Dr Pavel Kravchenko holds a PhD in technical sciences and is the founder of Distributed Lab.

In this opinion piece, Kravchenko explains the ins and outs of cryptographic tokens, what kinds there are and how each kind is different.

What we understand by the term “token” is actually best defined as the balance of some kind of account.

But, perhaps most importantly, it’s a balance that can really mean anything its founder wants it to mean. To date, tokens have been made to represent a user’s reputation within a system (augur), a deposit in US dollars (tether), the quantity of files that are saved in it (filecoin) and the balance in some internal currency system (bitcoin).

Because of this, I sometimes argue that tokens don’t even exist – mostly, because I want to draw attention to the fact that they always have a very specific meaning.

If we want an analogy, tokens can turn everything that we’re used to seeing in paper form – including shares, and money and promissory notes – digital. But the terms we will use for these things will remain unchanged (shares will still be shares). The fact that crypto assets are stored in a decentralized accounting system, or require digital signatures, doesn’t change their meaning or value.

As such, the problem that is emerging isn’t with the actual terms themselves, but that people have begun to assign attributes to tokens that they can’t possibly have.

There are people who claim that cryptocurrency tokens are something entirely new – and that projects that issue tokens can become amazingly transformed.

Sadly, that’s not the reality.

Tokens and tokens

In computer terminology, the term “token” has long meant one of two things: a gadget that can authorize a user (such as a dongle or a special thumb drive), or a fixed array of symbols that identify a user (such as an API key).

In both situations, tokens can pass between different owners. So, how are cryptocurrencies different from the tokens we know?

Generally, the term “crypto asset” means one of three different things:

- A cryptocurrency with decentralized issuance and transactions.

- A digital asset, issued into a decentralized system, and secured by either someone or something. This version can be split into two further subdivisions: either the accounting system isn’t trusted; or the issuer isn’t trusted.

- Something that’s both issued and validated by the same organization, yet not backed-up by anything.

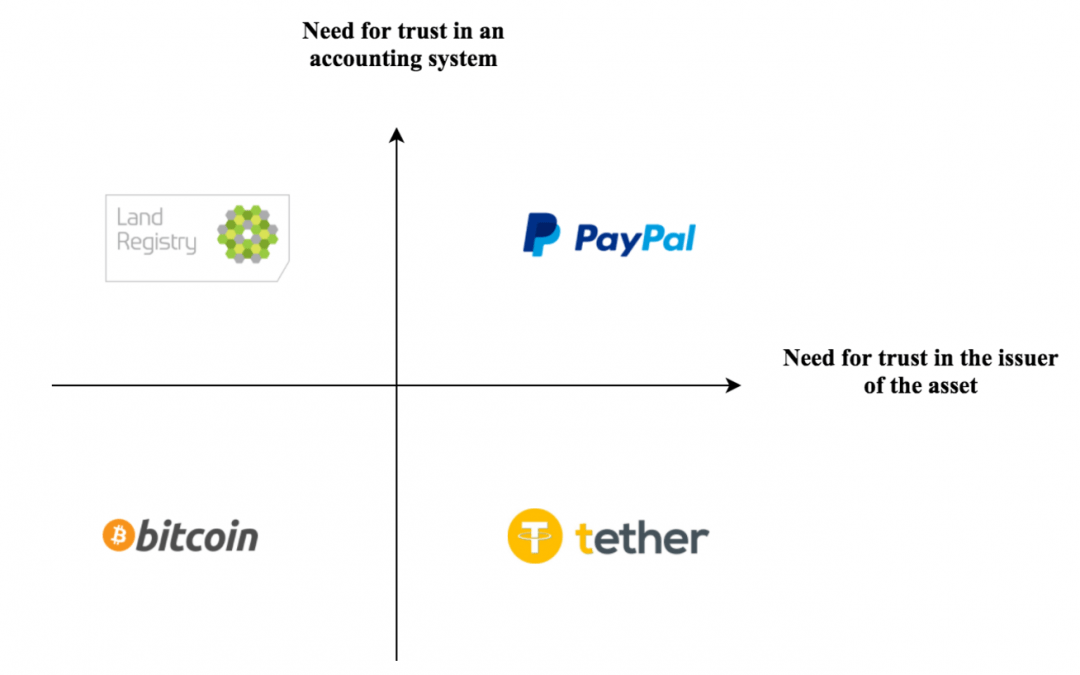

We can sum up all of the above possibilities in one simple diagram:

