Inflation implies a “decline in the purchasing power of a currency or an asset” or the fact that “most currencies or assets usually lose their value over time.” Prevailing traditional (fiat) currencies constantly lose their purchasing power mainly because central banks print them into oblivion, without any restrictions. This means that the same amount of money today can buy less than before, and projecting forwards, even less can be bought in the future. All financial systems take the inflation phenomenon into account. Cryptocurrencies, which are mainly financial assets, also have a similar concept of inflation. After reading this article, we want our readers to better understand why inflation – or rather the increase in monetary supply – is essential in both traditional and token-based economies, so-called “tokenomics”.

What is inflation?

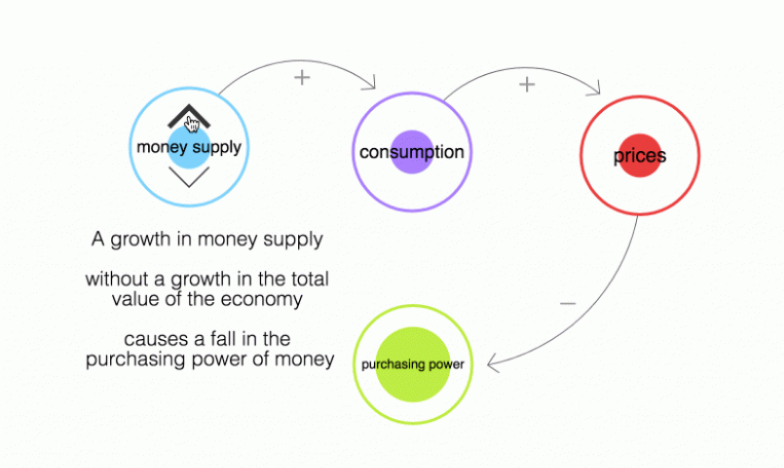

Inflation is defined as the growth of the money supply minus the growth of the total value of goods and services in an economy. You can think of it the following way:

Imagine that you have a limited budget. Suppose you are a student and your daily budget for food is $10. It is 4 PM, and you are on your way home after college. You are hungry and have already spent $9. There is only $1 left, which you can spend today. Luckily there is an affordable pizza place on the way home, and you can buy a slice of pizza there for only one dollar! But what if you were in the same situation the next week after inflation occurred, would your ability or desire to buy the same piece of pizza change?

After inflation, this 1 dollar is no longer as valuable on the way home because the pizza price has risen to $1.50. The same dollar can now buy less than before. No pizza for you, my friend!

The flip side: an inflationary spiral

As your purchasing power decreases based on your current income, you will seek to increase your earnings. After consumer prices rise, you usually see wages grow. However, this can lead to a loop, as rising wages can increase consumer spending as well as production costs, which in turn can lead to higher prices. This is known as an inflationary spiral.

Although it may seem that it is easy to avoid an inflationary spiral, inflation targeting is actually an inaccurate and indirect process subject to uncertainty.

In traditional economies, central banks are responsible for increasing or decreasing money supply – this can be seen as “printing” or “burning” money, although this is actually the responsibility of the Treasury. The purpose of central banks is to ensure financial stability. In most cases, this is achieved through their power to stabilize inflation with set target rates. There are two primary ways in which central banks target inflation: 1) buying or selling assets and 2) adjusting the interest rates – the combination of central banks’ measures is called monetary policy.

Unfortunately, these instruments have a limited impact on prices and interest rates. The ability of central bank policies to influence inflation is known as the transmission mechanism, which is characterized by variable and uncertain time lags. Thus, it is difficult to predict the exact impact of monetary policy actions on the economy and price levels.

What are the positive results of money supply growth?

It is important to note that money supply growth does not necessarily lead to inflation if the economy is experiencing a corresponding increase in the cost of goods and services. In fact, one could argue that a productive and prosperous economy requires money supply growth to facilitate it. Although such a system may become more productive over time, it is subject to financial instability due to the debt cycle (business cycle fluctuations) and difficulties in targeting inflation.

Despite this obstacle, the vast majority of countries choose to target inflation to a certain extent. This has several advantages for central banks and governments as it reduces the cost of debt over time and provides monetary policy flexibility. Perhaps even more importantly, growing money supply encourages investment in productivity growth in the short term.

Imagine that you have a great idea for a new company. If the money supply is stable and you have a well-paying job, you have very little incentive to take risks and start a company yourself. However, as the money supply grows (faster than prices and wages rise), you have a greater incentive to invest in your idea, knowing that in the future, it could bring in more than you currently earn.

At the same time, as the money supply grows, the real interest rate falls. This leads to the investors’ desire for higher returns from riskier projects. Increased investment in promising ideas today leads to higher long-term economic productivity.

How can the growth of token supply support the growth of a token-based economy?

Just as a growing money supply supports the productivity and growth of traditional economies, a productive and growing token-based economy requires a growing supply of tokens to support it. The growing supply of tokens will create incentives for greater consumption and investment in networks and lead to increased productivity and value in this economy over the long term.

In addition, the growing supply of tokens, when used for payments and network security, supports the growth of a token-based economy. This allows the network to reach its maximum value.

Let’s take a look at the example of a network that rewards transaction validators. To achieve the optimal level of transaction load (the highest value of the economy), both fees and the growing supply of tokens should be used as a reward to secure the network. This means that validators receive fees from users for checking transactions – and they are also rewarded by the growing token supply. If only fees were used to pay for transactions, the system would reach a lower equilibrium value and suffer irrecoverable losses for this security payment. When this security payment is made both at the expense of commissions and the increasing token supply, a more favorable equilibrium is achieved.

Take a look at this basic model, it’s just the beginning, but hopefully, it will allow you to see how adjusting the input affects the value of the economy as well as the validators’ incentives.

As the growing number of tokens is distributed among the validators, additional incentives are created to invest these tokens in the network. There is a greater incentive to increase the share, so as to increase the potential revenue. The result is a greater security margin and a higher level of transactional load on the network.

What other advantages and vulnerabilities can the growing supply of tokens bring?

There are several ways to effectively implement the growing supply of tokens in a token-based economy. An optimal number for a particular network will depend on the characteristics of this system. Some of the important variables to consider are:

- What kind of work is important for this system?

- Who is eligible to receive the newly minted tokens? How is their work valuable for the network?

- What percentage of tokens should be used to pay for the job?

- What is the optimal token supply’s growth rate?

Using the models presented in this article can be extremely informative to understand not only the impact of these variables on your economy but also potential vulnerabilities. For example, determining whether a network should heavily invest in security. Otherwise, it becomes an unnecessary premium that could have been spent elsewhere. To be effective, a growing supply must pay for security directly, instead of, for example, remunerating everyone on the network in the form of a dividend – regardless of who does the work of securing the network.

While models and simulations are an important part of the design process, some things are learned in practice. It is currently unknown what the optimal balance of rewards and transaction fees will be. The optimal inflation rate for these different types of economies is yet to be discovered. Best practices dictate that you create models and simulations to study these implications before the network is launched, and the real value is at stake. However, in the coming years, we are going to learn a lot from practice. What an exciting time we live in!

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.