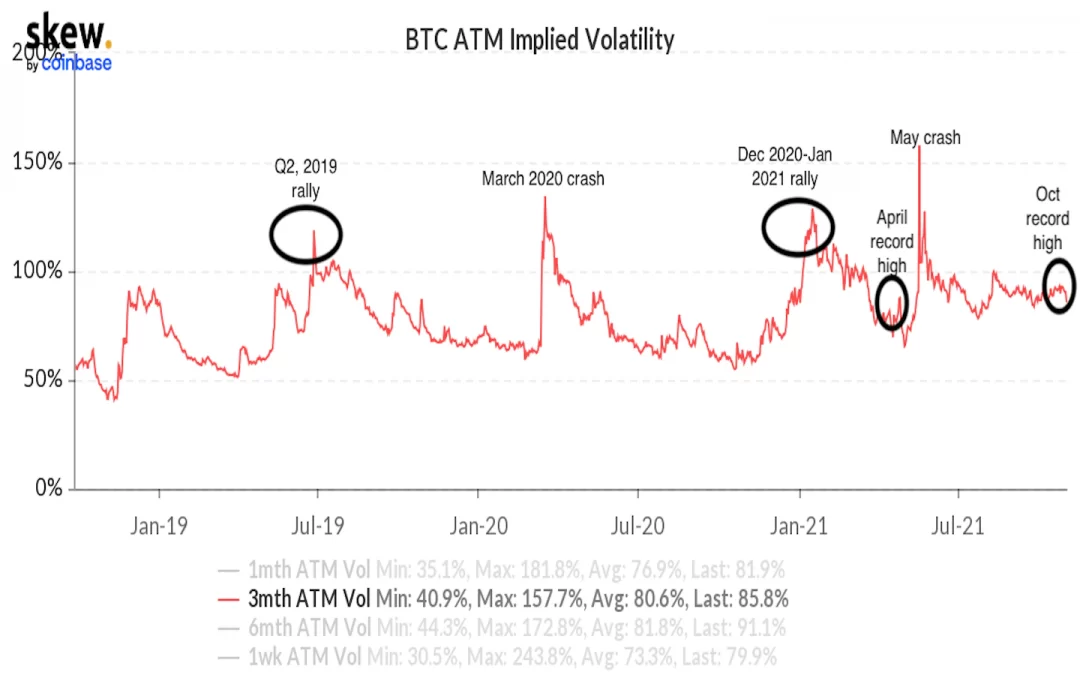

Bitcoin’s two bull runs in 2021 have differed from those in past years and one key distinction has been decreased volatility expectation.

This metric, which shows the cryptocurrency’s expected price swings, did not spike when bitcoin’s price hit record highs in April and then in October, indicating that bitcoin may be evolving into a more mature investment asset.

Prior to 2021, bitcoin’s three-month implied volatility (IV) – investors’ expectation of how turbulent prices will be over the ensuing three months – spiked during both bull and bear runs, according to data from crypto data firm Skew. But this year, a similar spike only occurred when the market crashed in May.

“IV tends to go up when people are unsure of what’s going to happen in the future,” Patrick Chu, director of institutional sales and trading at institution-focused, over-the-counter desk Paradigm, said. An increase in IV reflects a market attitude “like ‘wow! how high will it go!!’”

