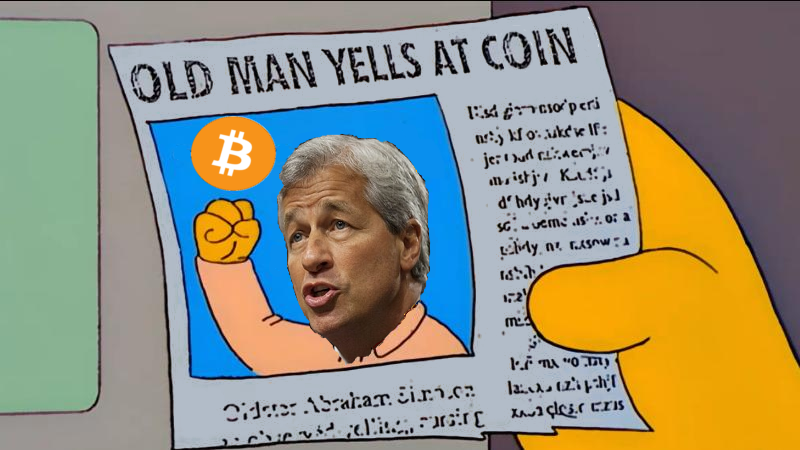

Perhaps cryptocurrency’s largest institutional nemesis is JP Morgan Chase. Led by the ever-belligerent Jamie Dimon, it and he have taken numerous opportunities to sandbag bitcoin and its spawn. Theories about why have long circled, but now there appears to be proof the legacy bank is threatened by decentralized currency in digital form, according to an internal annual report.

Also read: How To Regain Control From Nanny Zuck

JP Morgan Chase One Chastised Bitcoiners

In partial fulfilment of its fiduciary duty, JP Morgan Chase filed an Annual Report for 2017, Form 10-K: Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. It’s an exhaustive document mostly of interest to shareholders. This year, however, it contained unusual insight into the institutional mindset of the United States’ largest bank.

Under the rubric Competition, deep in the report, the bank worries aloud: “The financial services industry is highly competitive, and JPMorgan Chase’s results of operations will suffer if it is not a strong and effective competitor. JPMorgan Chase operates in a highly competitive environment, and expects that competition in the U.S. and global financial services industry will continue to be intense.”

Where competition seemed least likely, according to CEO Jamie Dimon, was in the area of cryptos such as bitcoin. Famously, Mr. Dimon chastised those who held or traded bitcoin as “stupid.” Indeed, the very concept, he maintained, was a “fraud.” He’d further attack his own employees who might dare dabble as risking their very job as a result. Though he’d later come off some of those remarks a tad, walking them back and almost apologizing, the truth of the matter might be more in line with taking a page from the Niccolò Machiavelli playbook: ridicule your opponent in an effort to minimize his popularity, knowing full well that foe could one day eat your lunch.

The Annual Report appears to shed light on the issue. It does list the usual suspects of other banks and institutions as competitors, warning ominously how “JPMorgan Chase cannot provide assurance that the significant competition in the financial services industry will not materially and adversely affect its future results of operations.” This seems, at least in part, due to the fact “New competitors have emerged.”

Disrupted by Technologies

After quick lines about the growth of e-commerce, the Report finally comes out with it. “These advances have also allowed financial institutions and other companies to provide electronic and internet-based financial solutions, including electronic securities trading, payment processing and online automated algorithmic-based investment advice. Furthermore, both financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation. New technologies have required and could require JPMorgan Chase to spend more to modify or adapt its products to attract and retain clients and customers or to match products and services offered by its competitors, including technology companies.”

And “intermediation” is Wall Street talk for banks. Cryptocurrencies can have the eventual impact of putting “downward pressure on prices and fees for JPMorgan Chase’s products and services or may cause JPMorgan Chase to lose market share,” the bank revealed.

What all this practically means for the short and long-term regarding the bank and crypto is anyone’s guess, but the following seems to give a rather large hint: “Increased competition also may require JPMorgan Chase to make additional capital investments in its businesses, or to extend more of its capital on behalf of its clients in order to remain competitive.” In other words, before it can beat crypto, it just might have to join crypto.

What do you think about JP Morgan’s latest admittals? Let us know in the comments section below.

Images courtesy of Pixabay. Jamie Redman contributed sourcing for this article.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post JP Morgan Chase Fears Crypto Is Disruptive Competition appeared first on Bitcoin News.