Over the past month, following The PBOC’s crackdown on Chinese Bitcoin exchanges, Japan has successfully evolved into the largest Bitcoin exchange market by trading volume, overtaking the US by a significant margin.

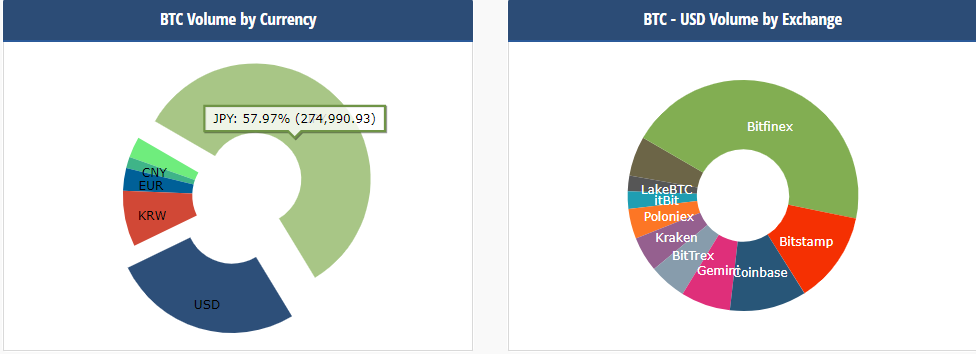

According to various market data providers including CryptoCompare, Japan accounts for 57,.89 percent of global Bitcoin trades, recording a daily trading volume that is more than twice as large as that of the US Bitcoin market.

As shown in the infographic above provided by CryptoCompare, Japan is responsible for the overwhelming majority of international Bitcoin trades. But, it is also important to acknowledge that Bitfinex, the Hong Kong-based cryptocurrency exchange, accounts for nearly 45 percent of USD-to-BTC trades.

Over the past few years, exchanges have halted their services in the US, due to the existence of regional regulatory frameworks. In the US, startups are required to comply with regulatory frameworks imposed by the federal government as well as regional regulators.

The most notorious example is New York’s BitLicense, an operational license granted to Bitcoin and cryptocurrency startups by the New York State Department of Financial Services (NYDFS) which requires companies in the US to be approved separately by the New York state government in order to provide services to customers within the state.

In 2015, George Frost, executive VP and chief legal officer at Bitstamp, revealed the high costs and lengthy process involved with applying for a BitLicense:

“Applying for the BitLicense is an expensive and difficult process, as many have noted. Some other firms have chosen to abandon the New York market entirely, rather than comply. We do not fault them for doing so. Our UK parent company has contributed a lot of time, expertise and money in the BitLicense effort, but much of this investment will benefit the entire Bitstamp group,”

For well-funded, more established companies, fees are easier to cover, but for smaller startups this is unaffordable. If more regional regulatory frameworks emerge in the near future, even the more established companies will likely find it difficult to justify the costs, as was shown by Bitfinex who in August announced that they would no longer be serving customers in the US.

“We regret to announce that, effective immediately, we will no longer be accepting verification requests for U.S. individuals. A surprisingly small percentage of our revenues come from verified U.S. individual accounts while a dramatically outsized portion of our resources goes into servicing the needs of U.S. individuals, including support, legal and regulatory.”

The Bitfinex team also added that it anticipates more regulatory changes in the future in regards to the US Bitcoin market.

“We anticipate the regulatory landscape to become even more challenging in the future,” noted the Bitfinex team.

As such, an increasing number of traders and investors have migrated to Asia, specifically to Japan and South Korea, which have imposed efficient and realistic regulatory frameworks which cryptocurrency businesses of all sizes can comply with. Last month, the Japanese Financial Services Agency (FSA) released a national licensing program for cryptocurrency trading platforms, providing a more robust and secure ecosystem for investors.

Yuzo Kano, the CEO at Bitfyer, the country’s largest cryptocurrency exchange with over 800,000 active users, stated that conservative Japanese investors are turning toward Bitcoin and the cryptocurrency markets.

“Japanese people tend to be very conservative with their investments, but once they get triggered they go all in,” said Kano in regards to the surge in demand for Bitcoin in the Japanese market.

In the long-term, the migration of trading volumes from unstable markets like China to Japan is a positive indicator of market growth.