Bitcoin mania has taken over the business world. Companies from India to Long Island are rushing to add bit, coin, crypto or blockchain to their names. As that is the case it would not be a big surprise if some have also stretched the definition of what they do too far just to have some connection to cryptocurrency. Now Israeli financial authorities have to decide how much hype is too much.

Also Read: Israeli PM Netanyahu Says Bitcoin Is Rising as Banks Are Destined to Disappear

Last week we reported about a new trend among firms whose shares are listed on the Tel Aviv Stock Exchange (TASE) – declaring they have some connection to bitcoin. Among those was a solar energy technology company, Apollo Power (TASE: APLP), which announced it carried out a “successful test” of mining cryptocurrency with the system it’s developing.

Last week we reported about a new trend among firms whose shares are listed on the Tel Aviv Stock Exchange (TASE) – declaring they have some connection to bitcoin. Among those was a solar energy technology company, Apollo Power (TASE: APLP), which announced it carried out a “successful test” of mining cryptocurrency with the system it’s developing.

This company was able to push its stock value up 150% in early trading by basically just mining half an hour for an insignificant amount of ether (about 4 cents worth), details it did not initially disclose. The share price has since come crashing down to reality, but management might have bigger concerns right now. The Israel Securities Authority (ISA) is reportedly investigating the firm for making false claims to investors. Beyond the specific matter at hand, this move is very likely also another attempt by the ISA to make it clear it will not welcome bitcoin to the TASE in any way.

Israeli Brokers Want Bitcoin Options

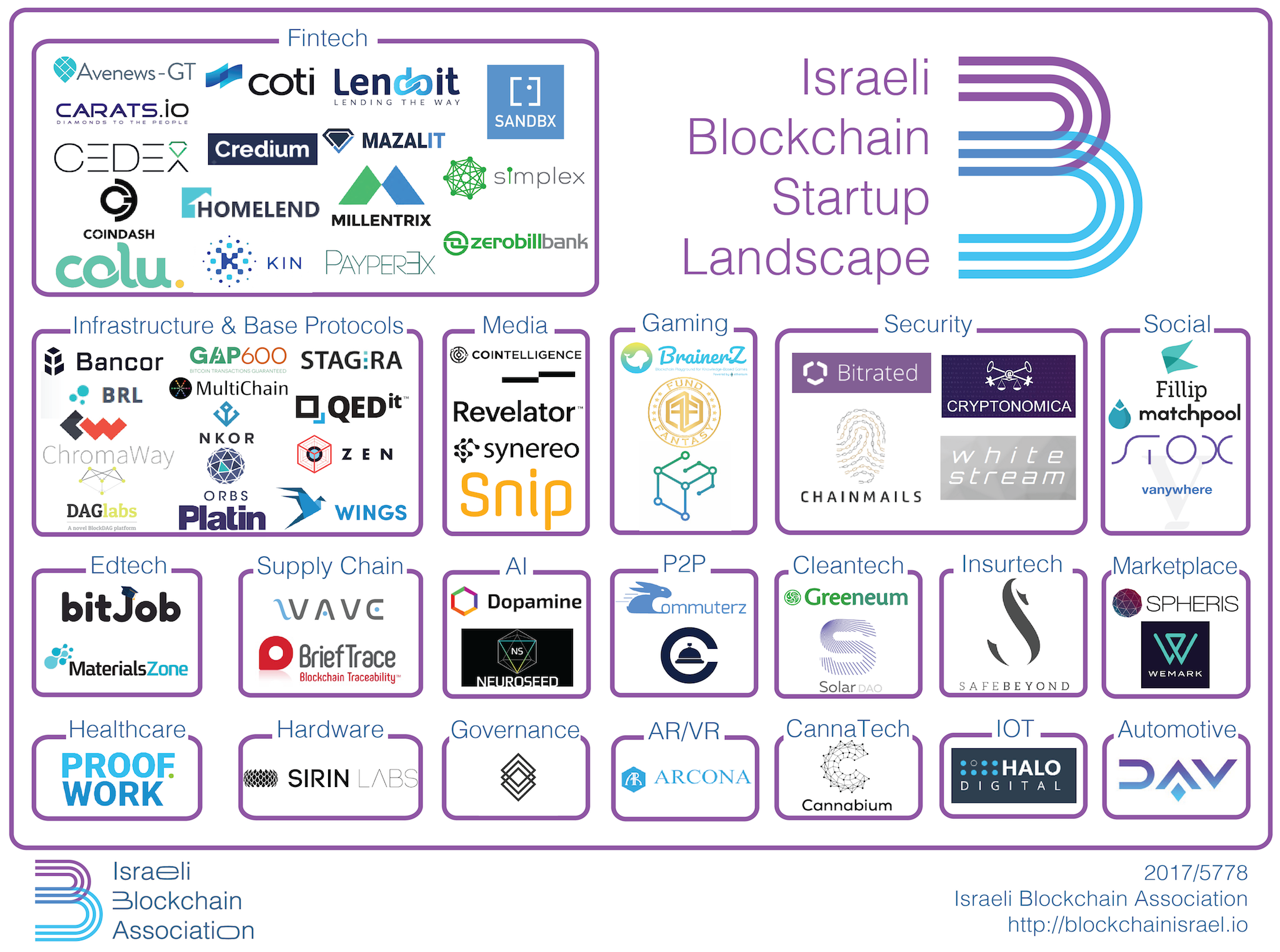

Despite repeated ISA warnings, Israeli investors are apparently still clamoring for some exposure to bitcoin or its derivatives. An “ultra-secure” new crypto phone promoted by soccer star Leo Messi has raised over $157 million from VC and ICO investors. The local ecosystem for ‘blockchain startups’ is thriving with many new entrants, and even the government is thinking about possibly joining the action with a new crypto shekel.

And all this excitement did not pass by stock brokers unnoticed. The head of the brokers’ association, Julien Assous, said: “There is definitely room for listing options on bitcoin and other cryptocurrencies on the TASE. It’s an opportunity for the local stock exchange to take the lead on a global level. What is good for the CME and CBOE stock exchanges, which are the world’s largest derivatives exchanges, (which now offer bitcoin futures) is also good for our stock exchange.”

Assous, who is also a TASE director, added: “Instead of sending the public to unsupervised entities to buy these currencies, action could have been taken in the familiar channels. This is a once-in-a-decade opportunity to revive the TASE and attract investors here from all over the world. Moreover, since bitcoin belongs to no one, no permission from anyone is needed in order to list options on it.”

Should investors trust anyone that claims to have some connection to bitcoin? Tell us what you think in the comments section below.

Should investors trust anyone that claims to have some connection to bitcoin? Tell us what you think in the comments section below.

Images courtesy of Shutterstock.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.

The post Israeli Regulator Investigating Public “Bitcoin” Company for False Claims appeared first on Bitcoin News.