A number of class-action lawsuits have been filed against various digital asset firms and exchanges on Friday. The U.S.-based “litigation boutique,” Roche Cyrulnik Freedman, filed the lawsuit for three plaintiffs in the Southern District of New York. All three lawsuits claim that organizations like the Tron Foundation, Bitmex, Binance, Bibox and Block.one allegedly sold unregistered securities to retail investors.

Also read: IMF Declares Global Recession, 80 Countries Request Help, Trillions of Dollars Needed

The Crypto Industry’s “Litigation Boutique” Files 11 Class-Action Lawsuits Against Various Digital Currency Firms

The New York law firm Roche Cyrulnik Freedman has been busy, as the attorneys have multiple high-profile lawsuits right now that stem from the crypto industry. The publication Bloomberg Law recently called the firm a “litigation boutique” that specializes in cryptocurrency cases. The two cases Roche Cyrulnik Freedman have been involved with before Friday’s filing include; the trillion-dollar lawsuit against Tether Limited and the Kleiman v. Wright court case. The case against the self-proclaimed Bitcoin inventor Craig Wright far exceeds $5.1 billion USD worth of BTC before punitive or treble damages.

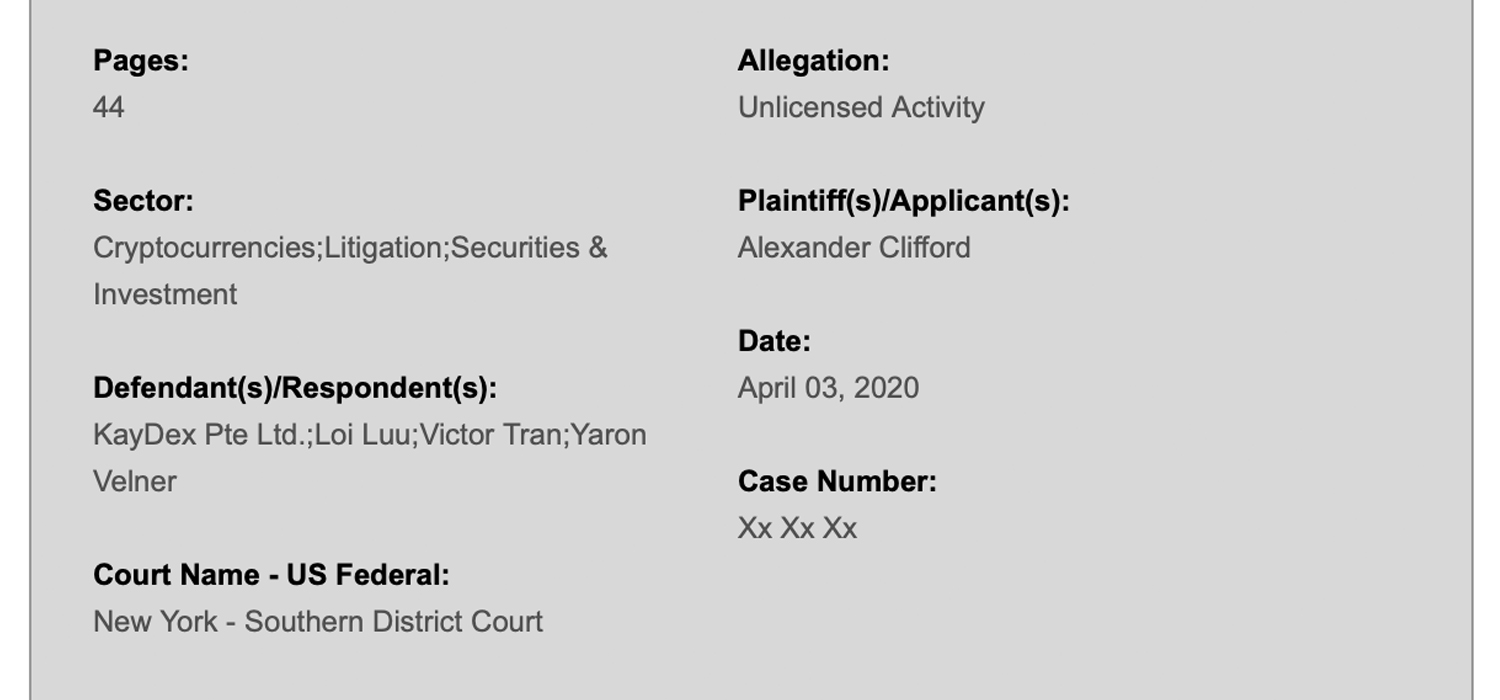

The class-action lawsuit filings were initiated by the defendants’ Eric Lee, Chase Williams, and Alexander Clifford. Court filings were found by the offshore news and research outlet, Offshore Alert, a think-tank that distinguishes themselves as offshore financial center experts. Crypto operations being sued by the plaintiffs include KayDex, Quantstamp, KuCoin, HDR Global Trading, BitMEX, Bprotocol, Status, Block.one, Civic and Binance. Developers and executives like Dan Larimer, Changpeng Zhao (CZ), Vinny Lingham, Arthur Hayes, and Brendan Blumer are all mentioned in each court filing. The class-action lawsuits filed, mentions the allegation of “unlicensed activity” and the sale of unregistered securities through initial coin offerings (ICO) or initial exchange offerings (IEO).

For example, the plaintiff Chase Williams’ class-action complaint against Binance and founder Changpeng Zhao says the exchange sold unregistered securities as digital tokens. Tokens named in the lawsuit include EOS, BNT, SNT, QSP, KNC, TRX, FUN, ICX, OMG, LEND, ELF, and CVC. All of the lawsuits were filed with the Southern District of New York court on April 3. There’s a total of 42 defendants named in the class-action suits and the individuals stem from countries like South Africa, Switzerland, Taiwan, the U.S., China, Seychelles, Singapore, Japan, Hong Kong, British Virgin Islands, and the Cayman Islands.

Plaintiffs Say Centralization Was Not Apparent at Issuance to a Reasonable Investor

The plaintiffs and the litigation firm Roche Cyrulnik Freedman will likely have a difficult time battling jurisdictions. Moreover, there really hasn’t been a government standard or conclusion toward the unregistered securities argument thus far and regulators still seem up in the air. This has been the case with the ongoing Ripple lawsuit, which also alleges that XRP was sold as an unregistered security. In every one of the filings submitted on April 3 by Roche Cyrulnik Freedman, the allegations claim these token sales were completely centralized. The accusation against the Tron Foundation notes:

The creation of TRX tokens thus occurred through a centralized process, in contrast to Bitcoin and Ethereum. This, however, would not have been apparent at issuance to a reasonable investor. Rather, it was only after the passage of time and disclosure of additional information about the issuer’s intent, the process of management, and success in allowing decentralization to arise that a reasonable purchaser could know that he or she had acquired a security. Purchasers were thereby misled into believing that TRX was something other than a security, when it was a security.

Nobody knows how these 11 cases will turn out, but the crypto community is discussing the subject with great fervor. The attorney Stephen Palley who specializes in cryptocurrencies and litigation explained that the defendants will likely try to get the cases dismissed.

“These lawsuits will be dismissed by the defendants in press releases as ambulance-chasing lawsuit trolling,” Palley said. “But it’s not quite that black and white upon closer inspection,” the lawyer added.

What do you think about the lawsuits against 11 crypto companies? Let us know in the comments below.

The post ICO Crackdown: 11 Class-Action Lawsuits Filed Against Cryptocurrency Companies appeared first on Bitcoin News.