Virtual Currencies: The Oversight Role of the U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission began in earnest at the United States Senate Dirksen office building Tuesday, 6 February. The Committee on Banking, Housing, and Urban Affairs summoned respective Chairs of the US Securities and Exchange Commission (SEC) and US Commodity Futures Trading Commission (CFTC) to testify in open session on cryptocurrencies, less than 24 hours after one of the worst crashes in ecosystem history.

Also read: Market Risk Advisory Committee: Bitcoin Futures Self-Certification Works

Senate Asks if SEC and CFTC Are Able to Handle Challenge of Bitcoin

Gaveling in the hearing at about 5 minutes after 10am EST, committee Chair Senator Mike Crapo noted the giant gains in bitcoin’s valuation in just one year. He also detailed the negative news of late, from hacks to prosecutions, but then urged a positive outlook on the technology with an eye toward protecting investors. Ranking member Senator Sherrod Brown called bitcoin’s growth “nothing short of remarkable,” and also urged regulators to protect investors from the “intersection of ingenuity and greed.” Mr. Brown also reminded regulators to keep their “day job” of going after big banks, an interesting juxtaposition considering bitcoin enthusiasts’ claim to be banking’s undoing.

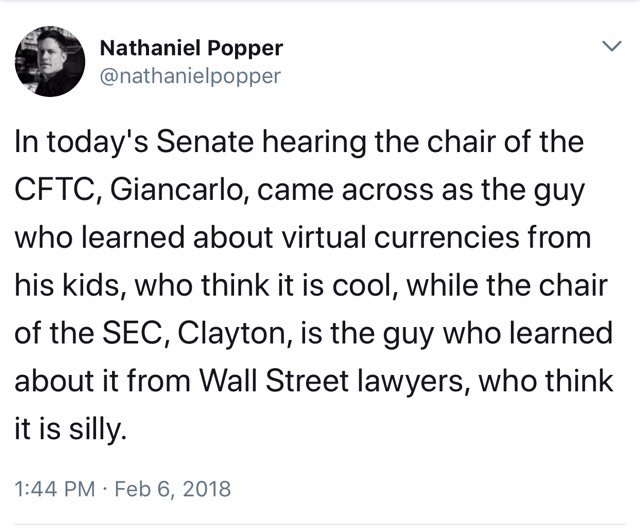

SEC Chair Jay Clayton was first to comment, and agreed blockchain technology was indeed good, but his concern was over cryptocurrency as a currency, and the proliferation of unregistered and unregulated initial coin offerings (ICOs). He reflected on cryptos like bitcoin not being the medium of exchange “panacea” they promised in terms of goods and services. But his main focus, as it would be throughout the hearing, was how ICOs are increasingly looking like securities, and have many problems: such markets have less oversight than traditional exchanges, no broker standards, no capital or conduct requirements, and are thus illegal, Mr. Clayton detailed.

He continues to believe existing law covers ICOs. A problem as well is how neither the SEC nor CFTC have jurisdiction over cryptocurrencies, he said, and yet they’re not prepared to ask for expanded jurisdiction, Mr. Clayton stressed. For now it is enough that their respective agencies are working with the likes of the Department of Justice to address concerns.

CFTC Chair J. Christopher Giancarlo spoke as a parent, one who struggled to get his children interested in finance through stocks and bonds. They were never interested, he confessed. The entrance of bitcoin into their lives has changed all that, and he feels regulators owe it to the new generation not to dismiss cryptocurrencies like bitcoin. Fraud should be cracked down on, but regulators need to catch up by educating themselves and the public, he said. The news has given to a lot of noise around crypto and bitcoin, he said, but it’s still a very small market. He also stressed how the CFTC is doing a ton of educating through podcasts, webinars, and a dedicated website – so much, in fact, that he claims his agency has never done this much with any financial product in its entire history. He too brought up the fact of there being no single dedicated regulatory body toward crypto.

The subject of jurisdiction was then discussed at some length in light of the present federal hiring freeze. Both Chairs agreed something needs to be explored in this area but neither were content to offer concrete suggestions at the moment. Both too mentioned working together due to the nature of bitcoin’s spot market being completely unregulated, and how regulation in the US has been left to a “patchwork” among the states. There is a gap, Mr. Giancarlo explained, noting technology has made all markets global, requiring “new thinking.”

Does Anyone at Either Agency Understand Crypto?

Senators Brown and Shelby followed up on the question of dedicating more resources exclusively to regulating crypto. Of the billions of dollars, for example, raised by ICOs in 2017, a significant amount was probably garnered in the United States, but Mr. Clayton couldn’t say for sure due to the unregulated nature of the industry. He was also careful to underline there is no consumer protection bureau for those who lose money or are defrauded. The SEC head emphasized, again, he believed existing securities law covered ICOs, but purposefully left the door open for more legislation in the future.