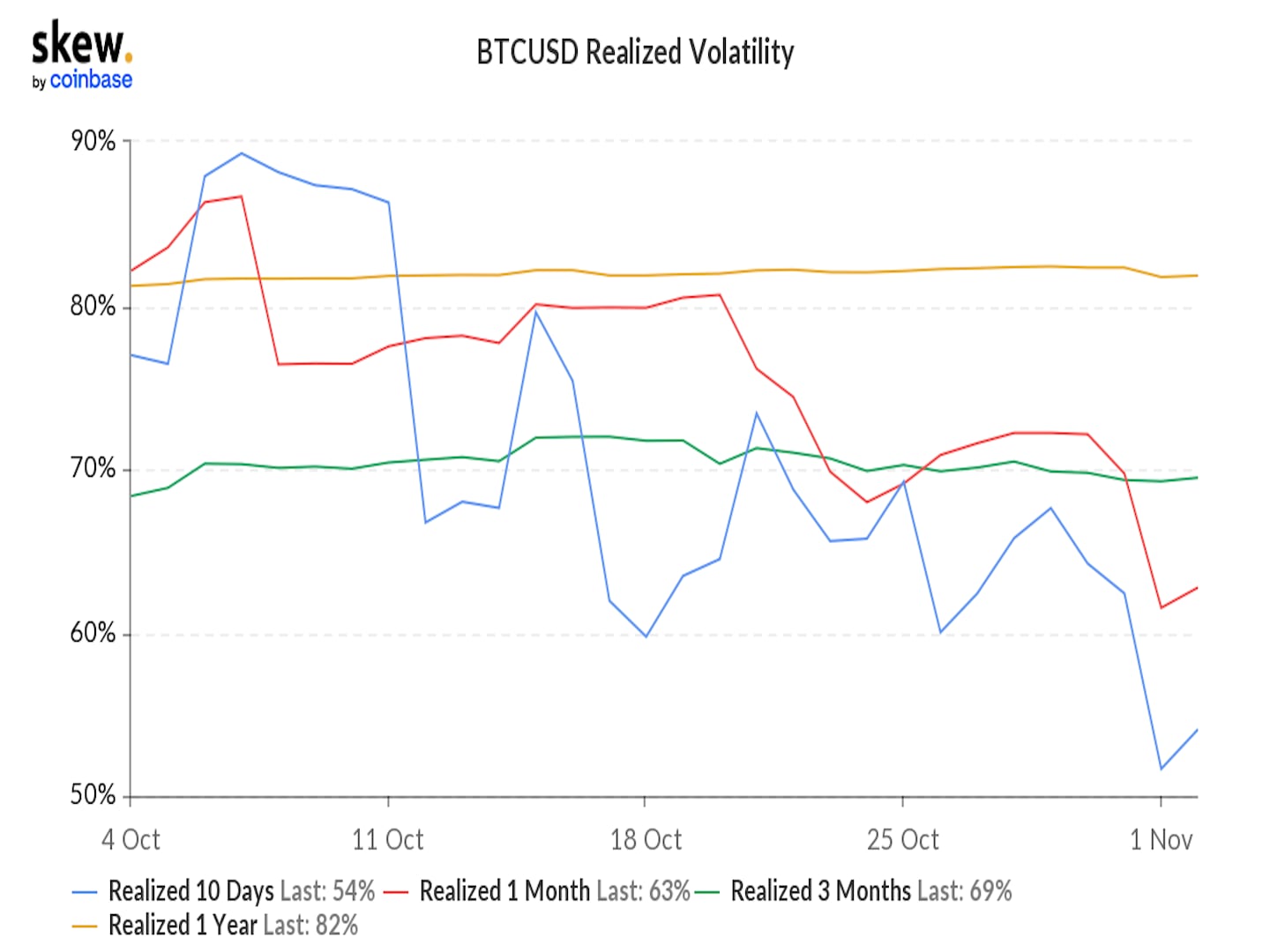

The change coincides with a low realized volatility of bitcoin – bitcoin volatility that has already occurred, Chu also noted.

“The market feels very complacent,” Chu said. “The recent realized volatility has been grinding lower as bitcoin becomes more mature, so most [our] clients are also not in a rush to buy options (buy implied volatility) to express their trade views at the current time.”

As CoinDesk reported, buying implied volatility is one of the lesser-known uses for options trading, which is a bet on whether price swings will increase or decrease. Traders buy options (call/put) when volatility is relatively cheap and sell when it’s high.

