peter Schiff Slams Bitcoin

Following our last market update, gold prices slumped for three consecutive days until after Trump’s travel ban. However, on March 12 gold started seeing some gains again as economic fears have deepened globally. Meanwhile, despite a number of BTC maxis claiming BTC is a store of value (SoV), it’s really performed like a risk asset during the last two weeks. On Thursday morning, spot gold and gold futures started to pick up. Economist and gold bug Peter Schiff used this opportunity to mock BTC supporters and those who believe in BTC’s SoV narrative.

“As bitcoin crashes below $6K, down almost 20% this year, hodlers can take comfort in bitcoin not being the worst performing asset of the decade,” Schiff tweeted during the crypto sell-off. “For now, that distinction belongs to oil, which is down by 50%. But at the rate bitcoin is falling this comfort may not last long.” The economist even bashed the news outlet CNBC for allegedly “pumping the price” of bitcoin. Schiff’s tweet storm continued:

CNBC pumped the price of bitcoin with non-stop daily coverage on the way up, allowing the whales to dump their holdings onto CNBC’s audience. Now as bitcoin crashes, CNBC has maintained radio silence on bitcoin all week. What gives? Did their lawyers finally impose a gag order?

New Bitcoin Prediction Model Predicts Price Bottoms

While lots of bitcoiners are talking about the stock-to-flow (S2F) theories and bitcoin’s parabolic curve predictions, author Data Dater has published a new model. Data Dater’s blog post called “Bitcoin’s Cost of Production — A Model for Bitcoin Valuation” examines existing models like S2F for their limitations.

While Data Dater is impressed by S2F he noted that “it’s not the best tool for a swing trader looking at time horizons of a quarter or less.” The researcher’s study highlights that the cost of production (CoP model) is more “reliable for obtaining an intrinsic floor price of Bitcoin.” Data Dater concluded:

This is the price that a bitcoin tends to move towards and serves as an over/ undervaluation metric. The model expects the price of a bitcoin to rise, given the rising trend of the effective cost of ASIC miners and network hashrate. It can be used to analyze the effect of other markets on that of Bitcoin.

Wading Through a Trough of Disillusionment

Overall, most crypto enthusiasts and traders are very uncertain of the short term future ahead. Coinbase CEO Brian Armstrong wrote that he was astonished to see bitcoin prices drop alongside global stock and commodity markets. “Surprised we’re seeing the bitcoin price fall in this environment, would have expected the opposite,” Armstrong tweeted. “I’m not surprised, bitcoin is in an endogenous process of monetization,” Pierre Rochard responded. “Trying to connect MSM ‘news’ with the bitcoin price is a fool’s errand.” Meanwhile, other hardcore bitcoiners wholeheartedly believe the downturn is a scare tactic crafted by bitcoin whales.

“Bitcoin is not naturally going down,” the popular crypto Twitter commentator XC tweeted. “It is being pushed down via whales placing spoofy sell orders on exchanges to make noobs and risk managers sell to ‘buy back lower.’ They are stealing your bags and will make you buy back at a higher price.”

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency prices referenced in this article were recorded on Monday, March 12, 2020, at 11:15 am EST.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, goldprice.org, Fair Use, Pixabay, and Wiki Commons.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Update: Global Economy Jolts Bitcoin, Overall Crypto Cap Loses $50B appeared first on Bitcoin News.