Mumbai-based digital assets exchange WazirX witnessed record-breaking activity this year, as investors from smaller Indian cities joined the crypto bandwagon despite lingering regulatory uncertainty and market volatility.

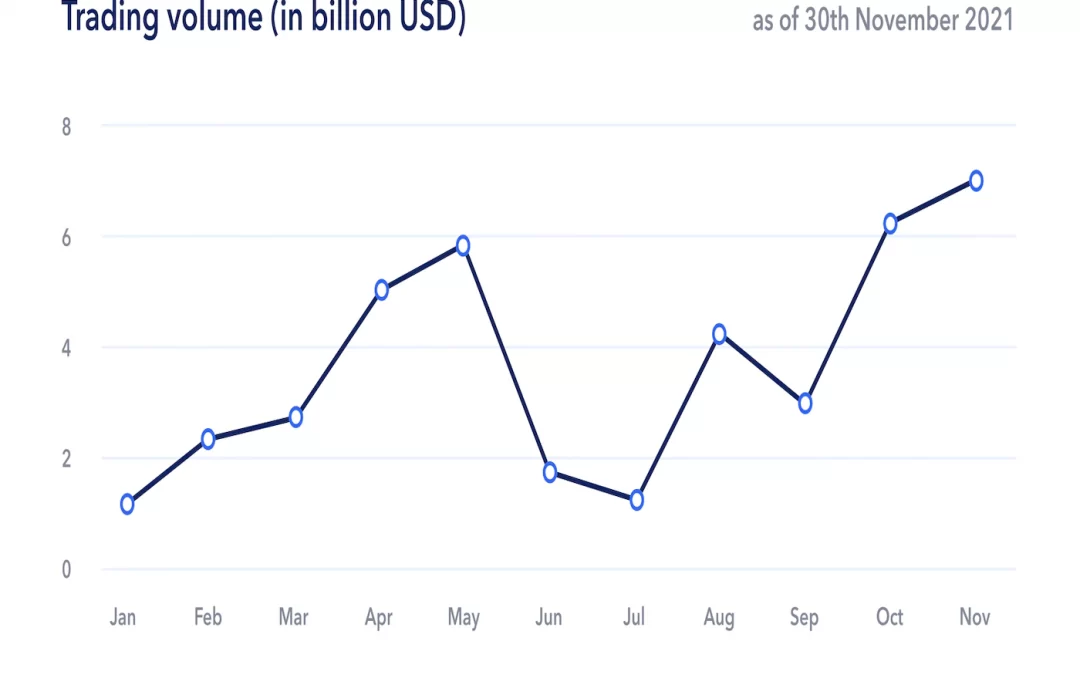

The Binance-owned entity registered annual trading volume of over $43 billion, marking a stunning 1,735% growth over 2020, according to a report published by the exchange and shared with CoinDesk on Thursday.

“We witnessed over 700% growth in signups from smaller cities like Guwahati, Karnal, Bareilly, among others,” the report titled Highlights and Observations from 2021 The Year of Crypto said. “It shows growing crypto adoption in the semi-urban and rural India.”

While the exchange added more than 200 market pairs, bitcoin remained the most traded cryptocurrency, followed by stablecoin tether and meme tokens DOGE and SHIB, WazirX token (WRX), and scaling solution Polygon’s MATIC.

Indian retail investors snapped up relatively cheap and more volatile coins like DOGE and SHIB, perhaps to make big money on a relatively small investment – a pattern observed across the globe, including Inflation-ridden Turkey. Investor interest in these coins was exceptionally high in the lead-up to the Diwali festival held in early November.

While male investors dominated the action in the volatile meme tokens, women investors mostly traded bitcoin, the report said. However, the number of new female users increased 1,009%, outshining the 829% increase in male signups, a sign of demographic shift, also represented by crypto’s growing popularity in the young generation.

“Only 11% of respondents in the age group of 51 years and above said to have allocated over 50% of their total portfolio to crypto whereas the same is true for 29% of respondents in the age group of 18-24 years,” WazirX noted. “66% of WazirX users [are] below 35 years of age.”

Cryptocurrencies have emerged as an alternative asset class in India and worldwide, with central banks flooding the global economy with fiat currency in the wake of the coronavirus-induced crash of 2020.

“As more people began to read about crypto and invest in this emerging alternative asset class, WazirX witnessed a massive surge in user signups leading to us crossing 10 million users,” the report said.

“During these uncertain times [of coronavirus pandemic], crypto has not only enabled common people with new ways to earn online but also fought the pandemic with the Indian crypto community stepping forward to help our country,” WazirX added.

Crypto adoption has boomed in India despite lack of clarity on the regulatory front. The Indian government has been sitting on a crypto regulation bill for at least a year and is unlikely to table the same in the parliament’s ongoing winter session, according to local reports.

While the government has softened its stance on cryptocurrencies in recent months, the Reserve Bank of India remains anti-crypto, with governor Shaktikanta Das recently saying the decade-old blockchain technology can thrive without digital tokens.

However, WazirX is confident that the government will regulate rather than ban cryptocurrencies, and Indian institutions will follow the lead of their American counterparts in adopting crypto.

“The government’s impetus towards a regulated approach for crypto would put India on the world map with other developed countries dealing in crypto. This, coupled with strong institutional participation in crypto, would go a long way in paving the future of this popular asset class in India and helping us become Atmanirbhar Bharat [self-reliant India],” WazirX’s CEO Nischal Shetty said.