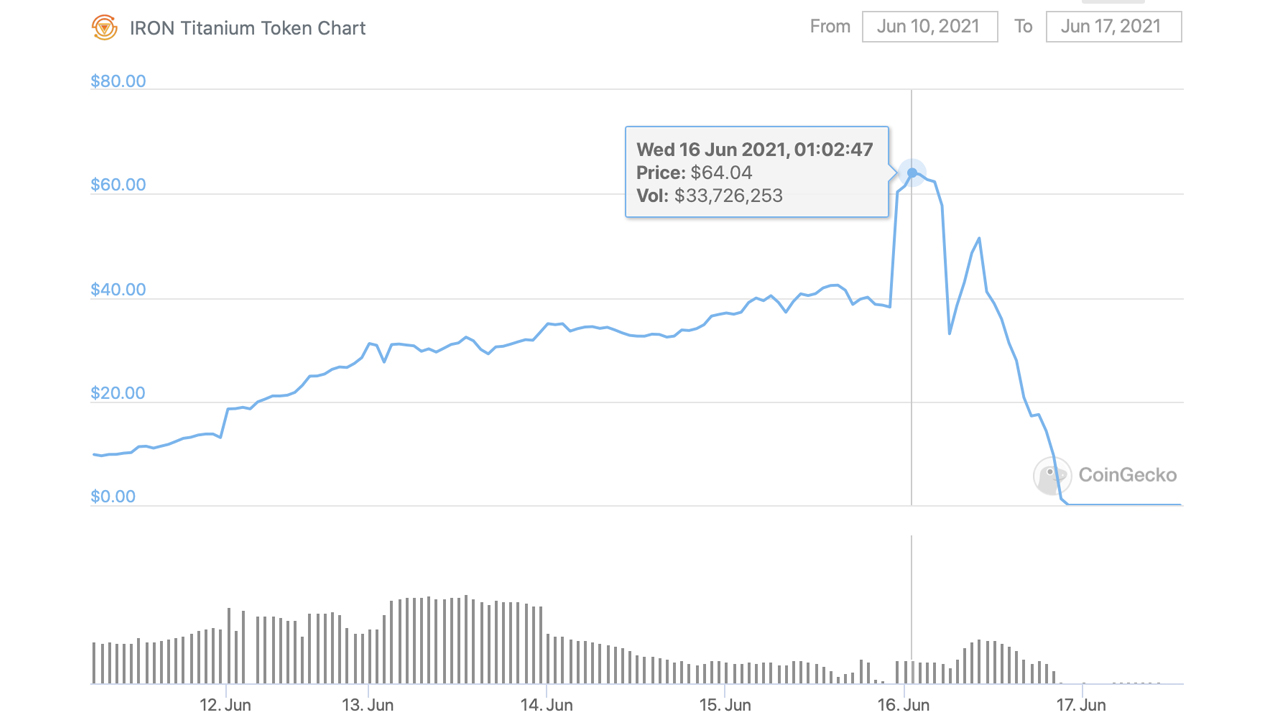

The Iron Titanium token (TITAN) value has quaked a great deal after the project suffered from what the team called “the world’s first large-scale crypto bank run.” After touching a high of $64 per token on Wednesday, the project slid to near zero and remained worthless on Thursday afternoon.

Iron Finance Claims Project Suffered from a ‘Bank Run’

The world of decentralized finance (defi) is exciting but it also comes with major risks stemming from smart contract exploits, flash loans, and alleged bank runs. That was the case for the Iron Finance project, as the team’s native token lost all of its value in a matter of hours. On Wednesday, the Iron Finance team explained what happened on Twitter and then followed up with a post mortem on Thursday.

“Dear community, please withdraw liquidity from all pools. We will share a post-mortem as soon as we have a better understanding of this bank run,” the official Twitter account noted on Wednesday. “USDC collateral is available for redemption as normal,” the Twitter account added.

Of course, the Iron Finance protocol team was criticized immediately after the tweet and people were not pleased with the situation. Iron Finance’s post mortem the following day explains how the project suffered. “We never thought it would happen, but it just did. We just experienced the world’s first large-scale crypto bank run,” the blog post says.

“Around 10am UTC on 16-June-2021, we noticed some whales began to remove liquidity from IRON/USDC, then sold TITAN to IRON and then IRON to USDC directly to liquidity pools instead of redeeming IRON, which caused the IRON price off-peg. TITAN dropped from 65$ to 30$ in 2 hours, which later recovered in 1 hour to 52$ and IRON fully recovered its peg,” the post mortem adds.

Following the recovery, the Iron Finance team noticed a few hours later that a “few big holders started selling again.” The Iron Finance project members said “a lot of users panicked” and the entire situation caused a “negative feedback loop.”

“At some points, the price of TITAN became so low, close to 0 actually, which caused the redeem contract to revert the redeem transactions. We already queued the fix for this, so people can redeem again at 5pm UTC,” the team noted. The Iron Titanium project members added:

What we just experienced is the worst thing that could happen to the protocol, a historical bank run in the modern high-tech crypto space. Remember that Iron.finance is a partially collateralized stablecoin, which is similar to the fractional reserve banking of the modern world. When people panic and run over to the bank to withdraw their money in a short period, the bank may and will collapse.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

A Number of Iron Finance Investors Lose Big

Commentary is littered all over Twitter and Reddit forums about the bank run, as it seems a lot of Iron Finance project investors lost money, according to a myriad of testimonies.

“My school fees [are] gone,” one individual tweeted on Wednesday. “I had $3,000 there and I’m left with $0.50. What is left for me to withdraw??!!! This isn’t fair! Whoever caused this should be found punished…… What am I going to do now?” the individual added.

“I lost all my Matic from pool Matic/TItan,” another person tweeted.

Others were not so sympathetic toward the investors who lost money, as a number of people repeated the age-old adage about investing only what you can afford to lose. One specific tweet response to the Iron Finance token thread said:

First rule of investing (especially in defi): don’t put in what you can’t lose. You really have no one to blame but yourself.

As far as the Iron Finance project team is concerned, the maintainers say they have “learned a great deal from this incident and while nothing could be fixed in the current system, we will continue our journey with more products in the future.”

Currently, the team plans to conduct an “in-depth analysis of the protocol” in order to grasp what happened during this unusual event. The post mortem also contains a quote from an Iron Finance investor and the founder of Finder.com.au, Fred Schebesta.

“There was no rug pull or exploits,” said Schebesta. “What happened is just the worst thing that could possibly happen considering their tokenomics,” the Iron Finance blog post concludes.

What do you think about the Iron Finance bank run? Let us know what you think about this subject in the comments section below.