| Asset | Current Value | Weekly Change |

| S&P 500 | 2380 | -0.45% |

| DAX | 12638 | -1.22% |

| WTI Crude Oil | 50.48 | 4.77% |

| GOLD | 1255.00 | 2.11% |

| Bitcoin | 1985 | 13.43% |

| EUR/USD | 1.1205 | 2.74% |

1. All eyes on the VIX as volatility is creeping back

The low volatility period that lasted for several weeks, ended abruptly on Wednesday, as we anticipated as the internal weakness of the market caused vulnerability in the broad indices. The US volatility index jumped by a whopping 50% in one session, as stocks experienced their worst one-day selloff in almost 10 months. The VIX then dipped lower as stocks recovered, but some damage has been done, and another long lower wouldn’t be a surprise at this point. With volatility-short strategies dominating the market, a sell-off could quickly accelerate as the said strategies trigger a domino-effect.

2. $50 billion, $60 billion, $70 billion…. $100 billion??

It seems that more and more investors are piling into the cryptocurrency market, as the global low yield environment encourages buyers to look for alternative investments, and the accelerating adoption of the coins provides a solid background for the boom. As Bitcoin is losing market share, despite its climb to new highs, the segment looks more stable with total capitalization steadily climbing amid the “rotation” between the currencies. It seems plausible that the market will soon reach the $100 billion mark, as ICOs are abundant, and more and more minor coins pop up on the radar with stellar gains.

3. The Dollar on the ground, as the Trump-scandal lifts treasuries

The US Dollar fell sharply all week long, as US treasuries jumped higher in the risk-off environment, while US stocks declined from their all-time highs. The USD hit multi-month lows against the Swiss Franc, the Euro, and the British Pound, while the Yen also gained ground thanks to safe-haven buying. As the Fed’s rate hikes are far from being carved into stone, and the French election still has a positive effect, the European majors were the biggest winners of the Dollar weakness.

4. Will oil hold above $50 per barrel after the OPEC meeting?

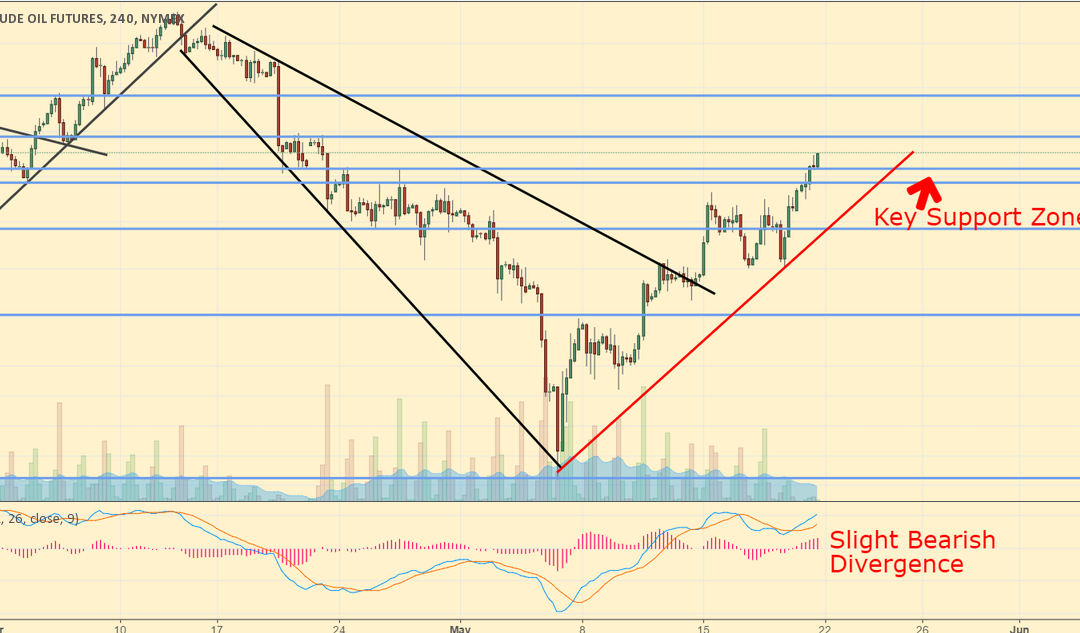

WTI Crude Oil, 4-Hour Chart Analysis

Oil showed strength throughout the week, as the bullish US inventory data, the OPEC deal-extension talks, and the Chinese correction all helped the commodity in regaining its steep losses once again. The stock market bounce gave another boost to oil on Friday and it finished the week near its highs, back above the key $50 per barrel level. The scheduled meeting of the oil cartel will take place on Wednesday, and the commodity might be vulnerable after the strong rally, in the case of a weak consensus among the OPEC-countries.

5. The Fed minutes in focus as US growth slows

The Federal Reserve dismissed the recent economic weakness in the US as transitional, but the numbers remained subdued since the previous meeting as well. Bond markets still suggest a rate hike in June, although the yields took a hit after Wednesday’s turmoil. The political fears could also make the central bank more cautious, so the minutes of the monetary meeting will be closely watched by traders. Friday’s key economic releases, Durable Goods, and the prelim GDP reading could also be important for stocks.

In Focus: Cryptocurrencies

Weekly performance comparison of the major cryptocurrencies, Hourly Chart

The cryptocurrency market continued to expand throughout the week, and the broad rally continued during the weekend, with some of the previous laggards joining the party, like Monero and Dash. Ripple also bounced higher after a correction phase, as Litecoin remained the weakest major coin concerning the week. Bitcoin left the direct vicinity of the $2000 today, while Ethereum also added to its recent lofty gains, as it is almost in par with Ripple regarding market cap once again. NEM is in a narrow consolidation range after its epic rally, while Stellar is drifting higher, probably preparing for its next major move.

| Currency | Weekly Volume | Monthly Volume | Market Cap |

| Bitcoin | 5,861 | 20,450 | 34,400 |

| Ripple | 1,829 | 4,302 | 13,577 |

| Ethereum | 1,715 | 5,840 | 13,000 |

| NEM | 218 | 470 | 2,160 |

| Litecoin | 637 | 3,733 | 1,360 |

| Dash | 109 | 544 | 731 |

| Ethereum Classic | 223 | 1,179 | 702 |

| Stellar Lumens | 300 | 1437 | 533 |

| Monero | 80 | 361 | 524 |

Key Economic Releases of the Week

| Day | Country | Release | Expected | Previous |

| Monday | EUROZONE | Eurogroup Meeting | – | – |

| Tuesday | EUROZONE | Manufacturing PMI | – | 56.7 |

| Tuesday | EUROZONE | Services PMI | – | 56.4 |

| Tuesday | CANADA | Wholesale Sales | – | -0.20% |

| Tuesday | US | New Home Sales | – | 621,000 |

| Wednesday | EUROZONE | ECB President Draghi Speaks | – | – |

| Wednesday | CANADA | BOC Rate Decision | 0.50% | 0.50% |

| Wednesday | CANADA | BOC Statement | – | – |

| Wednesday | US | Existing Home Sales | 1.26 mill | 1.22 mill |

| Wednesday | US | Crude Oil Inventories | – | 1.22 mill |

| Wednesday | US | FOMC Meeting Minutes | – | – |

| Thursday | UK | Revised GDP | – | 0.30% |

| Thursday | US | Initial Jobless Claims | – | 236,002 |

| Friday | JAPAN | National Core CPI | 0.40% | 0.20% |

| Friday | US | Core Durable Orders | – | 0.00% |

| Friday | US | Prelim GDP | – | 0.70% |

| Friday | US | UOM Consumer Sentiment | – | 97.7 |