This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

While weeks and months in crypto often feel like years, it has only been 60 days since the hard fork that contained EIP 1559 was implemented on Ethereum’s mainnet. A world of data regarding EIP 1559 has surfaced, but ultimately the upgrade is still in its infancy.

In fact, a few weeks ago, I wrote about Nic Carter’s somewhat overly eager Ethereum takeaways and how it was probably too early to estimate EIP 1559′s impact on the network. However, this week I am changing my tone a bit and looking at the potential implications of the upgrade’s base fee burn and its effect on the longevity of Ethereum.

At a very high level, under proof-of-work (PoW) and proof-of-stake (PoS), Ethereum uses block rewards to incentivize miners and validators of the chain. This incentive helps properly secure the network by paying those that are beneficial for confirming transactions and logging the state of the chain, which in turn encourages competition to grow a large and distributed base of miners/validators.

Reward issuance: Bitcoin vs Ethereum

Bitcoin uses a similar model, but every four years the amount paid in block rewards decreases until the reward is extremely negligible and the bitcoin supply tops at 21 million. As block rewards become negligible, bitcoin miners will be forced to rely on transaction fees in order to remain profitable. Reasonably, the network will have to maintain a level of activity high enough to pay miners for their services.

Ethereum and EIP 1559, on the other hand, now take a reverse approach to Bitcoin’s security budget. EIP 1559 took away the vast majority of transaction fee revenue that miners previously received, but Ethereum will continue to emit block rewards to miners (and eventually validators), indefinitely. While Ethereum takes an uncapped supply approach, the newly introduced fee burn will help counteract ether’s inflation.

Bitcoin’s role as a hedge against inflation has certainly been a huge part of the asset’s success. However, its “digital gold” narrative leads to lower network activity as the asset is considered a store of value rather than a medium of exchange, at least for the time being. This issue has left some wondering if transaction fees will be enough to keep miners interested, if miners will adapt or if the network will have to pivot to an updated compensation model.

It’s likely wrong to say that EIP 1559 “solved” this issue of paying miners into perpetuity, because again bitcoin’s fixed supply is what makes investing in the asset so attractive. Ether’s supply, on the other hand, will be extremely dependent on network activity and the demand for blockspace. The Bitcoin network is years away from the concern becoming a reality and will likely surprise me with its ability to adapt and survive.

My comparison between the two networks is strictly how they approach miner incentives, something I believe EIP 1559 possibly addressed with its fee burn mechanism. A future in which Ethereum can continue to subsidize validators without diluting those that hold ether is very promising for the network.

Pulse check

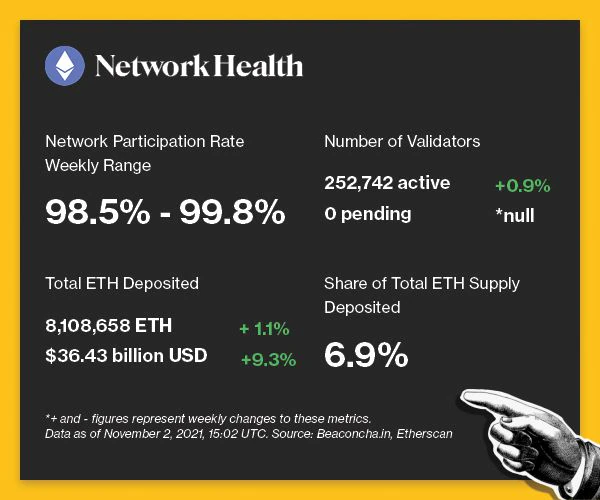

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

- The Altair upgrade shifted validator rewards toward newly created “sync committees” of 512 randomly selected validators. BACKGROUND: Sync committees are responsible for providing support for light clients and signing the newest block header. The odds of a validator getting chosen to the committee are currently 1/489 and attestation rewards/penalties are amplified for the 24-hour period that they are part of the sync committee.

- A CryptoPunk NFT appeared to sell for $530 million after an on-chain transaction caused price bot alerts last Thursday. BACKGROUND: While CryptoPunks have sold for as much as 4,200 ETH in the past, the fake sale would have been the largest by orders of magnitude. It appears the owner used a flash loan to make the fake purchase of the Punk, borrowing and repaying 124k ETH. The move was likely a marketing stunt.

- Cream Finance was exploited by a flash loan for over $260 million in depositor assets. BACKGROUND: Cream is a prominent peer-to-peer decentralized finance (DeFi) lending platform with a history of exploits. The flash loan manipulated the price of Cream’s faulty collateral “yUSD,” making the price artificially high and allowing the exploiter significant borrowing power. The exploiters showed significant DeFi knowledge, maximizing the return of their loot and hiding their tracks with the Ren Bitcoin bridge.

- Aave was rumored to be susceptible to an exploit similar to the one that targeted Cream, prompting Justin Sun to remove over $4 million in collateral. BACKGROUND: A vulnerability with xSushi collateral scared Aave depositors and led to a ~20% decrease in total value locked (TVL). The governance process held the team back from making an immediate fix and the bug is still exploitable as of today. The Aave team’s analysis showed that the manipulation would not be profitable for a hacker.

Factoid of the week

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.