This week the developers of the komodo (KMD) blockchain platform performed a successful atomic swap between KMD and bitcoin cash (BCH) using the team’s Barterdex exchange.

Also read: Only Big Broker Offering CME Bitcoin Futures Allows Whales to Short

Komodo Developers Perform Bitcoin Cash Atomic Swap On the Barterdex Platform

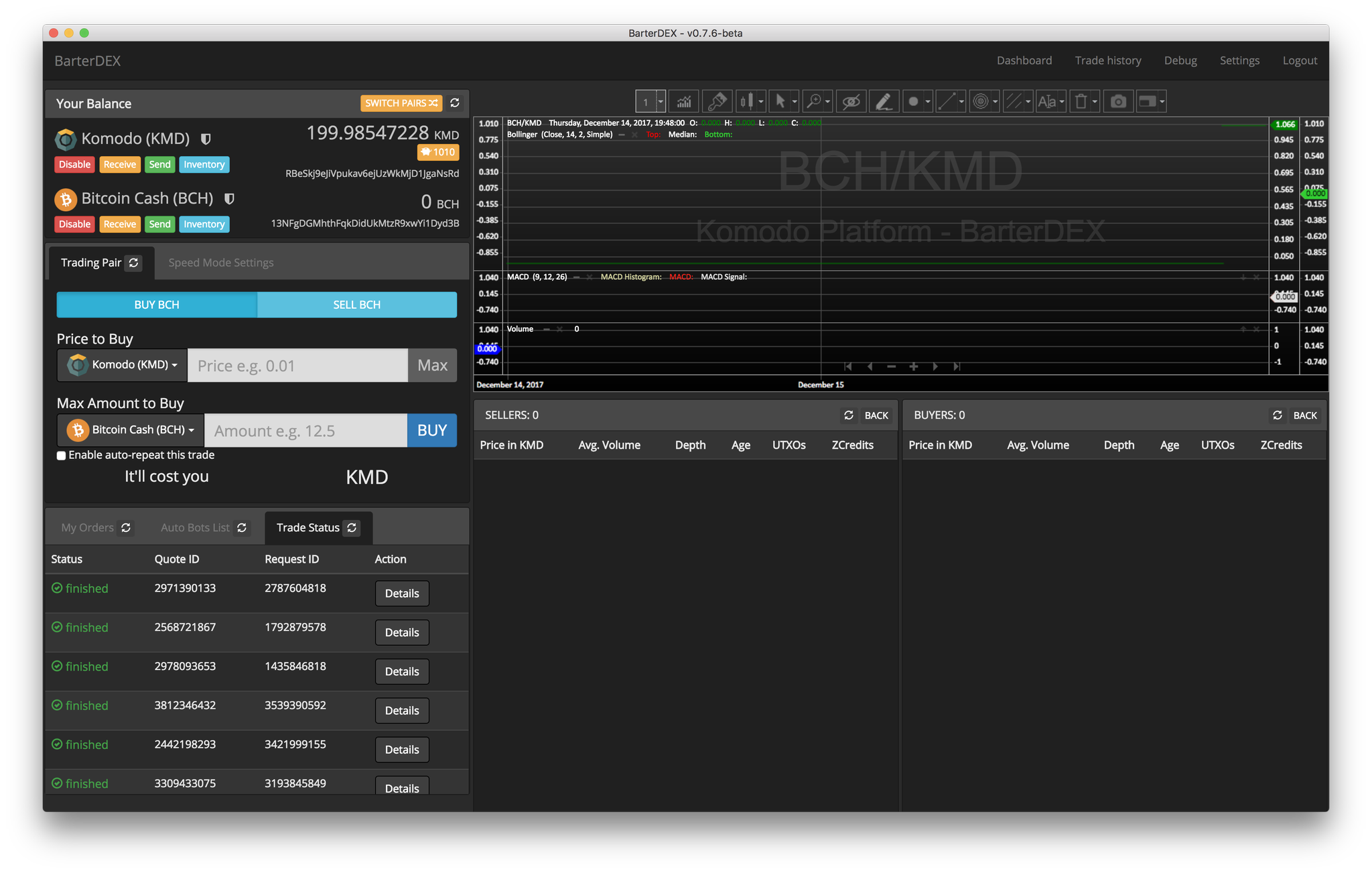

On December 14, the developers of the open source komodo cryptocurrency performed an atomic swap between KMD and BCH. Komodo is a digital asset that aims for privacy-centric ideals and hopes to provide more fungible blockchain transactions. The cryptocurrency uses a consensus mechanism called Delayed Proof-of-Work (dPoW) which is similar to bitcoin’s PoW, but also uses a block notarization method. In addition to the komodo token, the team has also built a decentralized exchange called Barterdex, a trading platform that provides cross-chain atomic swaps between other cryptocurrencies. Atomic swaps allow two parties to transact between two blockchains in a trustless manner without counterparty risk.