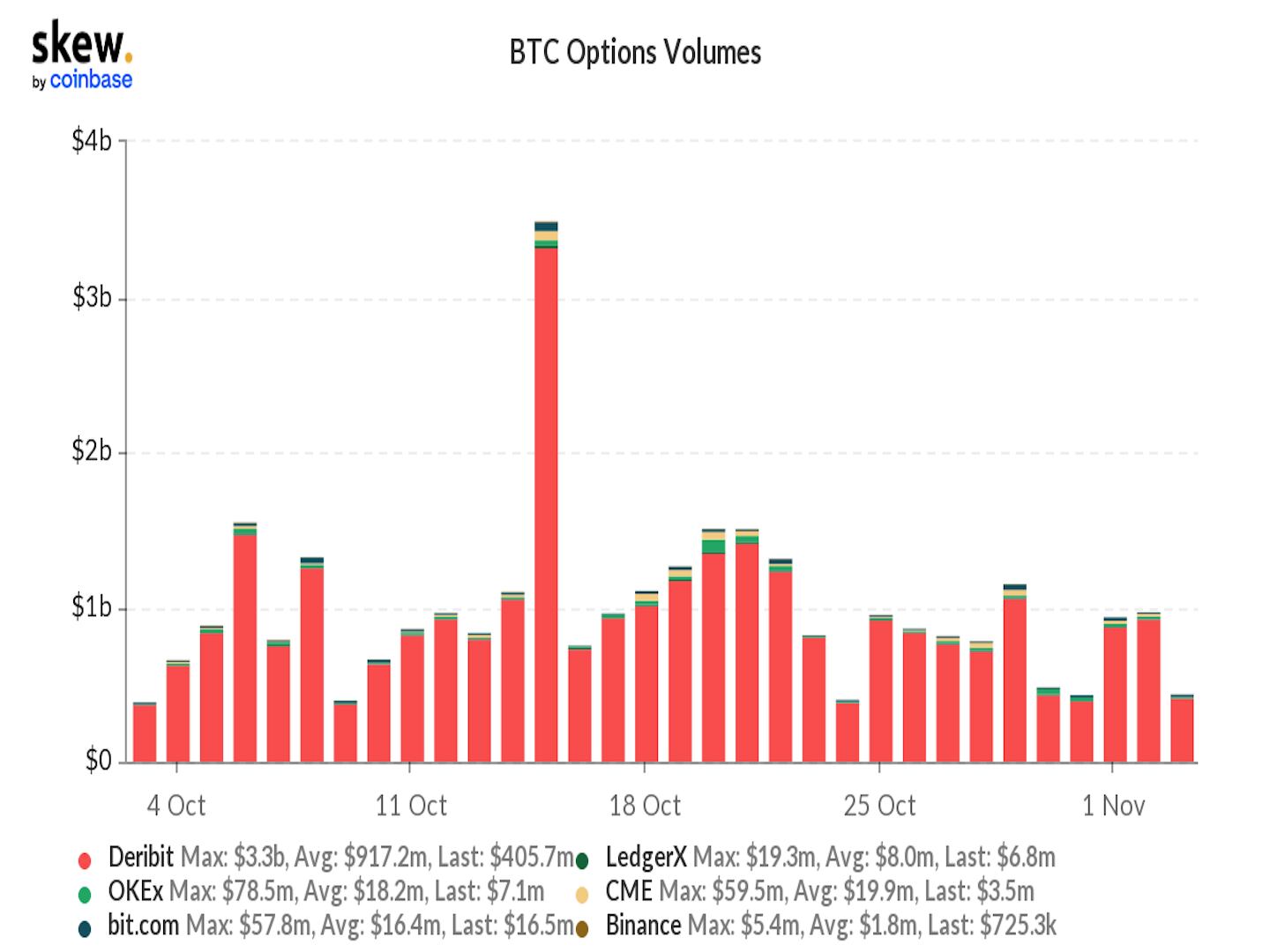

Data from Skew shows that except for a trading volume spike on Oct. 15 due to excitement over the debut of the first U.S. bitcoin futures-based exchange-traded fund (ETF), bitcoin options volume remained relatively low in October – even when bitcoin hit an all-time high on Oct. 20.

“When the market is stuck in a familiar range, traders tend to lose interest,” Chu added.

But some analysts argue that bitcoin is at an earlier stage and remains more volatile than traditional stock and capital markets.

IV “may have stabilized but is still very high compared to the S&P[500], for instance,” Noelle Acheson, head of market insights at Genesis Global Trading, said. (Genesis is owned by Digital Currency Group, which also owns CoinDesk).

Trader and analyst Alex Kruger told CoinDesk that bitcoin is still “far from” a traditional asset, adding that decreased IV could be due to more volatility sellers on the market.

