The Initial Coin Offering (ICO) craze has been a crowdfunding spectacle over the past two years gathering millions of dollars from investors. Lately, ICOs have been more prominent than ever and are starting to draw attention from government regulators and skeptics of these token projects filled with promises.

Also read: A Def Con 25 Demonstration Claims to ‘Break Bitcoin Hardware Wallets’

Initial Coin Offerings Raising Millions With Promises

Over the past six months, statistics say ICOs have raised roughly $300 million, and most of these projects are stemming from the Ethereum network. Some of the biggest ICOs have been platforms like Aeternity, Status, Aragon, Ten X, and the latest Bancor protocol which just recently surpassed the DAO in funding. Furthermore, there are many more token sales on the horizon like Tezos, and the hyped up EOS project created by the company Block.one. A huge token crowd sale has taken place nearly every two weeks or more.

ICO Warnings Stemming from China

According to the Chinese publication 8BTC, token crowd sales are causing concern and skepticism of ICO scams in the country. The news outlet reports that just recently the Shenzhen-based cryptocurrency exchange, BTC38, warned its customers about these crowdfunding projects. Essentially, the trading platform has declared it will not list these types of ICO assets on the BTC38 exchange. Moreover, the cryptocurrency platform Yunbi has also warned its users about the potential danger of ICO risks.

“Please beware of the risks from the ICO market, and protect your own benefits,” explains Yunbi.

In addition to the warnings, the regional news outlet 8BTC also details that fraudulent crowdfunding in China could be punishable by death or very harsh penalties. The author Red Li states, “illegal fundraising may face the death penalty in China.” Furthermore, the publication details that certain cryptocurrency luminaries are distancing themselves from these ICO projects.

“There have been lots of ICOs initiated by our friends,” reveals a statement made by Bitmain’s Jihan Wu on Weibo according to 8BTC. “We get involved in some projects purely out of friendship. Please don’t consider it as an investment endorsement. ICO is pure gambling, and we wish everyone good fortune.”

SEC Researches the Lack of ICO Oversight

ICO activities are also being investigated by officials in other countries like South Korea, the U.S. and more. Just recently Bitcoin.com reported on the U.S. Securities and Exchange Commission (SEC) researching the lack of regulation and oversight within the ICO market. Skeptics believe it will only be a matter of time before the regulatory agency may move in on projects providing false promises and inadequate information that fails to support ICO claims.

ICO activities are also being investigated by officials in other countries like South Korea, the U.S. and more. Just recently Bitcoin.com reported on the U.S. Securities and Exchange Commission (SEC) researching the lack of regulation and oversight within the ICO market. Skeptics believe it will only be a matter of time before the regulatory agency may move in on projects providing false promises and inadequate information that fails to support ICO claims.

Skeptics Grow Concerned Over the Latest EOS Offering and Potential ICO Backfire

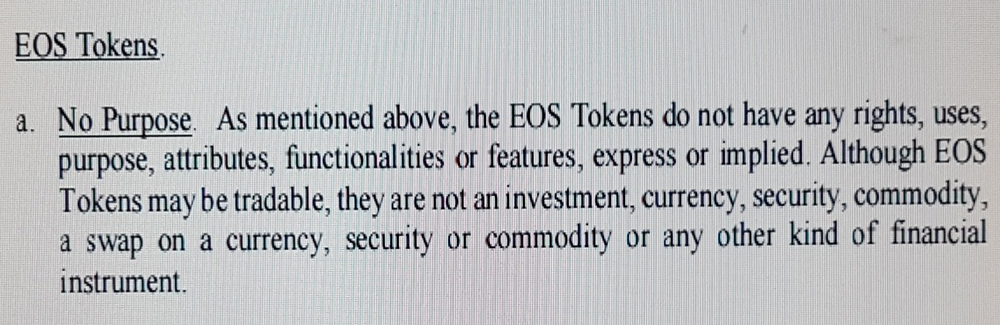

One specific ICO called EOS is causing a lot of speculation among cryptocurrency community members. Many believe it may raise more funds than the recent Bancor crowd sale which captured $153 million from investors. EOS purports itself to be a blockchain that produces smart contracts and decentralized commercial applications. Although the EOS purchase agreement fine print details that EOS tokens have “no purpose.”

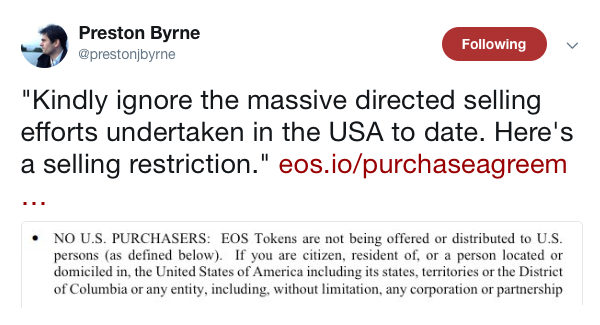

The project hype comes from the creators of the platform who are well-known within the industry such as Block.one’s Brendan Blumer, and Daniel Larimer, the creator of Bitshares and Steemit. Some believe the project will be an issue in the U.S., because according to skeptics the ICO was advertised heavily in the States, but U.S. residents are not supposed to purchase the token according to the EOS purchase agreement.

Many people in the community are concerned about the ICO madness taking place and are wondering if it will have adverse effects on the value of ethereum markets. Concern and uncertainty about the legality of ICOs have been regularly discussed topics happening throughout cryptocurrency forums and social media. Furthermore, the people who are doubtful of these crowdfunding projects hope these ICOs won’t backfire on the Bitcoin ecosystem which currently promises nothing but digital scarcity and settlement.

What do you think about people who are skeptical of the current ICO craze right now? Do they have a valid point? Let us know what you think in the comments below.

Images via Shutterstock, Bitcoin.com, Pixabay, Twitter, and the EOS purchase agreement.

Need to calculate your bitcoin holdings? Check our tools section.