On December 14, the developers of the open source komodo cryptocurrency performed an atomic swap between KMD and BCH. Komodo is a digital asset that aims for privacy-centric ideals and hopes to provide more fungible blockchain transactions. The cryptocurrency uses a consensus mechanism called Delayed Proof-of-Work (dPoW) which is similar to bitcoin’s PoW, but also uses a block notarization method. In addition to the komodo token, the team has also built a decentralized exchange called Barterdex, a trading platform that provides cross-chain atomic swaps between other cryptocurrencies. Atomic swaps allow two parties to transact between two blockchains in a trustless manner without counterparty risk.

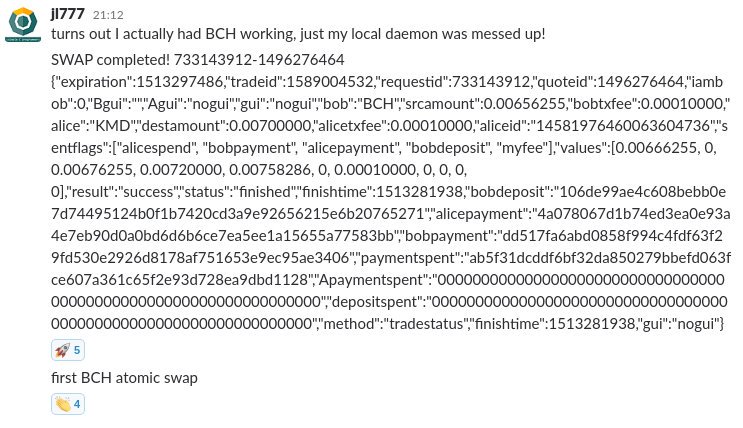

The developer who performed the first ‘BCH <-> KMD’ atomic swap revealed his findings on the Reddit forum.

“I was the one who did the actual swap,” the developer reveals. “This is an Atomic Swap between Komodo and Bitcoin Cash, where the KMD buyer bought BCH — The atomic swap protocol, as used in Barterdex, follows the Tier Nolan protocol (Alice is buyer, Bob is seller).”

Atomic Swaps Will Tear Down Cryptocurrency Trading Roadblocks

The Komodo team says the Barterdex BCH swap code is “quite complicated,” but also uses a 2-of-2 multi-signature mechanism which can be used if the trade needs to be canceled. The Barterdex platform also trades over 60 other digital assets that trade blockchain-to-blockchain. In addition to the atomic swaps with a GUI, Barterdex also provides decentralized order-matching. An order matching system matches buy and sell orders so each party can execute a desired trade. The Komodo team explains that there have been notable efforts to try and push the idea of decentralized exchanges like the Bisq network. However, the Bisq exchange and others still rely on an escrow system whereas Barterdex uses the atomic swap protocol.

According to the Komodo developers, bitcoin core (BTC) atomic swaps have been a nuisance during times when the mempool is congested. When the BTC blockchain is backed up with unconfirmed transactions, the Barterdex exchange has to put bitcoin core atomic swaps on hold until the mempool clears. “BTC won’t be disabled in Barterdex, except during periods of high mempool congestion when BTC atomic swaps are very likely to fail,” explains the komodo’s Twitter handle. For this reason, the developers explained to news.Bitcoin.com that they had decided to integrate bitcoin cash into the trading engine. The Komodo team explained to news.Bitcoin.com that they’re pleased with the BCH integration and believe atomic swaps will transform the future of cryptocurrency trading

“Atomic swaps tear down many major roadblocks, foremost among them being a current lack of security in cryptocurrency trading,” explains the Komodo development team.

What do you think about the Komodo developers performing an atomic swap between KMD and BCH? Let us know in the comments below.

Disclaimer: Bitcoin.com does not endorse the product/service Barterdex.

Readers should do their own due diligence before taking any actions related to the mentioned company, exchange, or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images via Shutterstock, Komodo, and the Barterdex GUI.

Keep track of the bitcoin exchange rate in real-time.

The post Komodo Developers Demonstrate Bitcoin Cash Atomic Swap appeared first on Bitcoin News.