Analysts Yoshiyuki Suimon and Kazuki Miyamoto claim bitcoin will assist Japan in a Gross Domestic Product (GDP) boost of 0.3% heading into the first three months of 2018. At the end of 2017, the cryptocurrency boasted a ¥12 trillion market capitalization, and if trends continue into early this year, that could translate into lifting Japanese personal consumption by anywhere from ¥0.2 to ¥0.4 billion, they explain, referring to the phenomenon as the bitcoin effect.

Also read: Bitcoin’s Value — Like Beauty — Is in the Eye of Beholder

Japan’s Bitcoin Effect as 0.3% of GDP

Yoshiyuki Suimon and Kazuki Miyamoto of Nomura offer a slightly different take on the Japanese relationship to bitcoin. Nomura is one of the world’s largest independent investment banks, and was known to have sponsored mathematical techniques for use in finance research.

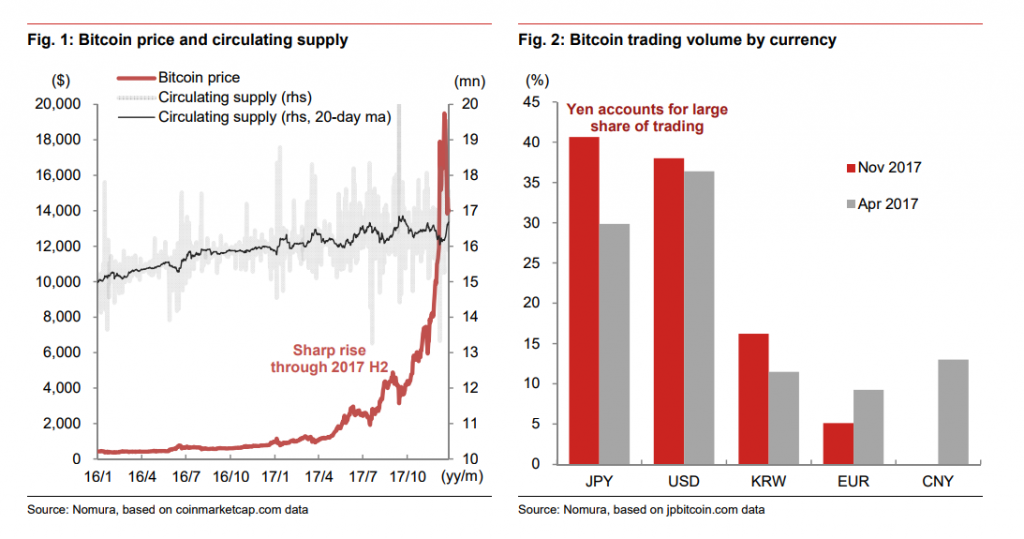

The usual reporting goes similar to a recent study put out by Deutsche Bank AG. In it, the bank notes they believe Japan’s “retail investors are shifting from leveraged foreign-exchange trading to leveraged cryptocurrency trading,” analyst Masao Muraki was quoted by Bloomberg. And indeed, the same study offered a Nikkei telling of the Japanese taking up half the world’s foreign-exchange trades, and so it seemed only natural a global currency like bitcoin would get at least 40 percent Japanese participation, and climbing, by the final quarter of this year.

The more profound, real-world case is hidden within those numbers. It appears Japanese consumers and retail businesses will also benefit from the country’s crypto craze. Mr. Suimon and Mr. Miyamoto posit something akin to a wealth effect happening. A famous historical example occurred in the late 60s United States after a double-digit tax increase. Most economists expected consumer spending to slow, a belt-tightening in response. However, due to the stock market’s precipitous rise, the average American ‘felt’ wealthier, and spent accordingly.

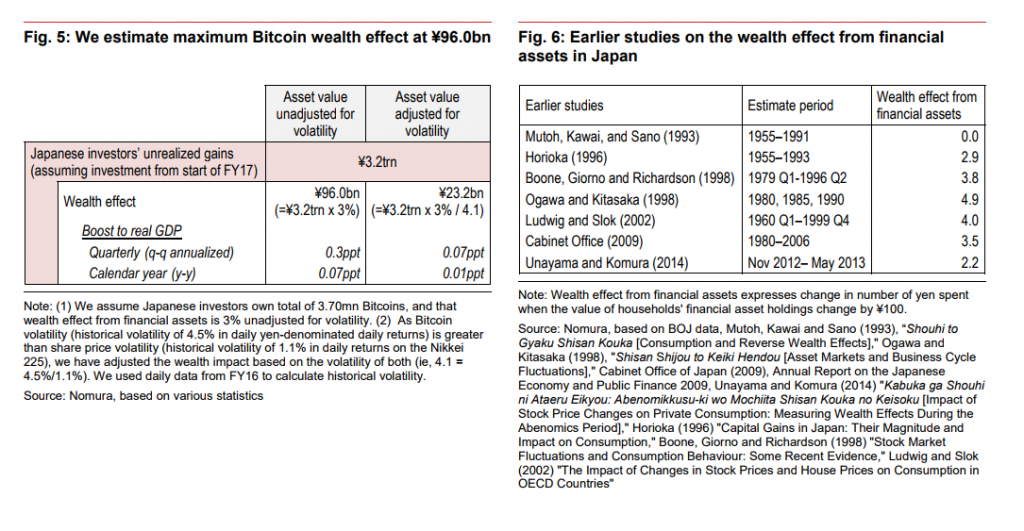

The last three months of 2017 just might carry the country’s GDP 0.3% higher (GDP is a measure of all final goods and services produced) into early 2018, according to the Nomura analysts. They’ve pegged a formula as follows: every jump in asset value wealth of ¥10 billion yields consumption to rise in proportion by ¥0.2 to ¥0.4 billion.

¥96 Billion in Personal Consumption

Spring of 2017 saw the country’s relative embrace of bitcoin, as the Payment Services Act formally allowed crypto trading. Yen has followed. With the Chinese government making its Yuan impotent in crypto circles, the land of the rising sun has filled that vacuum. And by the end of last year, the world’s most popular cryptocurrency reached ¥12 trillion in market cap, well-triggering the bitcoin effect.

The two analysts believe the island nation to be sitting on ¥5.1 trillion in the digital asset. And though that wealth doesn’t “feed straight through” to the street, the wealth effect of its kind could “drive ¥96 billion in personal consumption,” according to Value Walk.

The two analysts believe the island nation to be sitting on ¥5.1 trillion in the digital asset. And though that wealth doesn’t “feed straight through” to the street, the wealth effect of its kind could “drive ¥96 billion in personal consumption,” according to Value Walk.

“Cryptocurrencies are going to offer different benefits for different people,” Value Walk quotes Arizona State University professor Geoffrey Smith. “Some like the institutional backing and may gravitate to a utility coin offered by the major banks while others might value the ability to transfer money from one geographic region to the next efficiently,”

To what extent major Bitcoin holders who have increased their assets through the end of the year will bolster consumer spending through the beginning of year remains to be seen, but we should keep in mind the possibility that spending will exceed expectations as a result of this factor.

There does indeed seem to be something different about the wealth accumulated through crypto. That it might lead an important world economy to grow 0.3% is a sign whatever is happening is more than mere speculation.

Do you think the bitcoin effect is real? Tell us in the comment section below!

Images via Pixabay, Nomura.

Express yourself freely at Bitcoin.com’s user forums. We don’t censor on political grounds. Check forum.Bitcoin.com.

The post Japan’s GDP Grows Due to Bitcoin Wealth Effect appeared first on Bitcoin News.