PayPal manages digital balances and transaction processing independently and non-transparently. This implies that its users must have implicit trust in PayPal, in order to be able to use its systems.

Bitcoin handles processing and transaction processing entirely transparently, and in a completely decentralized way – because people would not trust an anonymous system under any other circumstances whatsoever.

Tether handles processing entirely transparently (even better than the bitcoin network), but users must trust that it is faithfully issued (each token is 100% backed up by cash money on a bank account).

Any centralized land registry demands that its users trust it in aspects of correctness of accounting – yet there are no issues on the question of issue (since new land can’t be produced from thin air, and all land already exists).

Types of tokens

So what kinds of token are there? And how do they differ?

A token can fulfil either one, or several of the following functions:

- A currency, used as a payment system between participants.

- A digital asset (a digital right – to land ownership, or tomatoes in a warehouse, and similar assets).

- A means for accounting (number of API-calls, volume of torrent uploads).

- A share (stake) in a specific start-up.

- A way of rewarding main players (the best example is bitcoin).

- A way of preventing attacks (such as commission within the bitcoin network).

- Payment for using a system.

Yet because there are so many options it may be hard to classify any particular token; they are often a cross between shares, an internal currency and accounting units.

Tokens that are directly linked to shares in a company, for instance, don’t need further consideration; they are completely identical to shares. More complex are so-called “utility tokens.”

Let’s remember, this kind of token is used as way of making internal payments – yet their price can rise due to limitations in their issue, and due to rising demand. It’s precisely due to this dual functionality that it’s hard to define exactly what they are. Sometimes they behave on markets as though they are shares, yet regulators treat them as accounting units.

Alongside this, people can sometimes use these to make payments to each other.

The best definition for “utility tokens” is the one put forward by Vladimir Dubinin (my business partner). He compared the pre-sale of tokens with the sale of government bonds in US dollars. These bonds are denominated in the national currency, and profits from them will be paid out in that currency too.

These bonds, it seems, will be sold at a heavy discount, but if they go well, the currency rate might rise quickly.

In this light, we shouldn’t forget that no nation whatsoever is keen to see its currency becoming too pricey because this leads to a sluggish economy and has a negative effect on the balance of payments.

Questions for investors

I’d say the main questions for investors are these:

- What does this token represent?

- Is it a share, an internal currency or an accounting unit?

- What would cause the value of this token to rise?

- Is it limited issue, or do you need to hold tokens to complete each transactions when using a product?

- What’s the potential for growth? Does this product have potential to be needed by everyone on earth?

- Will the product remain in demand, say, if the token costs $1,000? In other words, couldn’t the product’s popularity become its own Achilles’ heel? For example, if a transaction costs 1 token, at a price of $1,000, then would that be a reasonable and affordable price for users?

- Could that same product continue to exist without the tokens for it? Bitcoin, for example, couldn’t function without the bitcoin token, yet Ripple could easily do so.

In short, it’s worth doing an analysis of this kind when looking at tokens as part of a long-term investment portfolio, rather than when buying with a view to speculating.

My own personal feeling is that the market for crypto-assets remains rather overheated. It could be better to hold off the moment for getting into this market.

Antique coins image via Shutterstock

The leader in blockchain news, CoinDesk strives to offer an open platform for dialogue and discussion on all things blockchain by encouraging contributed articles. As such, the opinions expressed in this article are the author’s own and do not necessarily reflect the view of CoinDesk.

For more details on how you can submit an opinion or analysis article, view our Editorial Collaboration Guide or email [email protected].