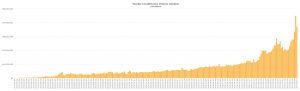

Peer-to-peer (P2P) bitcoin trading on Localbitcoins established a new global weekly all-time high for the week of the 19th of September, largely driven by an exodus of capital from China’s cryptocurrency markets. The spike in global P2P trading volume has seen record-breaking Localbitcoins trading volume across numerous international markets, including China, India, Malaysia, New Zealand, Pakistan, Switzerland, Thailand, the United Arab Emirates, and Venezuela in recent weeks.

Also Read: Localbitcoins Compensates Users by Selling Bitcoin Cash for BTC

China’s Crackdown on Cryptocurrency Exchanges Has Forced Many Traders to Use P2P and OTC Markets

The Chinese Localbitcoins markets set a new all-time high for trade volume this past week, with over 115 million CNY worth of bitcoin being exchanged. Many believe that the record volume is a direct result of China’s cryptocurrency crackdown, which has driven traders to use platforms that are outside of the Chinese central government’s control.

Switzerland also witnessed record highs in P2P bitcoin trading volume this week, establishing a new high of approximately 140,000 francs. The high comprises the second consecutive week that the Swiss Localbitcoins markets set a new all-time for trading volume, following a 37 percent increase in trading volume during the week of the 19th of September.

Many International P2P Bitcoin Markets Witnessed a Significant Spike in Volume During the Week of the 19th of September

Malaysia’s Localbitcoins markets established a new all-time high for trading volume last fortnight. Approximately 5.27 million ringgit worth of bitcoin was traded on Localbitcoins during the week of September 19th – a more than 25 percent increase over the preceding week’s record volume of 3.6 million ringgit. Thailand also broke its previous P2P weekly volume record by 25 percent during the same week, establishing a new all-time high of approximately 29.5 million baht.

The United Arab Emirates witnessed a dramatic spike in Localbitcoins trade volume, breaking its preceding weekly all-time high of approximately 1 million dirhams by nearly 36 percent to set a record of 1.59 million dirhams. New Zealand-based weekly P2P bitcoin trading also shot up by over 50% during the week of the 19th of September, setting a new high of 1.3 million NZD.

India and Pakistan set weekly P2P volume highs during September, with India setting a new all-time high of almost 70 million Indian rupees in trade last week. The record comprises the second consecutive weekly all-time high to be set by the Indian Localbitcoins markets. Pakistan set a new record of 47.5 million Pakistani rupees in trade during the week of the 9th of September and has witnessed strong volume throughout the month since.

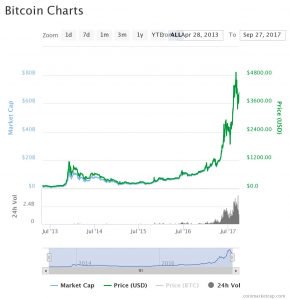

P2P Bitcoin Trading and the Total Bitcoin Market Capitalization Show Signs of Divergence

The total bitcoin market capitalization and global P2P bitcoin trading volume are showing signs of divergence during September, following numerous months of relative correlation. This divergence likely signifies that much of the spike in volume across international P2P bitcoin markets can be attributed to traders based outside of China withdrawing capital from China’s cryptocurrency exchanges.

Venezuela’s Localbitcoins trading volume has also set numerous all-time highs for trade volume in recent months, signifying an intensification of the country’s hyperinflation crisis which has seen the Bolivar lose more than 77% of its value in the last decade. In an interview with CNBC, Daniel Osorio of Andean Capital Advisors recently described Venezuela’s monetary crisis as “potentially [driving] the first bitcoinization of a sovereign state… out of necessity.”

Do you think that China’s crackdown is largely responsible for the international spike in localbitcoins trading volume? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Coindance, Localbitcoins

Get our news feed on your site. Check our widget services