One of the central pillars of Bitcoin and cryptocurrency in general is that the system is decentralized, ensuring no single point of failure for adversaries to attack. However, new research has found the majority of assets in the ecosystem today to be highly centralized.

Also Read: Crypto Hedge Fund Launches Retail Public Offering in Japan

Taxonomy Report Reveals a Concentration of Crypto Power

Cryptocompare, the cryptocurrency market data aggregator, has published a Cryptoasset Taxonomy Report. The nearly 80-page document is designed to provide investors, regulators and the industry with an independent classification of coins and tokens to help differentiate from a long list of ever-growing options.

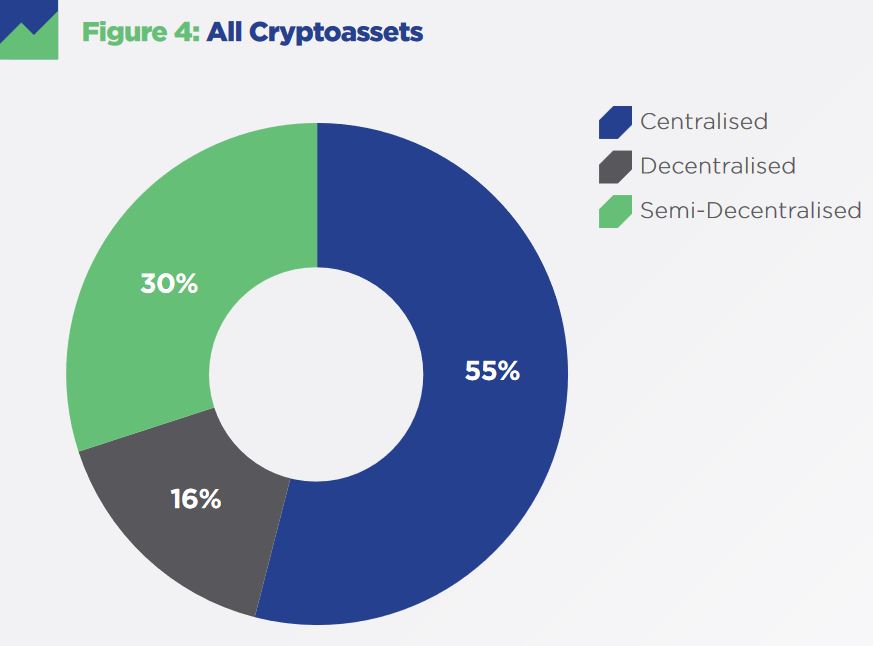

The report is based on an analysis of over 200 crypto assets, using more than 30 attributes and covering a range of economic, legal and technological features. Researchers analyzed these assets from a variety of perspectives including regulatory classifications, access and governance, market cap and volume data, level of decentralization, and distribution and supply concentration.

Charles Hayter, CEO of Cryptocompare, said: “Daily, retail and institutional investment communities express an appetite to invest and develop investment products and instruments based on crypto assets. Key to this is the demand for a single, independent and trustworthy taxonomy offering transparency, consistency and confidence.”

Just 16% of Cryptocurrencies Are Really Decentralized

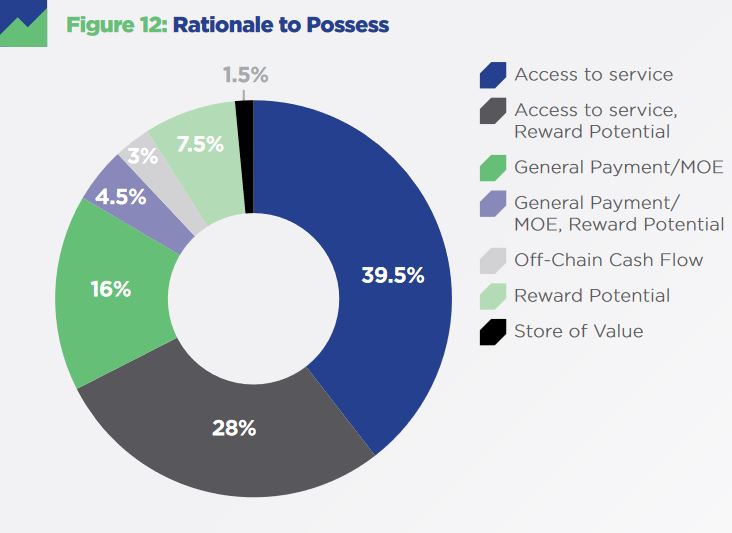

In the section on centralization and counter-party, the report identifies how regulators might approach their decision as to whether an asset is centralized and thus possibly deemed a security. A fundamental point the researchers found is that decentralized and open source projects may not rely on a central issuer. Using this distinction, the taxonomy has explored the extent to which crypto assets are de facto decentralized.

The results of this analysis are quite disappointing for cryptocurrency proponents. Just 16% of crypto assets were found to be truly decentralized, with 55% categorized as centralized and the rest as semi-decentralized. Even just looking at payment tokens, defined as assets intended to provide a means of payment or value exchange which do not confer any claims upon the issuer, just 37% were found to be decentralized.

Do you think decentralization matters with cryptocurrencies, and if so, to what extent? Share your thoughts in the comments section below.

Images courtesy of Shutterstock and Cryptocompare.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post Majority of Crypto Assets Are Highly Centralized, Research Finds appeared first on Bitcoin News.