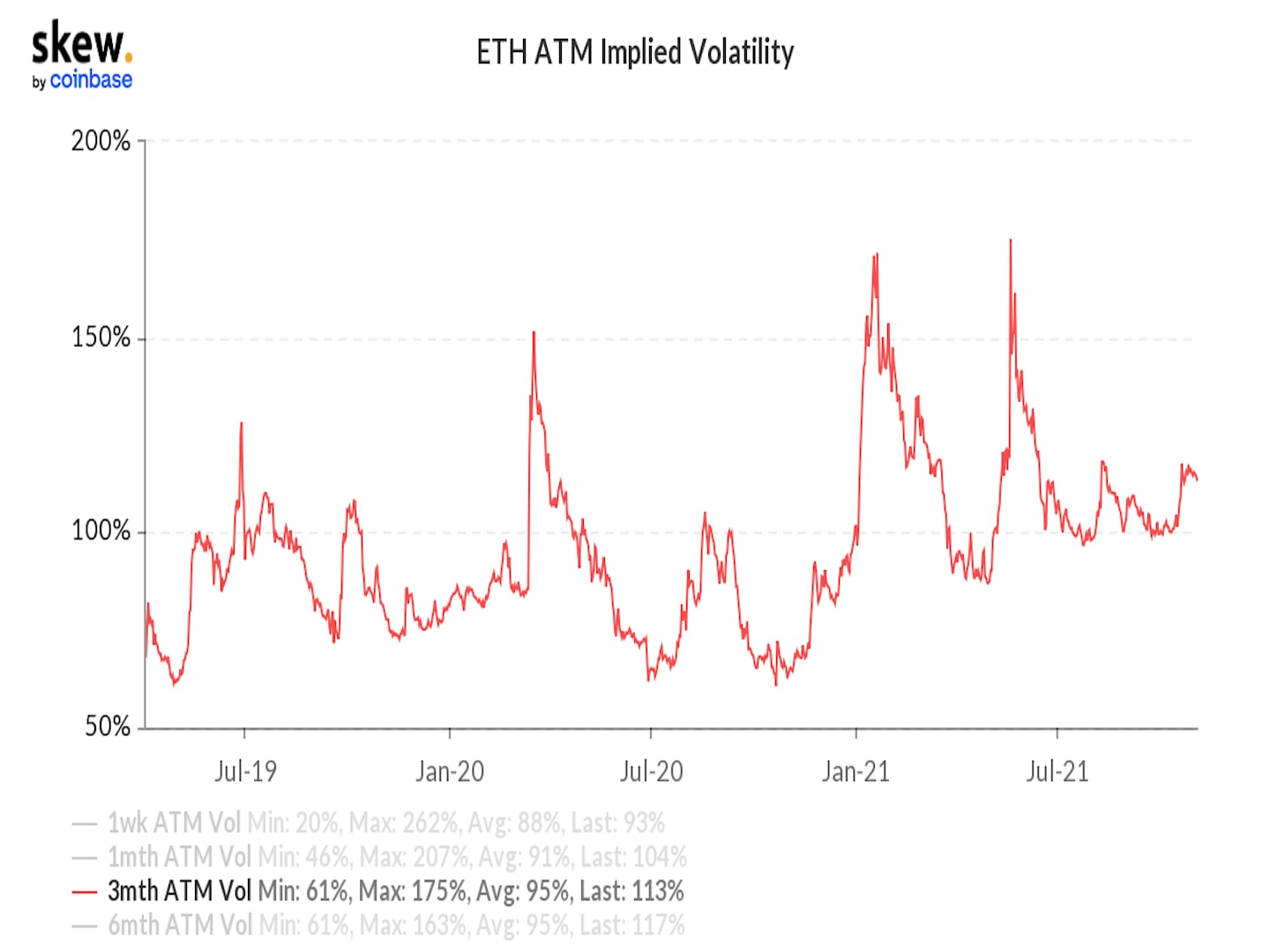

Meanwhile, speculative trading interest appears to have shifted to ether, the second largest cryptocurrency by market capitalization.

Ether’s three-month implied volatility and its options trading volume have both elevated in recent days, according to Skew, as the cryptocurrency broke to a record high on Tuesday.

As CoinDesk reported, options traders have turned to long-term bullish bets on ether as some anticipate that an ether-based ETF product will likely follow the launch of the first bitcoin futures-based ETF in the U.S.