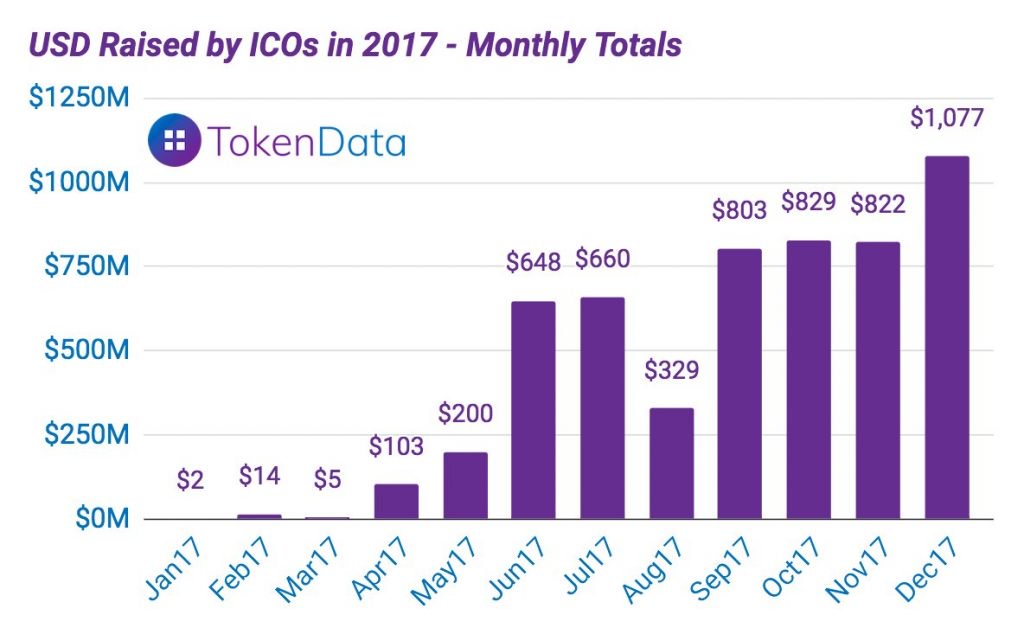

While bitcoin and resurgent altcoins were claiming the headlines in December, ICOs were quietly claiming the money. From a media perspective, the summer of 2017 was when ICO mania hit its peak. That’s when several of the largest token sales concluded, raising hundreds of millions of dollars apiece. But from a financial perspective, December will go down as the most lucrative month to date, with over US $1 billion raised from Initial Coin Offerings for the first time.

Also read: Convenience Stores and Pawn Shops See Foot Traffic from Bitcoin ATMs

Small Sales Are Big Business

The definition of what constitutes a “small” token sale is debatable in a space where millions of dollars are raised for startups that don’t even have a development team. It is evident however that mammoth token sales, especially those that are uncapped, are becoming less prevalent. The last ICO to clear $200 million was Filecoin back in September, and the glut of those tokens were snapped up by institutional investors.

Prior to that, Tezos was the last public sale in which the $200 million mark was troubled. The records made – and subsequent promises broken – by Tezos may be one reason why ICOs maintained a lower profile in Q4 of 2017. Behind the scenes though, it’s been business as usual, with more token sales than ever reaching completion with each passing month. December saw the conclusion of ICOs hosted by Sirin Labs (which raised $158m), Bankex, ($70m), Nebulas ($60m) and Blockstack ($52m).

2018 Looks Set to Be Another Record-Breaker

December was the first month that ICOs raised over $1 billion, finishing the year on a record high of $1.2 billion, with Sirin Labs and Bankex helping nudge the total over that symbolic threshold. According to Tokendata, this meant a total of $5.6 billion was raised from ICOs in 2017, based on 442 completed ICOs, with a median of $4.5 million raised. Tokendata tends to list only the larger ICOs; throw in the less fancied ones listed by the likes of ICO Alert and Tokenreport and that figure is closer to $6 billion.

January looks like being another bumper month for token sales, thanks to major offerings from the likes of WYS Token, an ecommerce project, and Cryptohawk, an all-in-one cryptocurrency payment solution. The Swiss-based company aims to connect all things crypto, making it easier to exchange cryptocurrencies for offline purchases and providing a payment solution for shop operators. Cryptohawk’s project includes plans for crypto ATMS and credit cards, two financial services that are attracting a lot of attention from ICOs. Lending services also look like faring well in 2018. Salt and Ethlend’s platforms are already live, while decentralized credit scoring system Bloom completed its crowdsale on January 1, raising over $40 million.

Quality Not Quantity

From an investment perspective, ICOs are evidently still profitable, but the days when “X on the blockchain” or “A decentralized Y” could automatically be expected to raise millions are gone. It has been estimated that two thirds of token sales fall short of their soft cap; one analysis of 400 completed ICOs in 2017 found that 35% reported their fundraising figures. The remainder stayed silent, which is indicative of targets being missed.

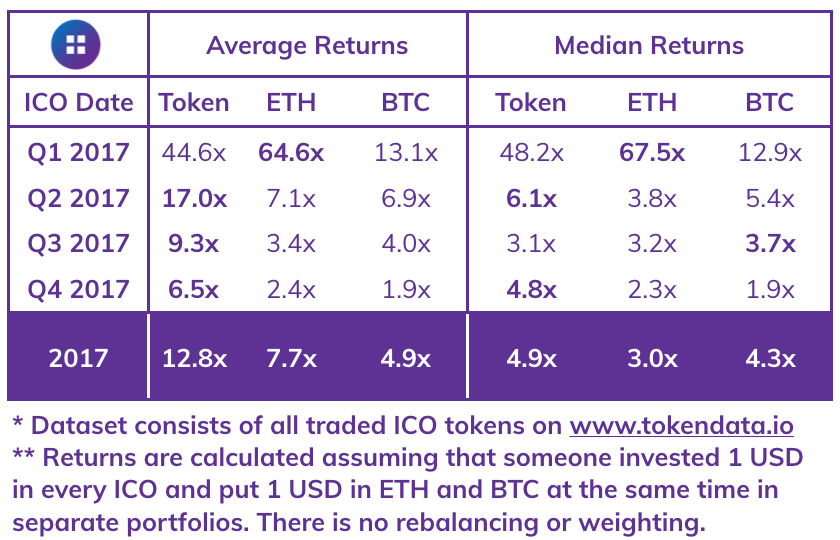

It would be surprising if the median return to investors on tokens this year surpassed that of 2017, when Tokendata calculated there to be an average return of 12.8x. With more investors and investor tools than ever scrutinizing every new token sale, the odds of finding ‘undiscovered gems’ are becoming less likely. Even highly publicized gems are capable of performing robustly once released onto the open market, however. Despite increased scrutiny from regulators, signs point towards 2018 being another bumper year for Initial Coin Offerings.

What ICOs are you looking forward to in 2018? Let us know in the comments section below.

Images courtesy of Shutterstock, and Tokendata.io.

Express yourself freely at Bitcoin.com’s user forums. We don’t censor on political grounds. Check forum.Bitcoin.com.

The post ICOs Raise Over $1 Billion in a Month for the First Time appeared first on Bitcoin News.