Leading Contract for Difference (CFD) and spread betting provider, IG Group, is actively marketing bitcoin, bitcoin cash and ether CFD trading to the mainstream. While customers speculate without owning actual cryptocurrencies, IG purchases and sells them to hedge its clients’ positions.

Also read: New FCA Rules Could Reduce UK Bitcoin Spread Betting Appeal

IG’s Crypto Products

IG Group has been stepping up its game in promoting cryptocurrency products. Currently, products based on three cryptocurrencies are offered; bitcoin, bitcoin cash, and ether.

“We’re the no.1 provider of CFDs and spread betting worldwide,” the company’s website states. IG is regulated by the UK’s Financial Conduct Authority (FCA). It operates in 17 countries and its subsidiaries are regulated by the relevant authorities in the countries where they operate such as Australia, Japan, South Africa, UAE and Singapore. The platform provides 185,000 active traders and retail investors access to more than 15,000 financial markets. In the U.S., it operates under the brand Nadex. The platform facilitates almost 8 million transactions a month.

“We’re the no.1 provider of CFDs and spread betting worldwide,” the company’s website states. IG is regulated by the UK’s Financial Conduct Authority (FCA). It operates in 17 countries and its subsidiaries are regulated by the relevant authorities in the countries where they operate such as Australia, Japan, South Africa, UAE and Singapore. The platform provides 185,000 active traders and retail investors access to more than 15,000 financial markets. In the U.S., it operates under the brand Nadex. The platform facilitates almost 8 million transactions a month.

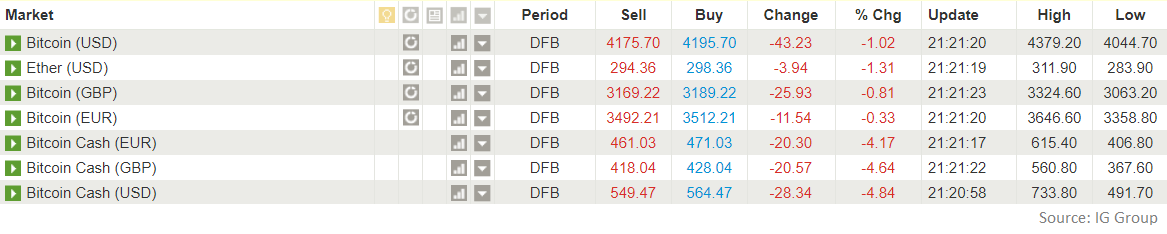

Users can speculate on the price of bitcoin and bitcoin cash against the USD, EUR, and GBP. However, only USD is offered for ether.

Clients Want Choices

Spread bets come in two varieties; Daily Funded Bets (DFBs) and forward bets, IG detailed. The former run for as long as the user wants to keep them open, whereas the latter expire after a set period of time. Therefore, the cost of maintaining a DFB position is levied on the corresponding account each day, whereas the entire cost of a forward bet is taken into account in the spread, IG noted.

Spread bets come in two varieties; Daily Funded Bets (DFBs) and forward bets, IG detailed. The former run for as long as the user wants to keep them open, whereas the latter expire after a set period of time. Therefore, the cost of maintaining a DFB position is levied on the corresponding account each day, whereas the entire cost of a forward bet is taken into account in the spread, IG noted.

Customers speculate without owning actual bitcoins, the company states. In addition, “IG’s bitcoin settlement is based on a combination of real time prices provided directly by some of the world’s most liquid bitcoin exchanges,” according to the company’s FAQs. IG market analyst Chris Weston explained:

The ability to take a position without putting down the full face value of the position is an attraction, especially when traders are purely speculating on price movements and, by not actually taking delivery of the coins, this mitigates the possibility of the coins being hacked or stolen.

While bitcoin products have been around since 2013, IG started offering its ether product in July this year. “The introduction of Ethereum as a trading vehicle has been led by demand,” Weston wrote, adding that “the bottom line is traders want choice.” The company added bitcoin cash (BCH) products last month.

IG Trades and Holds Bitcoin

IG revealed in its 2017 annual report that the group buys, holds, and uses bitcoin as a hedge in order to cover its clients’ positions. The company wrote:

The Group normally would hedge its clients’ trading positions with its brokers. However, as its brokers do not offer bitcoin as a hedging product, the Group purchases and sells bitcoins to hedge the clients’ positions.

For the financial year 2017, IG reported “£11.9 million (31 May 2016: £3.2 million) related to amounts held on bitcoin exchanges and in third party vaults.”

Reaching the Mainstream

Recently, IG has been increasing its marketing efforts to attract investors to CFD and spread betting on the three cryptocurrencies.

IG’s ads for CFD and spread betting in bitcoin, bitcoin cash and ether, can be found in mainstream newspapers such as the London Evening Standard. The free daily newspaper has a circulation of 899,484 as of July this year.

A similar ad can be found in leading Swedish financial newspaper Dagens Industri. According to a media survey, Dagens Industri’s printed edition had about 328,000 daily readers during the beginning of 2017.

What do you think of IG’s product offerings? Do you think more people will be attracted CFD or spread betting on cryptocurrencies? Let us know in the comments section below.

Images courtesy of Shutterstock, Financial Times, IG, Reddit u/Fengstrom, Dagens Industri

Need to calculate your bitcoin holdings? Check our tools section.