The issue of where bitcoin derives its intrinsic value, while lacking a sovereign in the sense senators have understood currency arose, and Mr. Giancarlo answered. He believes bitcoin’s value might be in the relationship between mining and bitcoin, and the costs associated. However, he’s seen charts where prices seemed to obey those trends and others where they have not. Mr. Clayton described, “smart people think there is something to crypto” but that he remains skeptical as its benefits haven’t translated to the marketplace. He said value comes with what people are willing to pay, and in the SEC world there are rules, guidelines; in crypto, he said, there are no rules.

Senator Reed asked a revealing question in that he wanted to know if either agency actually has “cryptologists” working for them. Mr. Clayton mentioned a cryptocurrency working group within the SEC, and listed economists and technologists, but then added they could “always use more horsepower.” Mr. Giancarlo said they have Lab CFTC in New York City where much of the innovation in crypto happens, he believes. They’ve hired a “chief innovation officer,” he said, with a “deep background” in crypto. Neither head directly answered the question.

Senator Reed asked a revealing question in that he wanted to know if either agency actually has “cryptologists” working for them. Mr. Clayton mentioned a cryptocurrency working group within the SEC, and listed economists and technologists, but then added they could “always use more horsepower.” Mr. Giancarlo said they have Lab CFTC in New York City where much of the innovation in crypto happens, he believes. They’ve hired a “chief innovation officer,” he said, with a “deep background” in crypto. Neither head directly answered the question.

Senator Reed then asked about the explosion of altcoins, and asked if the agencies were looking beyond just bitcoin, and if they felt altcoin growth posed systemic risk to the economy. Mr. Giancarlo dismissed his concerns by suggesting only a handful are significant in terms of traction, and pretty much all the others are “fraudulent.” He cited his agency’s civil prosecution of My Big Coin, concluding cryptos are too small to pose a systemic risk. Mr. Clayton simply punted on the question, and basically said it wasn’t his agency’s job to track them. He did concede to watching a few, but ultimately having “15 [cryptocurrencies] fluctuating doesn’t make a lot of sense” to him.

Are Regulators Useless in Crypto?

The discussion then turned to classification of cryptocurrency, and Mr. Clayton returned to his theme of defining what a security is: offering him something, and he gives you money in expectation of profit, say in the value of a coin, and he can trade it with someone else to profit in a just a few days, “that is a security,” he stressed. Picking up on that, Senator Rounds asked if bitcoin is a commodity or a security, or both. Mr. Giancarlo said bitcoin is a store of value and a medium of exchange. He then said his 30-year-old niece is a Hodler, someone who doesn’t know how it will all shake out but she’s not going to sell. He then gave a few anecdotes about its medium of exchange properties being limited in recent months, highlighting the Miami North American Bitcoin Conference where organizers dropped it as a method of payment due to excessive fees.

A rather fun exchange seemed to leave the room in dead silence. Senator Kennedy asked if Mr. Giancarlo read the prospectus demanded by law, demanded by regulators, when he last invested. Mr. Giancarlo admitted he had not. Senator Kennedy then wondered aloud what all the fuss was about and why anyone needed regulators to govern bitcoin. He suggested such regulations were only good for lawyers and financial advisors, and that consumer protection was just a pretext for over-regulation, over-disclosure. He compared their efforts to that of China and South Korea. Mr. Giancarlo had no answer really, and Mr. Clayton worried the real issue was investors believing crypto exchanges were already being monitored and regulated by the SEC. He agreed with Senator Kennedy they “should not go too far.”

Senator Warner seemed most literate on the subject, describing bitcoin as “transformational” while rightly insisting blockchain technology could not be separated from the digital asset. He also suggested if rates of increase for the crypto markets continued at the present pace, by 2020 it would be a 20 trillion dollar market. He also added regulating coins such as ethereum might be impossible because they cannot be categorized in any traditional sense due to its versatility.

The rest of the hearing ended on typical concerns about foreign powers co-opting the tech in order to get around sanctions and to fund terror. Russia and Venezuela were both discussed. Mr. Giancarlo, of the two regulators, clearly came out shining in most bitcoiners’ eyes. He seemed to relish the decentralized technology, admiring the hypothetical of perhaps catching banking problems early enough in 2008 if the the blockchain was in full swing back then. He also downplayed volatility, though his main two exchanges, CME and Cboe, have seen bitcoin futures plummet from a high of 19,000 USD to a low of below 6,000 USD. For Mr. Giancarlo and the commodities industry, he said, they are used to volatility. Mr. Clayton again reiterated his frequent statements about not being comfortable with bitcoin ETFs, and when asked how many ICOs of those raising the 4+ billion USD were registered with the SEC, he answered, “not one.”

The hearing adjourned promptly at 12pm EST, and, as of this writing, crypto markets were up across the board on news from the Senate hearing.

What are your thoughts on the Senate hearing? Let us know in the comments section below.

Images courtesy of Pixabay, US Senate, Twitter.

Need to calculate your bitcoin holdings? Check our tools section

The post Landmark Senate Crypto Hearing Seen as Mostly Positive by Bitcoiners appeared first on Bitcoin News.